Author: Lian

Mobile App UA & Creative Roundup July 2021

This month, get insider info on IDFA’s crushing impact and how persona-led creative can help you recover efficiency. In a post-IDFA world, ad creative that targets specific user motivation helps regain efficiency by allowing paid social algorithms to cluster users based on behaviors and creative trends. Scroll down to see July 2021 creative guides—from RPG to entertainment to casual, get tactics you can use to improve your campaigns today.

Why is persona-led creative critical? Check out IDFA’s Crushing Impact, providing a deep dive into over $300M in ad spend, comparing install rates for Android versus iOS, SKAN versus non-SKAN, and CPI versus installs. The data shows just how devastating the loss of IDFA has been for iOS app advertisers.

But don’t despair. Dean Takahashi from GamesBeat says, “Advertisers aren’t helpless. In a post-IDFA world, Facebook, Branch, and Consumer Acquisition recommend focusing on ‘persona-led creative’ (or marketing to a type of person) to regain efficiency by allowing paid social algorithms to cluster users based on behaviors and creative trends.”

Persona-Led Creative & Creative Trends

Persona-Led Creative

What motivates a player to choose one app over another, or to click on one ad over another? The answer lies in a concept called “horizontal segmentation” which began with consumer research to find the perfect sweetness for Pepsi. There is no perfect ad. But there are perfect ads if you know who your audience is.

Match 3

From creative that leverages SFX and bright colors to combining gameplay with simple character situations, we break down successful match-3 ads for Toon Blast.

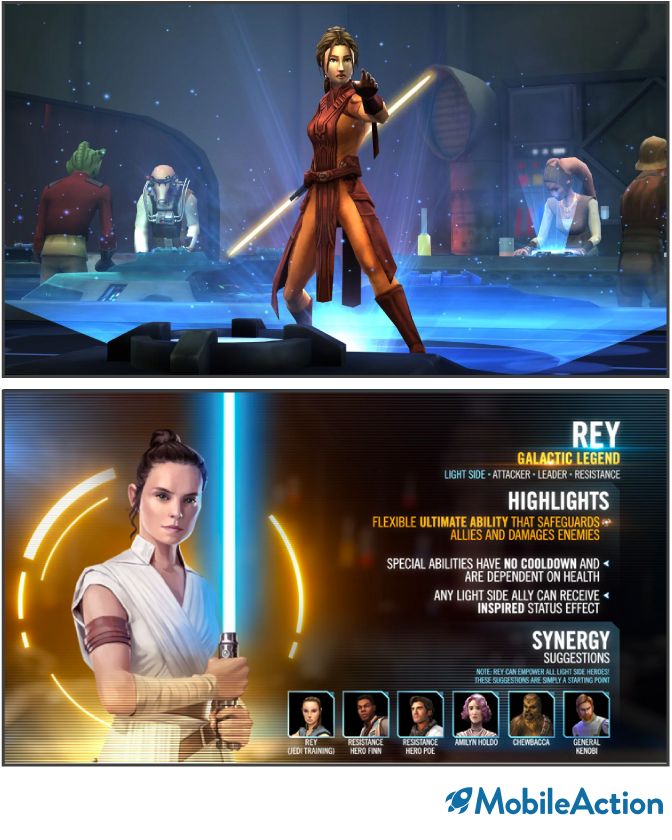

RPG

See how role playing games attract players interested in unlocking levels, characters, power, and narrative through our deep dive into Electronic Arts hit Star Wars – Galaxy of Heroes.

Card Game

Challenging players to make a move and appealing to nostalgia are among the winning tactics for Mattel’s Uno, a leader in the Card Game genre.

Hypercasual

See how simple gameplay and provocative headers are attracting players to Hypercasual apps like Voodoo’s Draw Climber.

Hidden Object

For Hidden Object games like Manor Matters from Playrix, winning creative includes pickers and puzzle concepts combined with narrative progression.

Casino

See how Playtica’s Bingo Blitz dominates the Casino app genre with creative featuring discounts, social connections, and influencers.

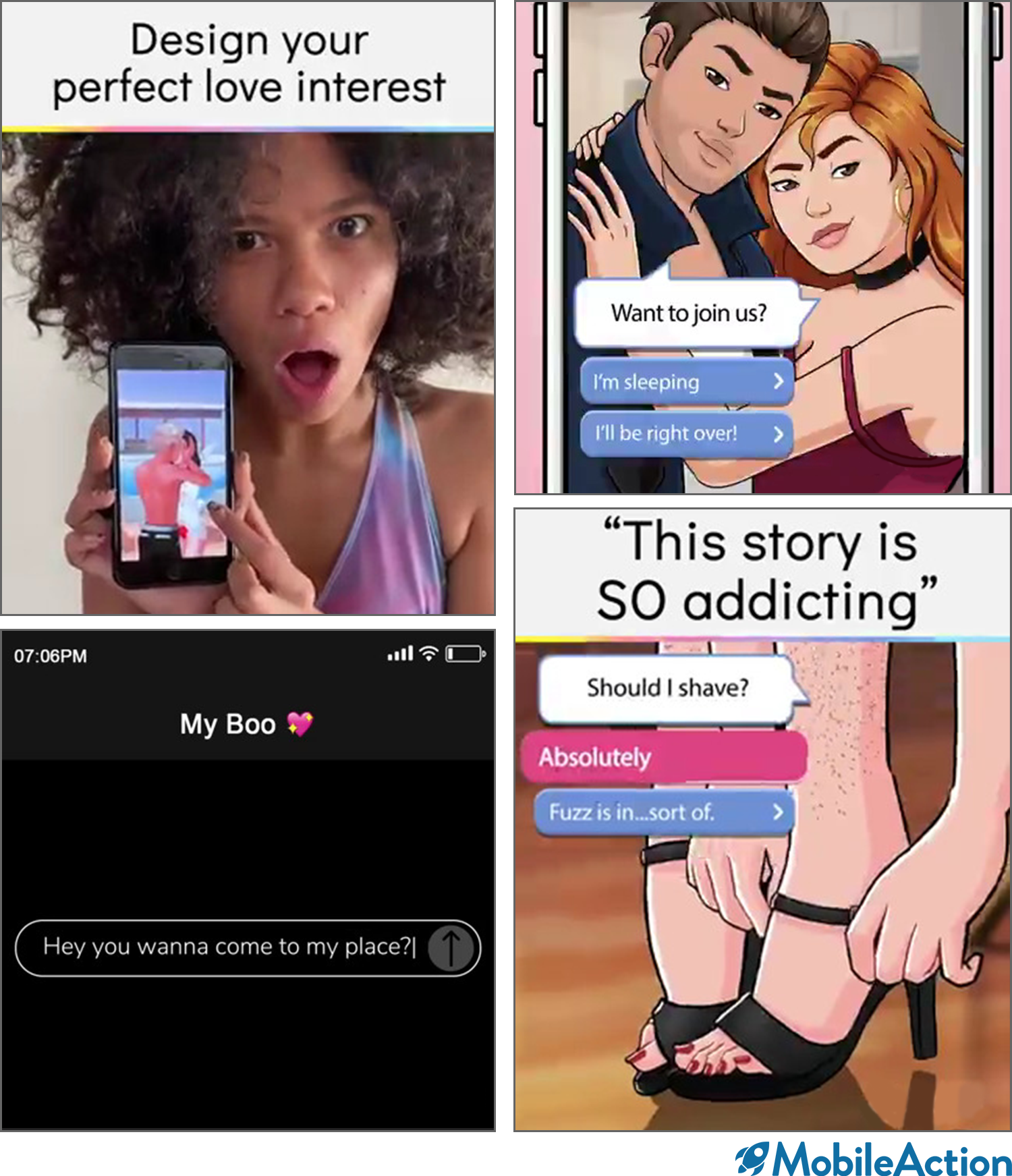

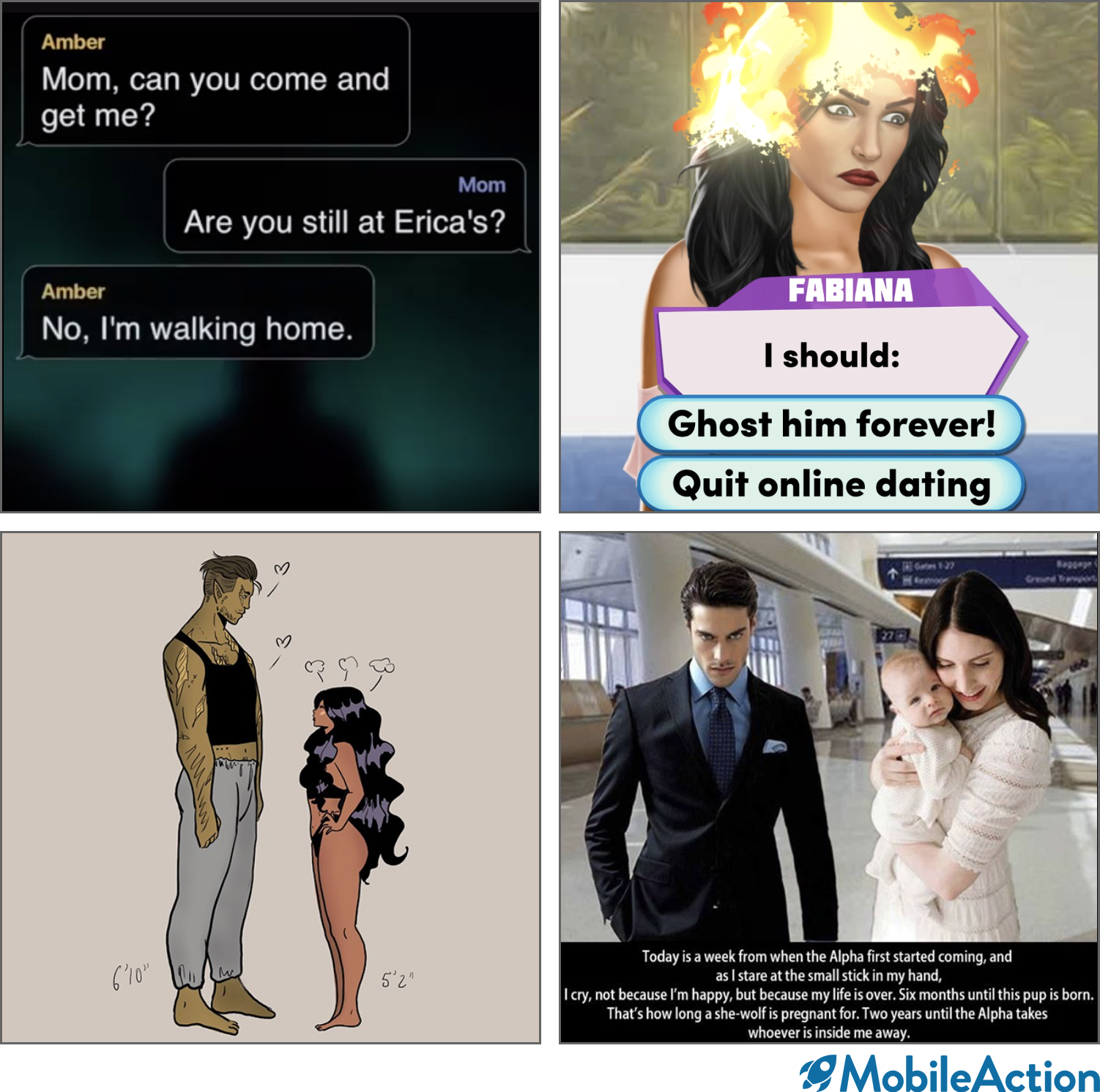

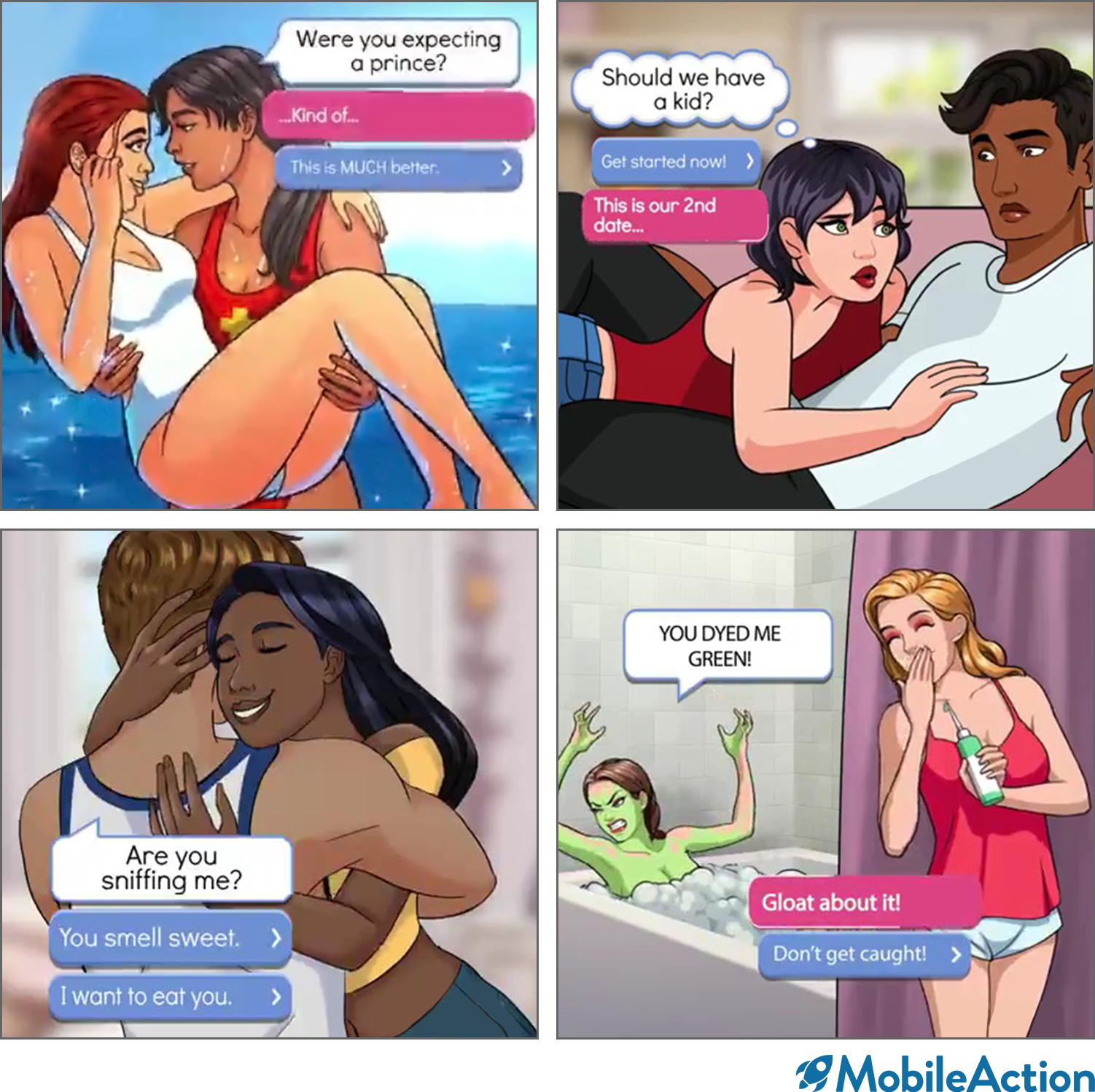

Romance

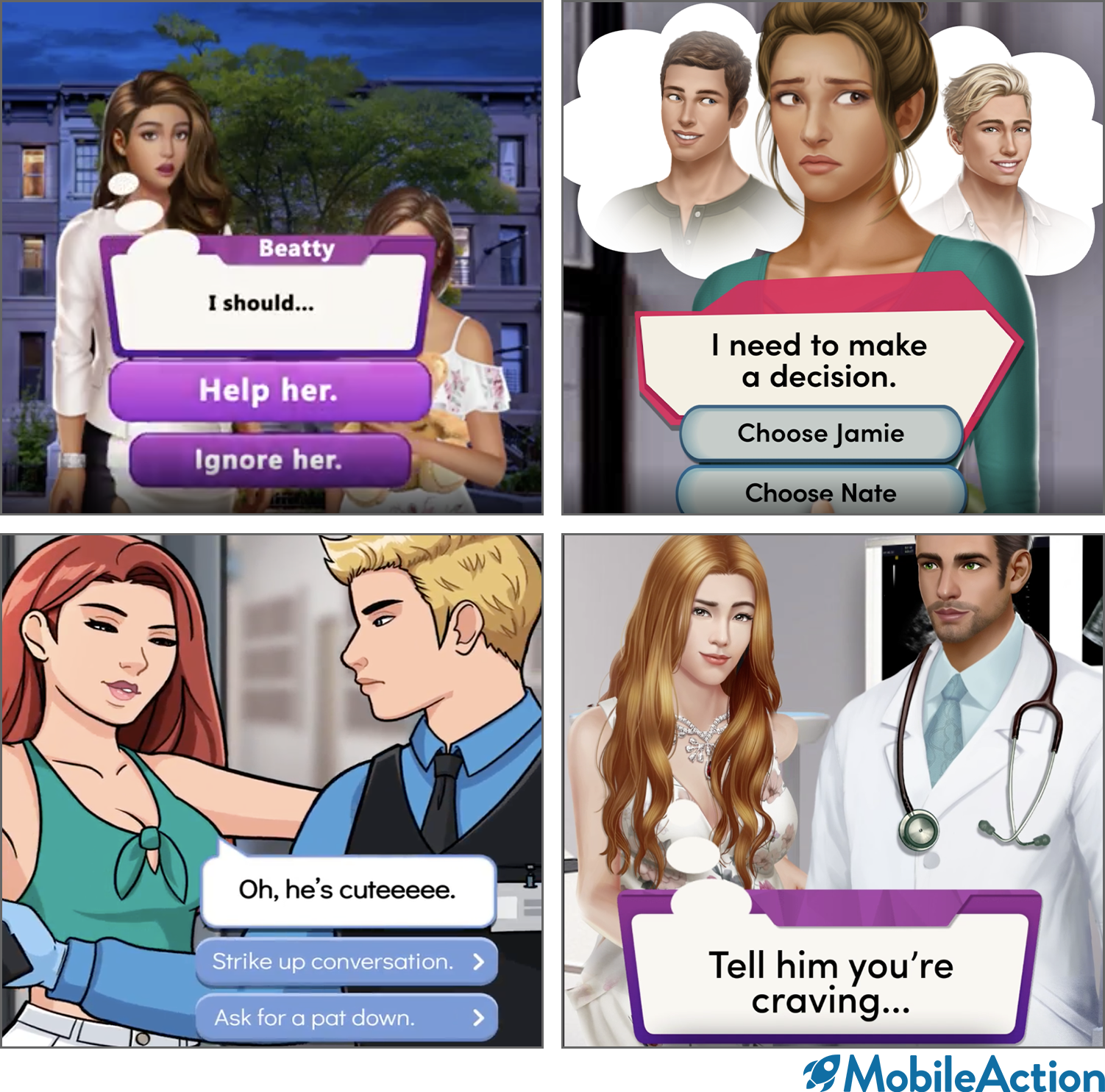

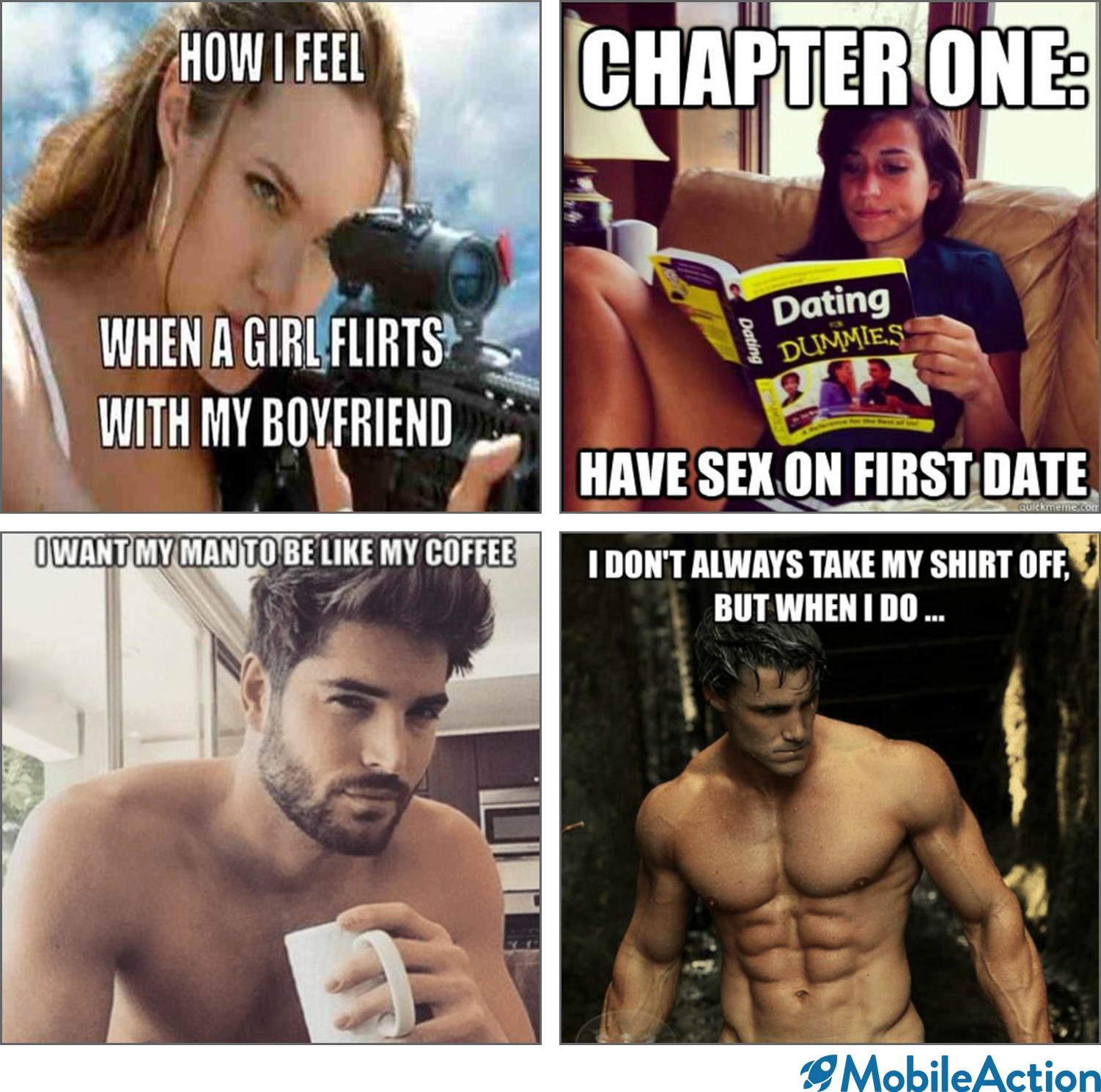

Highlighting relatable, quirky, and diverse characters in quick vignettes, we break down successful Romance creative for Pocket Gems’ Episode.

Simulation

See how injecting narrative while showcasing gameplay is driving Simulation Game creative for Storm8 Studios’ Home Design Makeover.

How To Expand Your Assets

CA+ is better, cheaper, faster, premier creative services offering:

- Live Action Video Production

- Photography Production

- Game Capture: Unity/Unreal Engines

- Full Post-Production Services

- 3D Computer Animation

- Branding

- ASO Icons, Screenshots, Videos

Featured Article

- Data analysis representing $300 million in paid social spend reveals the devastating post-IDFA impact on click-to-install (c2i) traffic quality, iOS CPM spikes, decrease in mobile app value and event optimization performance, and decreases in lookalike audience effectiveness.

- iOS advertisers are experiencing a 15-20% revenue drop and inflation in unattributed organic traffic.

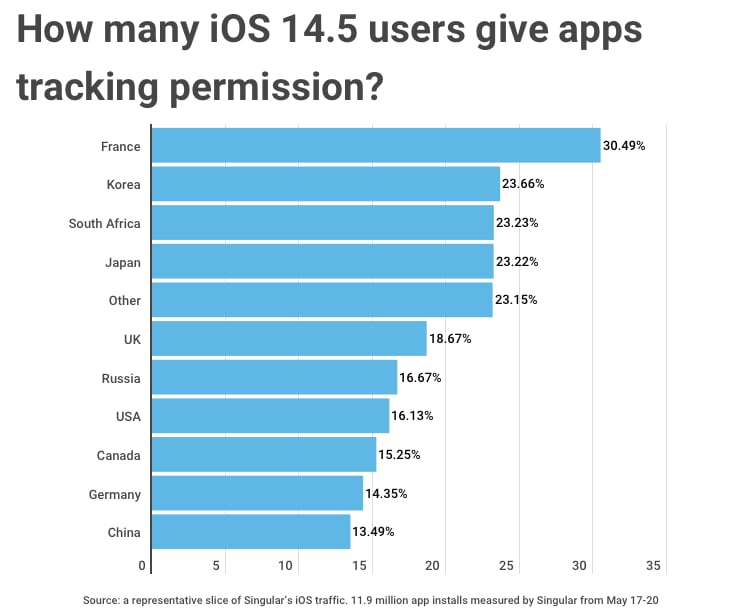

- Only 20% of consumers say yes to the ATT prompt allowing apps to personalize ads.

- Without deterministic attribution, advertisers lose the ability to effectively attribute revenue and are experiencing an erosion of LTV and the effectiveness of LTV models.

- In a post-IDFA world, Facebook, Branch, and Consumer Acquisition recommend focusing on persona-led creative to regain efficiency by allowing paid social algorithms to cluster users based on behaviors and creative trends.

In Other News

With one of the world’s most recognizable brands, Rovio wanted a fresh approach to promote Angry Birds 2, the new arcade mobile game in the billion-dollar franchise. In a departure from cartoon cardinals and canaries, Rovio wanted a live action ad with real actors to highlight the universal appeal of the game across every demographic and device.

Through our agile production process, we efficiently captured hundreds of video and photo assets in one shoot. To understand user motivations and the competitive landscape, we incorporated intensive research from our creative learning agenda to generate persona-led creative. Beyond an entertaining ad, our agile production approach provided Rovio with multiple variations to test, including different character reactions, different narrative progression, and different gameplay. The ad is optimized for multiple platforms and for iterative testing, allowing Rovio to sustain profitable ad spend. See our expertise in action in our Angry Birds 2.

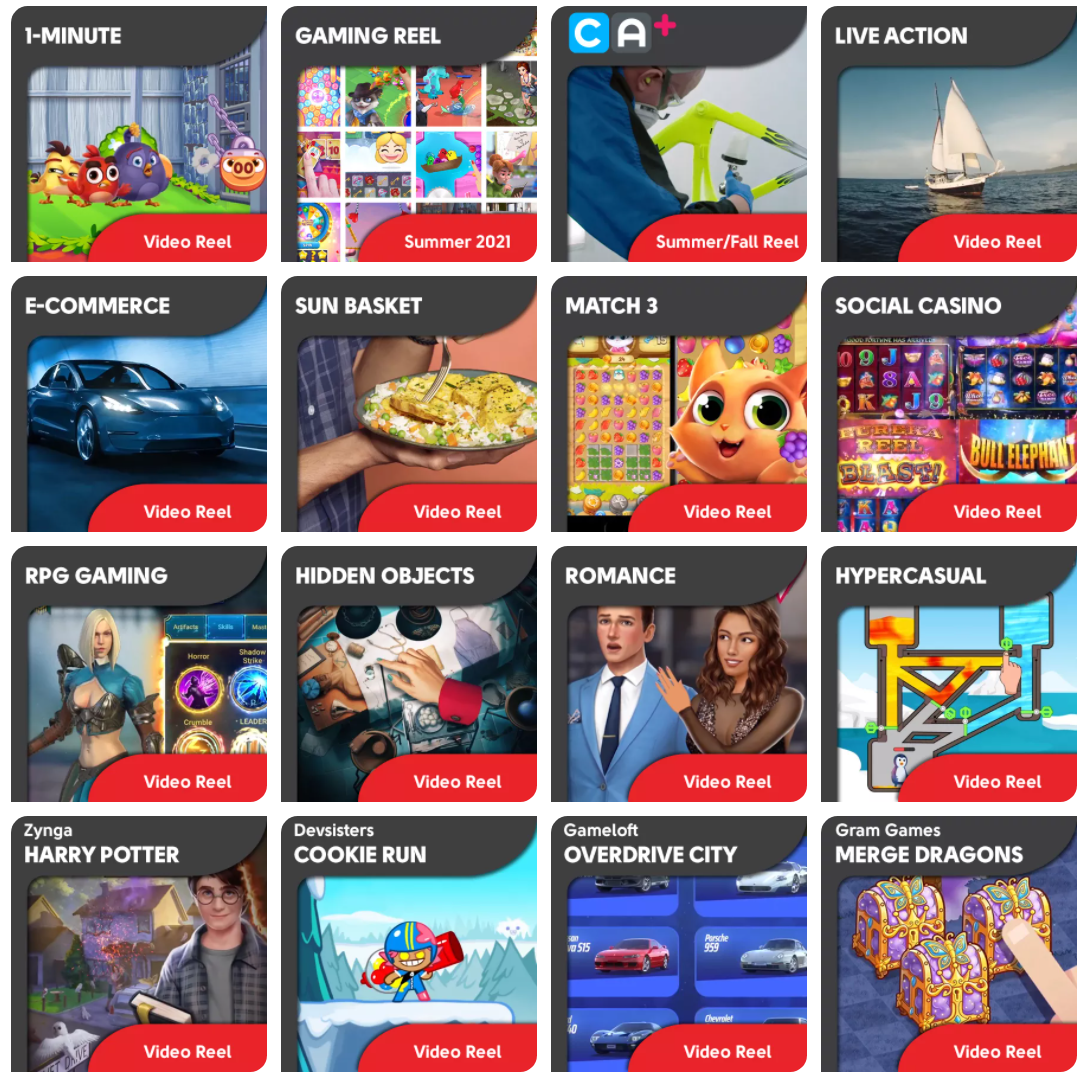

Check Out Our Creative Work

More Creative Trends

Helpful Content

- June 2021: Facebook UA and creative roundup

- Life of Facebook Creative Infographic

- Facebook Creative Fatigue

- Player Profiles & User Motivations

- Better, Faster, Cheaper – Facebook Asset Production & Agile Shoots

- Breakthrough Creative for Facebook Ads

- The Definitive Guide to Unity & Unreal Engine Gameplay Capture

- App Store Optimization Essentials

For more information on persona-led creative or IDFA impact, please contact sales@consumeracquisition.com.

IDFA’s Crushing Impact: How to Survive & Thrive

- Data analysis representing $300 million in paid social spend reveals the devastating post-IDFA impact on click-to-install (c2i) traffic quality, iOS CPM spikes, decrease in mobile app value and event optimization performance, and decreases in lookalike audience effectiveness.

- iOS advertisers are experiencing a 15-20% revenue drop and inflation in unattributed organic traffic.

- Only 20% of consumers say yes to the ATT prompt allowing apps to personalize ads.

- Without deterministic attribution, advertisers lose the ability to effectively attribute revenue and are experiencing an erosion of LTV and the effectiveness of LTV models.

- In a post-IDFA world, Facebook, Branch, and Consumer Acquisition recommend focusing on persona-led creative to regain efficiency by allowing paid social algorithms to cluster users based on behaviors and creative trends.

- We suspect Apple will roll back or soften IDFA changes by Black Friday and Google would benefit from going full Minority Report!

- Check out Brian Bowman’s full interview with VentureBeat for more in-depth analysis and thoughts

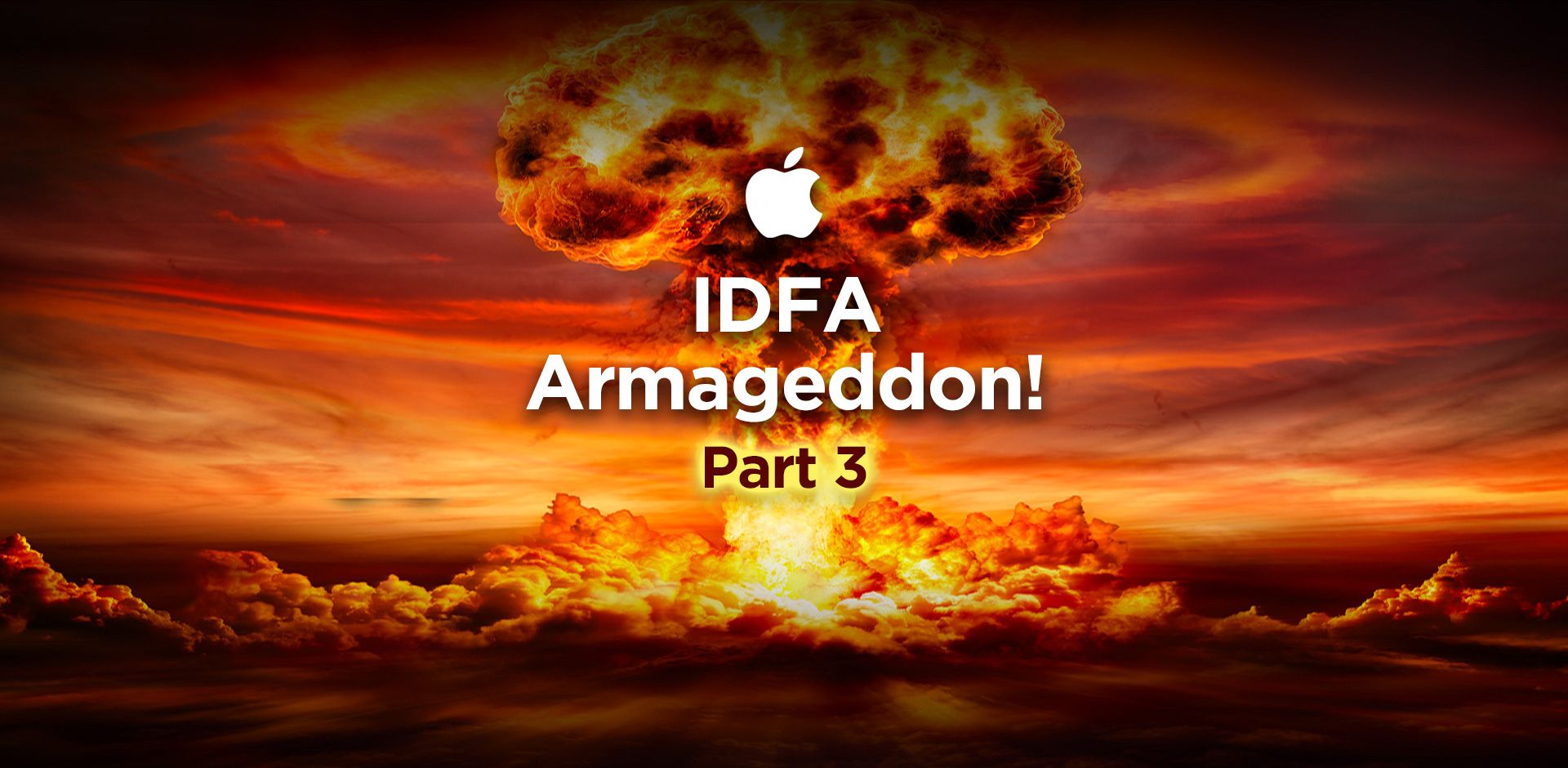

Post-IDFA Crushing Impact: How to Survive & Thrive

For months we have been sharing insights about the loss of Apple’s IDFA and its profound impact on the mobile app ad ecosystem (Hey Apple, You Suck!, IDFA Armageddon Part I, IDFA Armageddon Part II, IDFA Armageddon Part III). After reviewing $250 million in ad spend, we now have a clearer picture of how dramatically Apple has hurt iOS app advertisers and we have recommendations for how to survive and thrive in this post-IDFA world!

By breaking down paid social spend, we tracked how the quality of traffic has steadily decreased since January 2021. For the purposes of this study, the erosion of traffic quality is measured by users’ click-to-install rate (c2i). We are using this c2i to avoid the noise generated by CPMs across genres and countries. Scroll down to the bottom of this article to see the devastating impacts.

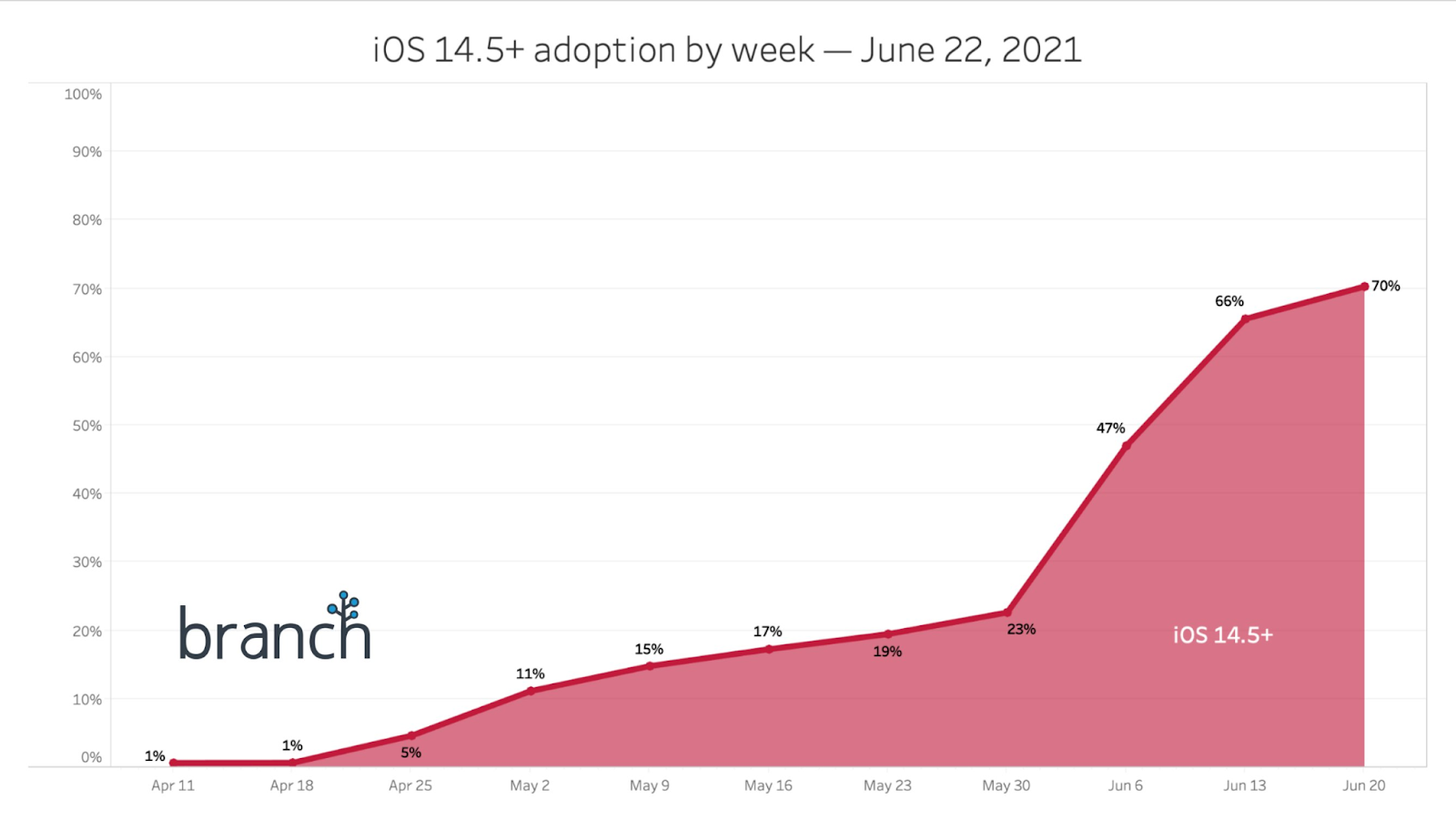

Tracking c2i alongside the loss of Apple’s IDFA and the subsequent operating system updates, we see the decline of traffic quality accelerating. Most notably after Apple began pushing the upgrade of iOS 14.6 in late May 2021. Based on the adoption rate, Apple’s iOS 14.6 may achieve 80% user adoption in late July 2021, which means the full financial impact on KPIs and LTVs could be known next month, August 2021!

Post-IDFA Trends

We can already see the trends. Only 20% of users are allowing apps to personalize their ads by allowing the app to track them when presented with the ATT prompt. For the traffic we evaluated, as personalization and tracking drop, paid social value bidding performance has faded. Across paid social platforms, down-stream event optimization and lookalike audience performance are also eroding. As a result, iOS advertisers are experiencing a revenue drop of 15-20% with inflation in unattributed organic traffic, but not enough to cover the financial loss.

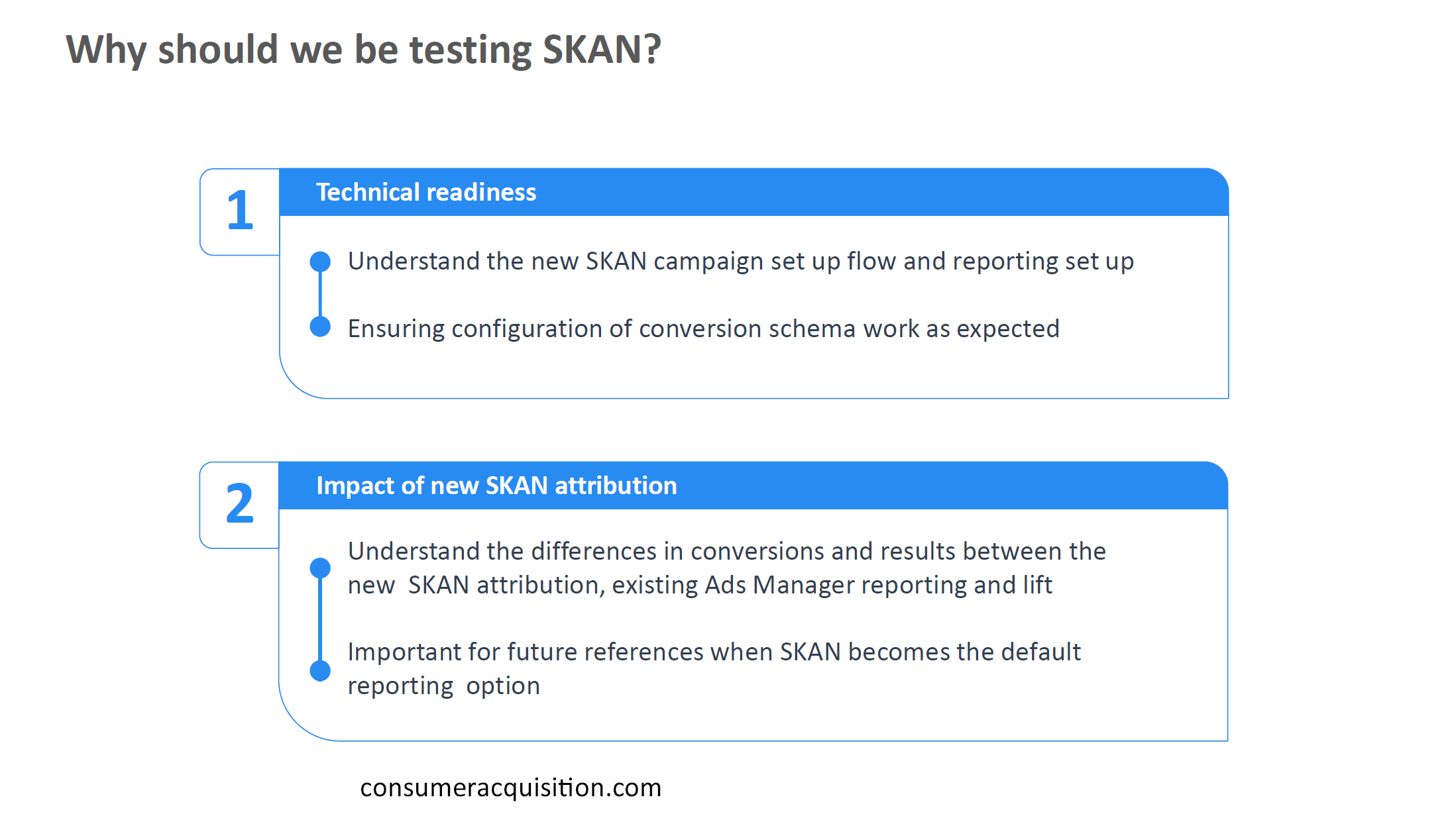

Based on data and conversations, due to the adoption rate of iOS 14.5+ and material erosion of traffic quality and performance, advertisers have shifted their iOS campaigns to SKAN. Apple’s SKAN threshold is 25-30% null installs and clients are seeing a large increase in organic revenue due to unattributed traffic.

Ad Spend

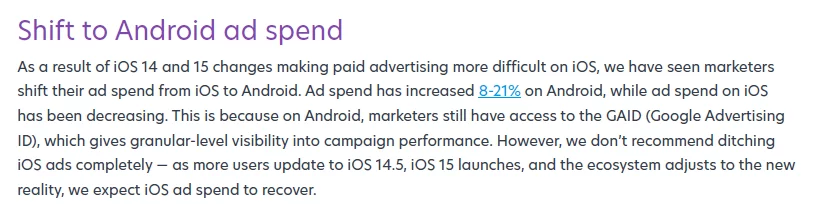

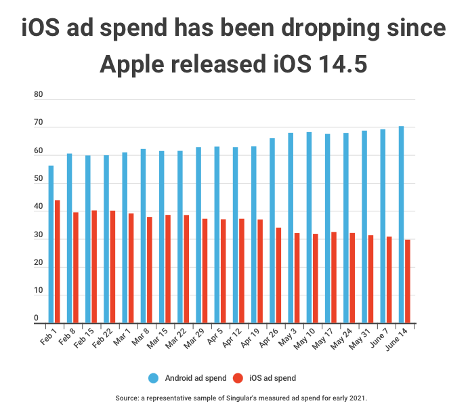

As for deterministic attribution declines with accelerated iOS 14.6+ adoption, advertisers will no longer be able to effectively attribute revenue. They are experiencing an erosion of LTV and the effectiveness of their corresponding models. If advertisers cannot track revenue effectively, ad dollars spent on iOS advertising will drop as it becomes less efficient due to restricted measurement and poor personalization capabilities. Branch’s 2021 Mobile Growth Handbook shows that as iOS advertising has dropped, Android advertising has increased 8-21% due to Google maintaining advertiser’s ability to personalize and customize ads properly.

According to eMarketer, at the 2021 peak of ad spend on iOS, during the week of February 2 to 7, marketer budgets were split relatively evenly between operating systems: 43.84% went to iOS app install campaigns, and 56.16% went to Android, according to mobile analytics firm Singular. (However, Singular notes that spending may have been artificially high as advertisers scrambled before ATT went into effect.) By the week of June 14 to 20, Apple’s share dropped to just 29.71% while Android claimed 70.29% of the budget.

Post-IDFA Data Analysis

To provide a perspective on what is going on with the loss of IDFA, we analyzed data representing $300 million in paid social ad spend. We focused on click-to-install (c2i) rates for Android versus iOS, SKAN versus non-SKAN, CPI versus c2i, value optimization, event optimization, and mobile app optimization. The following graphs show how dramatically the loss of IDFA has impacted iOS mobile app advertisers. Disclaimer: Consumer Acquisition performance reports are based on limited proprietary datasets; actual marketplace metrics may vary.

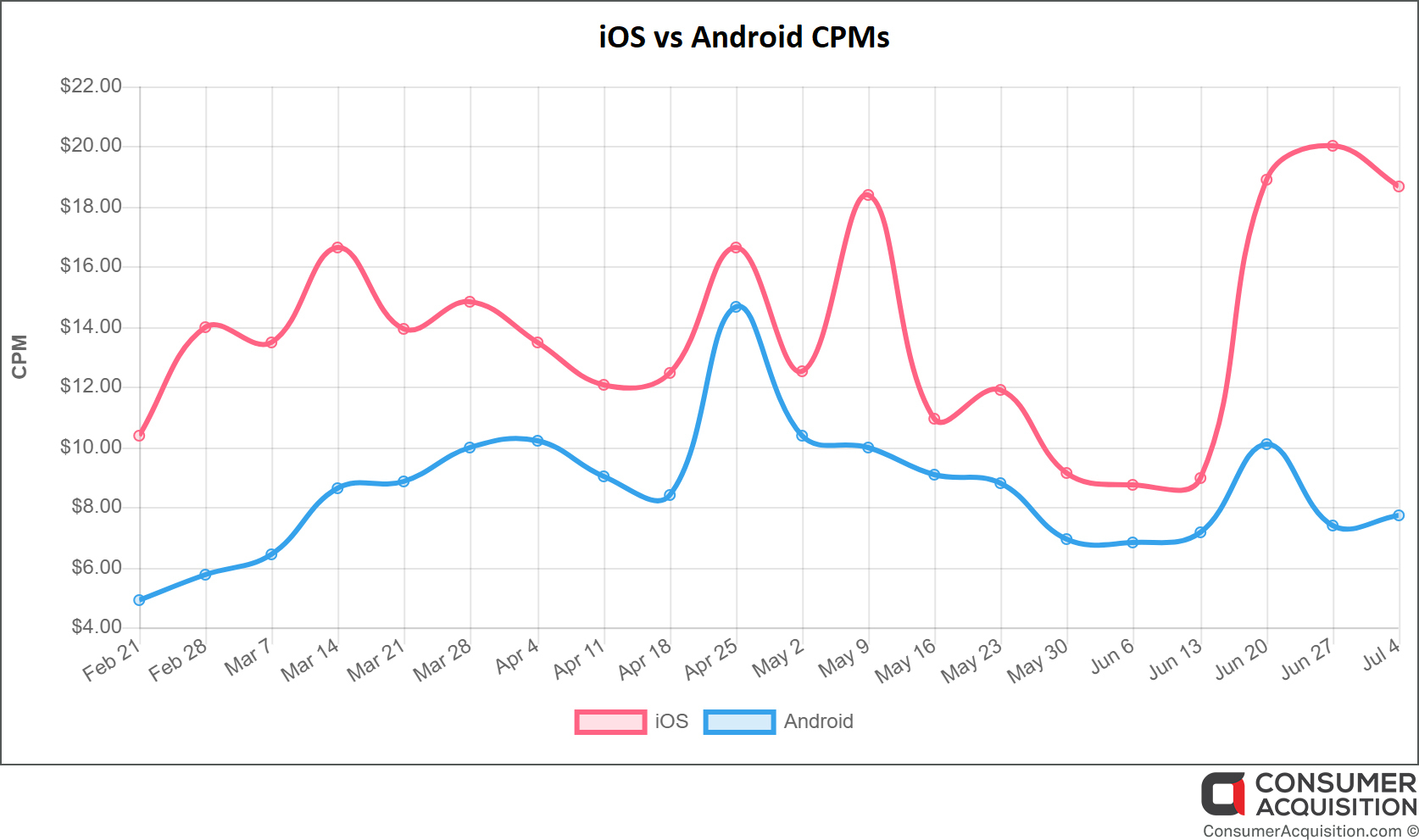

CPM Overview Chart:

Ad Spend: >$300 million

Period: February 21, 2021, through July 4, 2021

Region: US

Platform: Android and iOS

Notable: iOS has consistently been more expensive than Android, depending on the flow of our client’s genre, we see the gap between operating systems close. However, you will notice an increase in iOS CPMs tied to the launch of iOS14.6 vs stable Android.

Campaigns

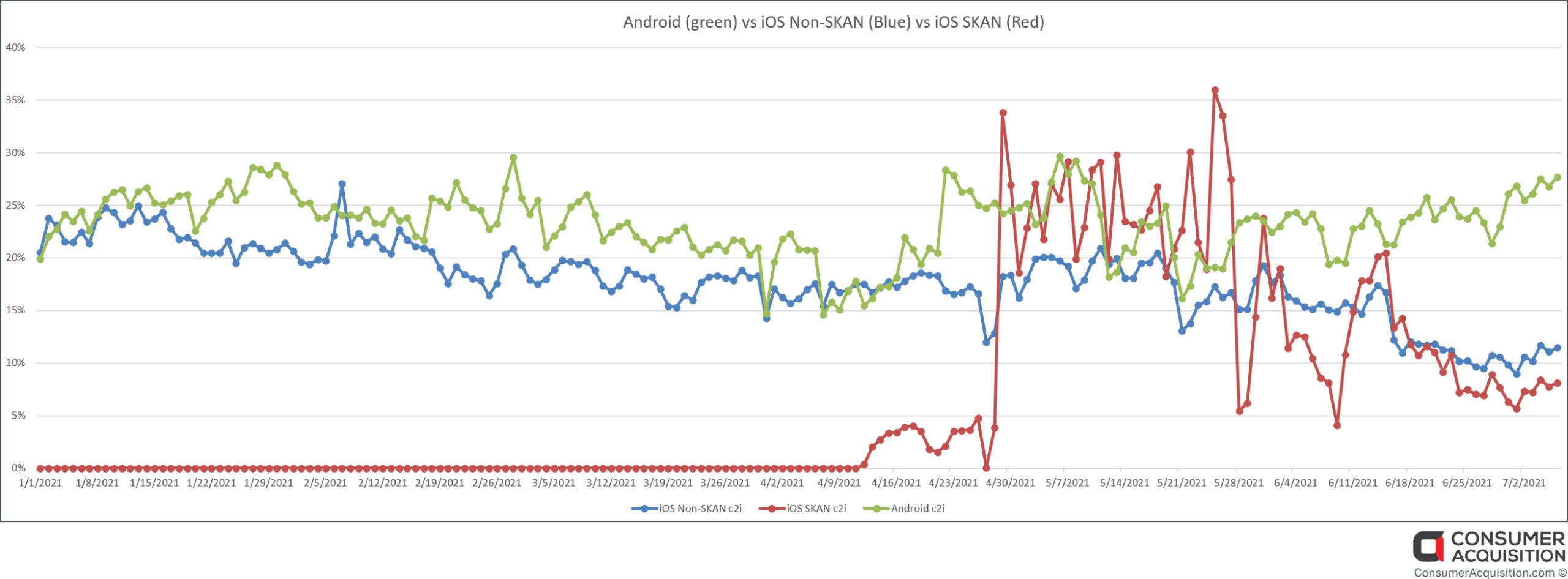

A: Click-to-install (c2i)

Ad Spend: >$250 million

Period: January 2021 through June 2021

Region: US

Platform: Android and iOS

Notable: Using c2i as a proxy for traffic quality, notice that Android c2i remains steady and increases in June while iOS c2i erodes both for SKAN and non-SKAN tied to IDFA loss. iOS traffic quality traffic has eroded with the rollout of iOS 14.5 and 14.6 while CPMs have skyrocketed.

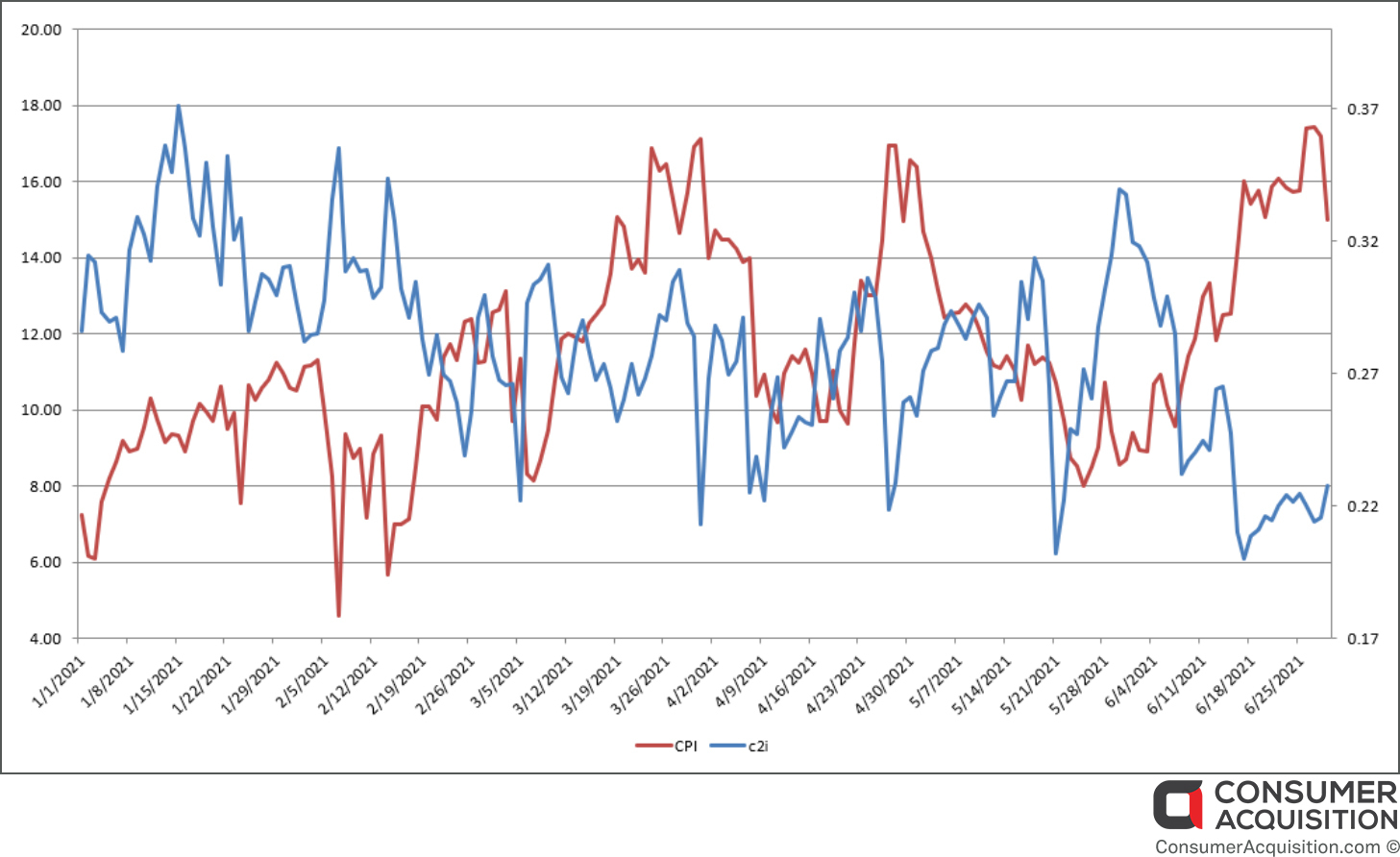

B: Cost-Per-Install (CPI) vs. Click-to-install (c2i)

Ad Spend: $42 million

Period: January 2021 through June 2021

Region: US

Platform: Android and iOS

Notable: June, CPI spikes while click-to-install (c2i) erodes post-IDFA loss, indicating lower quality traffic at increased CPMs.

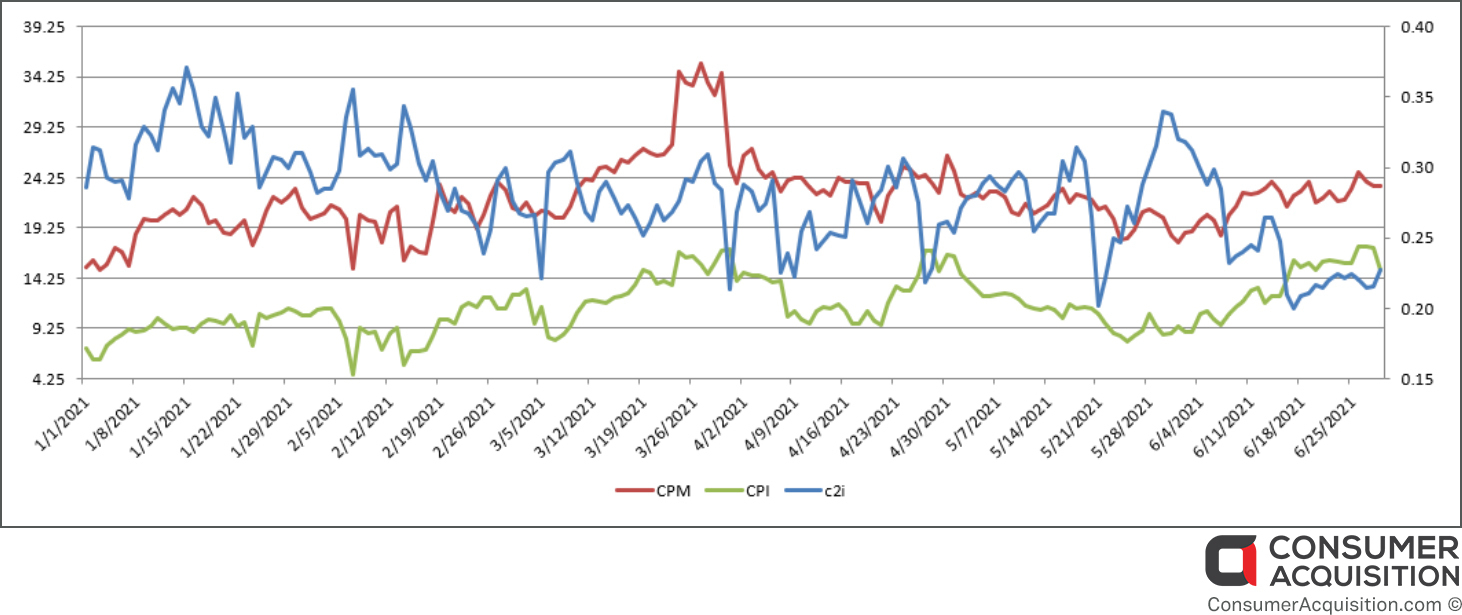

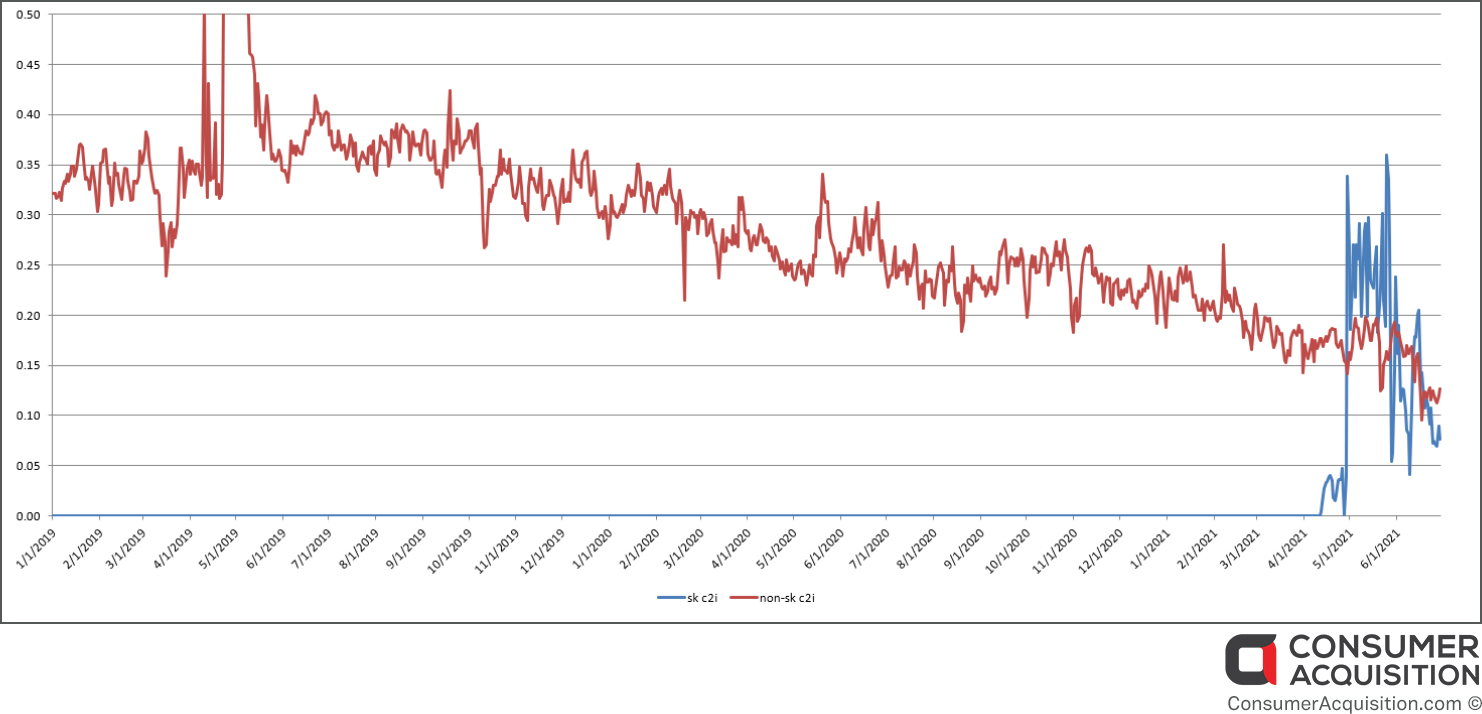

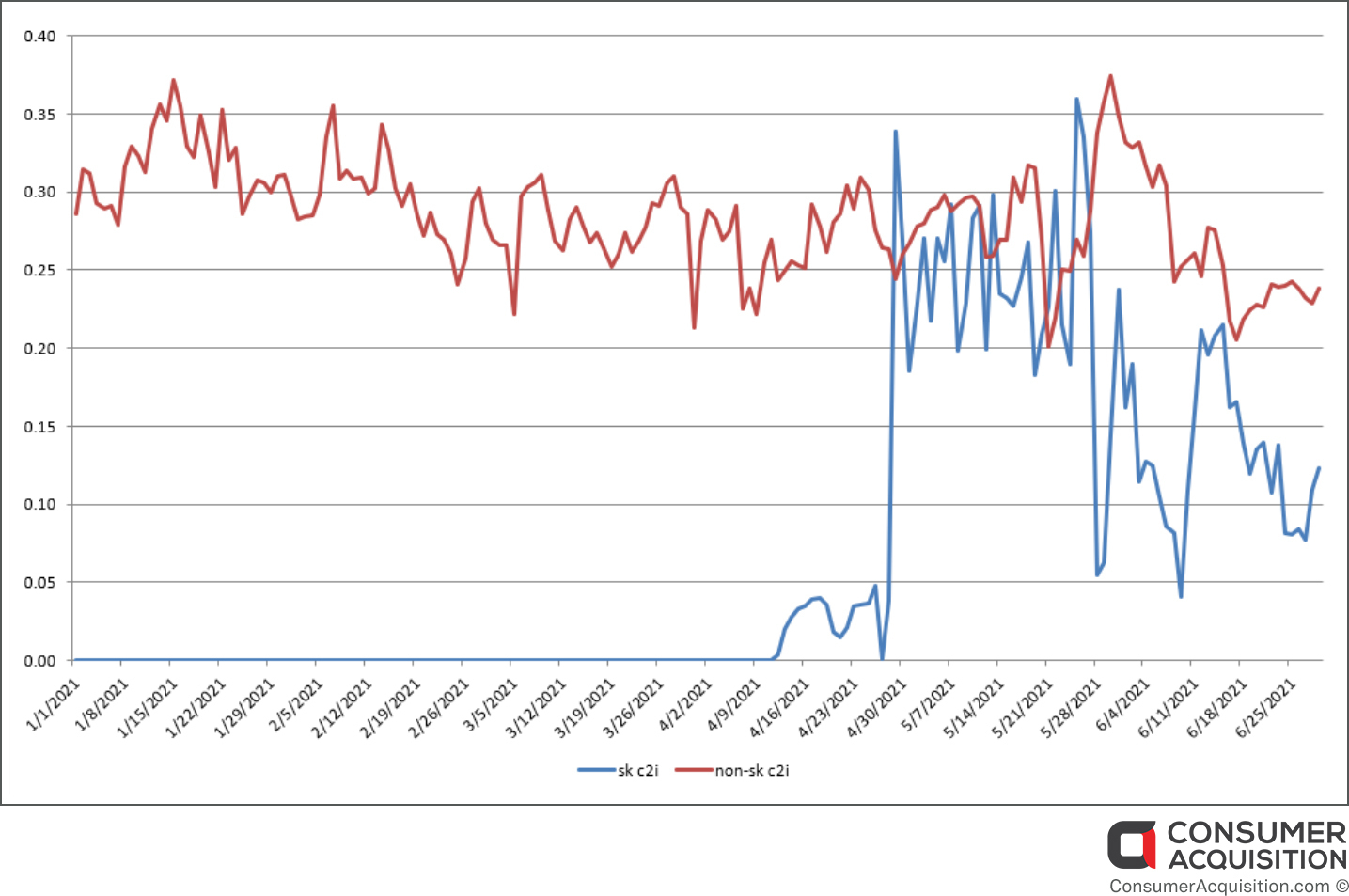

C: SKAN vs. Non-SKAN

Ad Spend: $180 million in spend

Period: January 2019 through June 2021

Region: US

Platform: iOS, Top 5 Gaming Genres & Entertainment

Notable: Comparing SKAN c21 (blue) to non-SKAN (red) c21 there is a noticeable drop in c2i performance as COVID hit in March 2020 and another dip in March 2021, with an accelerated drop in June 2021 due to the increased adoption of iOS 14.5+.

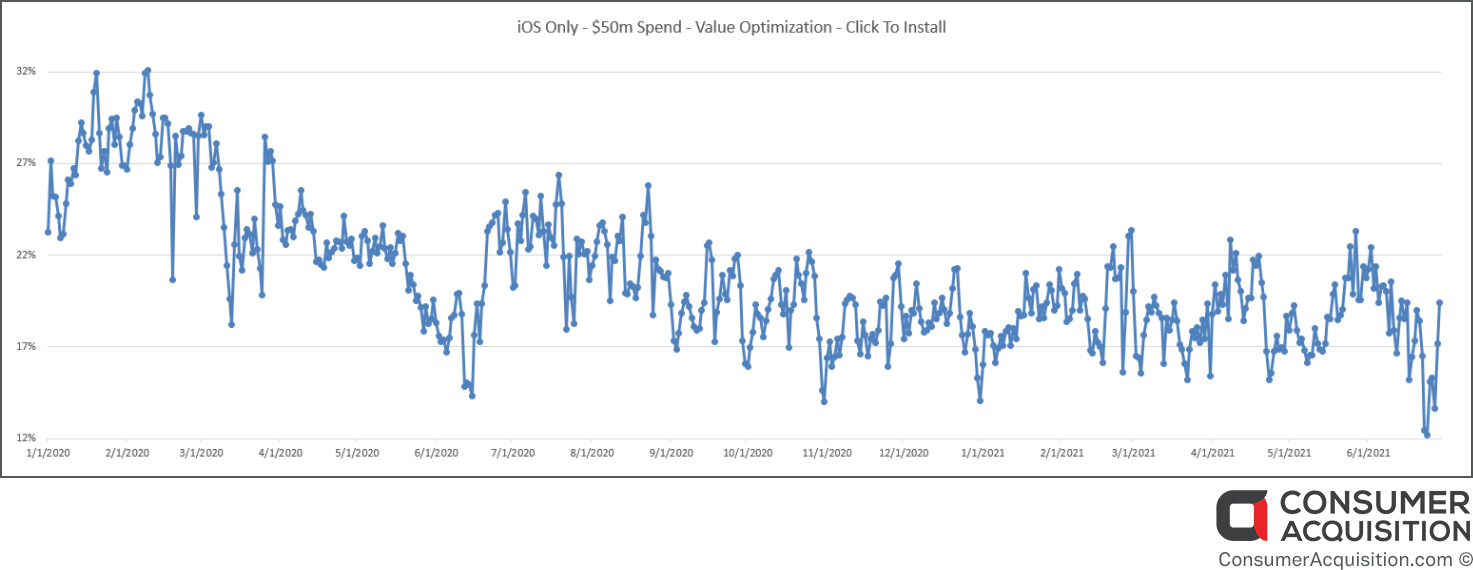

D: Value Optimization (VO), Click-to-Install (c2i)

Ad Spend: $50 Million

Period: January 2020 through June 2021

Region: US

Platform: iOS, Limited to Top 3 Gaming Genres

Notable: In June 2020, drop-in traffic quality. January 2021 did not recover as expected, while eCommerce advertisers exited the holiday marketplace; we believe other advertisers front-loaded Q1 2021 spend to get ahead of potential negative impacts due to IDFA loss. The larger drop in June 2021 corresponds to the iOS 14.6 update.

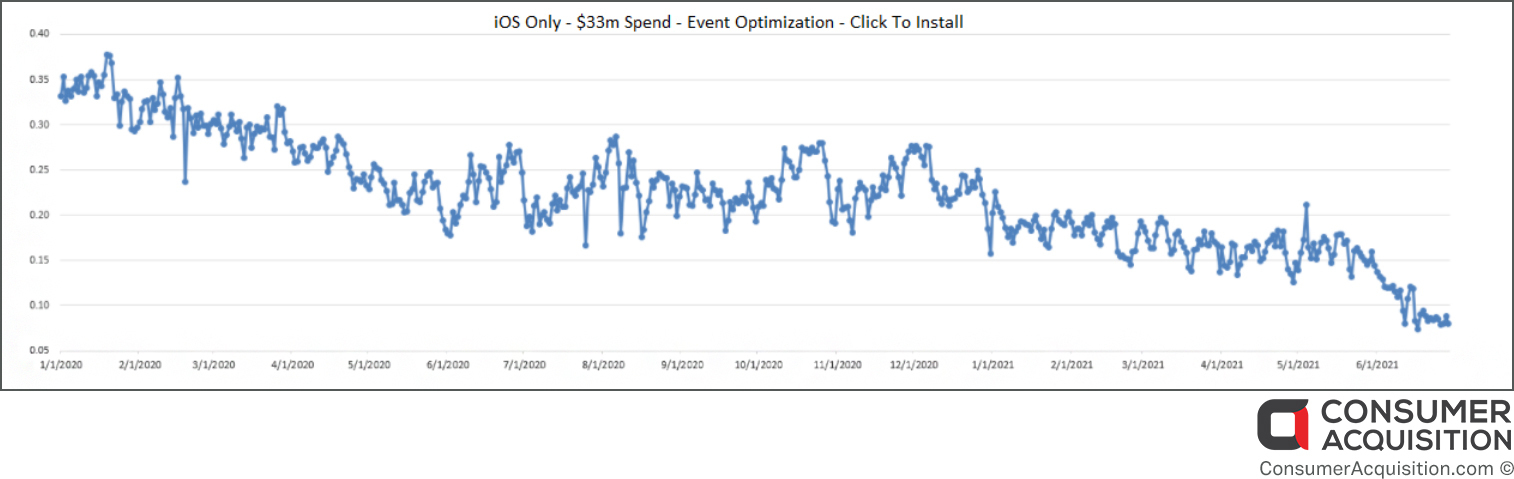

E: App Event Optimization, Click-to-install

Ad Spend: $33 Million

Period: January 2020 through June 2021

Region: US

Platform: iOS, 2 Gaming Genres

Notable: Steady decrease in event optimization click-to-install performance during COVID. C2i stabilizes Aug > Dec 2020 with an additional loss in c2i corresponding to iOS 14.6 June 2021.

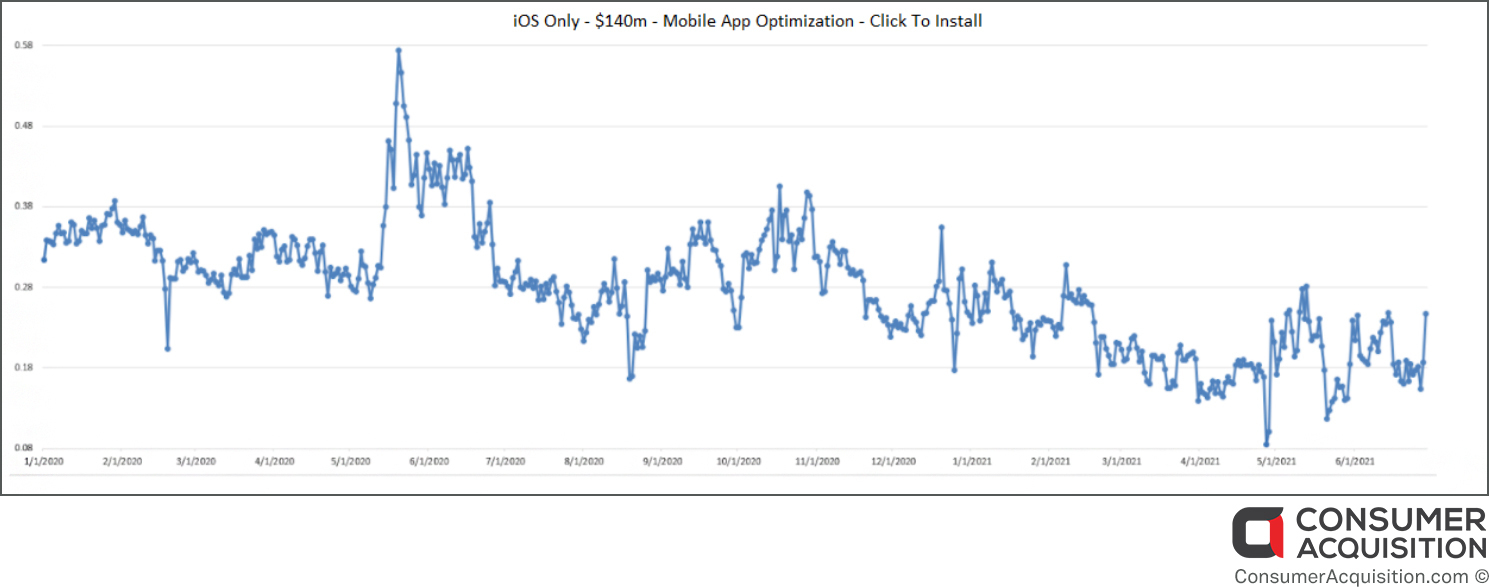

F: Mobile App Optimization, Click-to-install

Ad Spend: $140 Million

Period: January 2020 through June 2021

Region: US

Platform: iOS

Notable: Large increase in traffic quality in June 2020 may be due to advertisers in our marketplace but our overall c2i quality drops starting January 2021, additional loss of c2i quality near the end of April 2021, and further erosion with the iOS 14.6 update.

G: SKAN vs. Non-SKAN

Period: January 2021 through June 2021

Region: US

Platform: iOs

Notable: non-SKAN c2i (red) drops -46% vs January. SKAN c2i (blue) swings wildly with traffic eroding through June 2021.

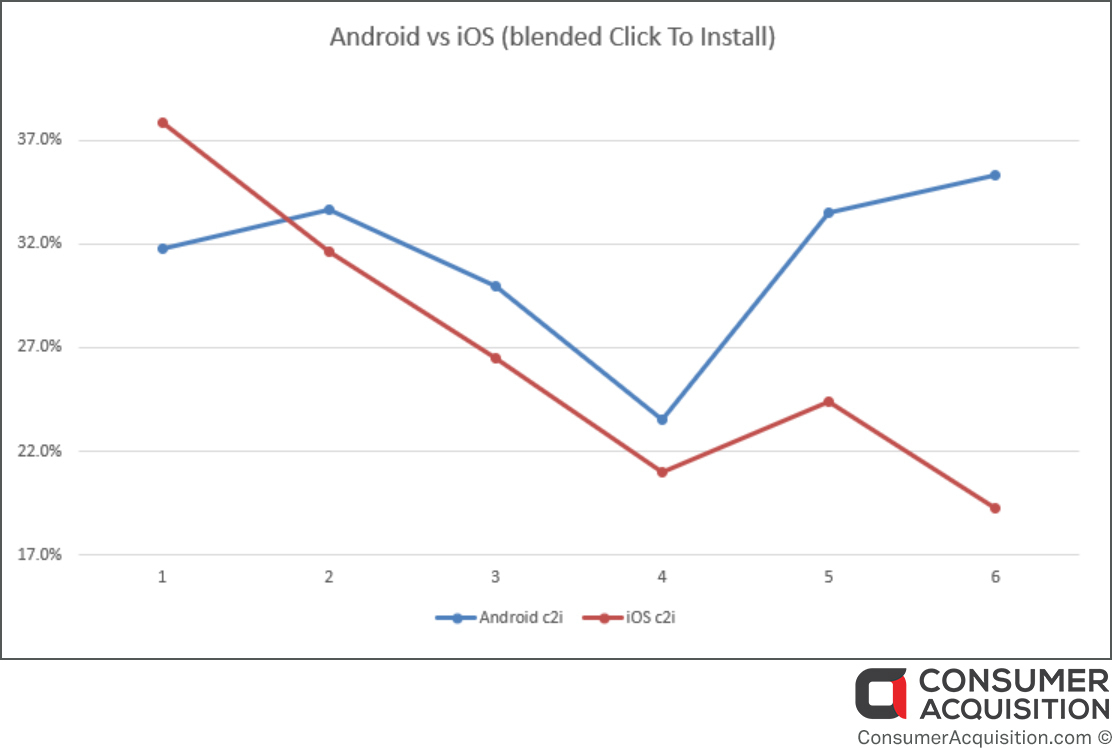

H: Android vs. iOS, Click-to-install

Period: January 2021 through June 2021

Region: US

Platform: iOs and Android

Notable: We are seeing a significant movement in ad spend from iOS to Android. Comparing Android vs. iOS blended (with and without SKAdNetwork), Android c2i increases in June whereas c2I for iOS declines -55% since January 2021.

Before we get to our recommendations, here’s my take:

Apple will roll back or soften IDFA changes before Black Friday.

- As with Apple’s prior failed attempts at launching ad networks (iad), they lack the mettle to build an ad experience that consumers will enjoy. Also, with Netflix and Amazon, consumers have come to expect thoughtful, AI-driven suggestions based on usage data and do not prefer human-curated content. Without the willingness to personalize the merchandising of apps, Apple’s ad network will suffer the same fate as TV commercials. Which are ignored, and skipped by consumers, relegated to the heaping pile of poor user experiences. When Apple realizes they lack “Steve Jobs’ innovation” and that consumers prefer to be delighted by personalized ads and want to maintain “free apps”, Apple will re-enable a version of IDFA to allow reputable companies like Facebook, Google, TikTok, Amazon, Snap, and others to do what they do best and merchandise apps that delight consumers.

- What is the alternative? Apple forces app developers to offer their products for free, without the ability to recover development costs or improve monetization through usage data? Having said all that, I do believe the underbelly of app advertising—the weird ads that follow you around due to 3rd party trackers—will be permanently relegated to the “trash heap” of inappropriate advertising. As a guy who likes to bet, Apple will start to roll back IDFA policies by November 2021, before the Black Friday holiday.

Mobile App Developers Beware!

- Apple is not just reducing the efficiency of paid advertising. They are also hurting app developer retention, LTV calculations, and product development iteration testing. We would like to issue a warning that the KPIs you are testing to tune performance, retention, and LTV may need to be thrown out as of the rollout of iOS14.6. Or, you may consider combining data with organic due to Apple’s SKAN restrictions. Either way, the stability of data and reporting of hundreds of thousands of developers are likely to be questioned.

Why is Android performance suffering?

- Our expectation was that advertisers would move to Android as a safe, haven from iOS chaos, leverage the learnings, audiences, and unobstructed creative optimization, and then port the learnings to iOS. Conceptually, it does not make sense that the performance of Android has taken a hit. Sure, Travel, Restaurants, Auto, Entertainment, SMB, and other COVID-impacted advertisers are back in the market but why would mobile app event bidding on Android across social platforms produce lower ROAS? CPM increases cannot be the only driver.

Why are lookalike audiences collapsing so quickly and what replaces them?

- With only a 20% ATT adoption rate on iOS, we expected the reach and effectiveness of lookalike audiences to decrease. However, the rate of performance degradation across social ad platforms has outpaced the adoption rate of iOS 14.6 and the normal refresh rate of custom audiences and their corresponding deterministic lookalike (LaLs) audiences. Yes, most LaLs are derived from revenue events like purchases but why is LaL performance dropping so quickly?

Unless legally forced to do so, as with their delay in killing pixel tracking, Google will NOT kill GAID!

- Google is one of the world’s best companies at identifying what people want next and delivering it to them. If Sundar Pichai were to ask my option on IDFA (which, for the record, he has not), I would advise him to go full “Minority Report”! Do what you do best and delight consumers, like Netflix, by guiding them on what they may enjoy next based on AI, quantitative analysis, and behavioral dynamics.

Where are we headed?

- My new least favorite phrase is probabilistic targeting. Mainly because it connotes lower quality recommendations (e.g., spam) and lowers ROAS / net profit. Since it looks like Apple is willing to burn down their own iOS marketplace and they do not appear to be budging…why aren’t the large social ad platforms offering a tool that allows advertisers to import custom audiences and generate a contextually targeted interest cluster of users? While the deterministic financial efficiency would still be less, this could allow most existing advertisers to maintain their investments and historical learnings and may function as a bridge into the new probabilistic ad world. If you then enhance that data with the massive treasure troves of 1st party data coupled with interest audience segments tied to persona-led creative, we may have a sustainable path forward. As the data shows, it is certain to be a less profitable path forward, but it is still a path forward.

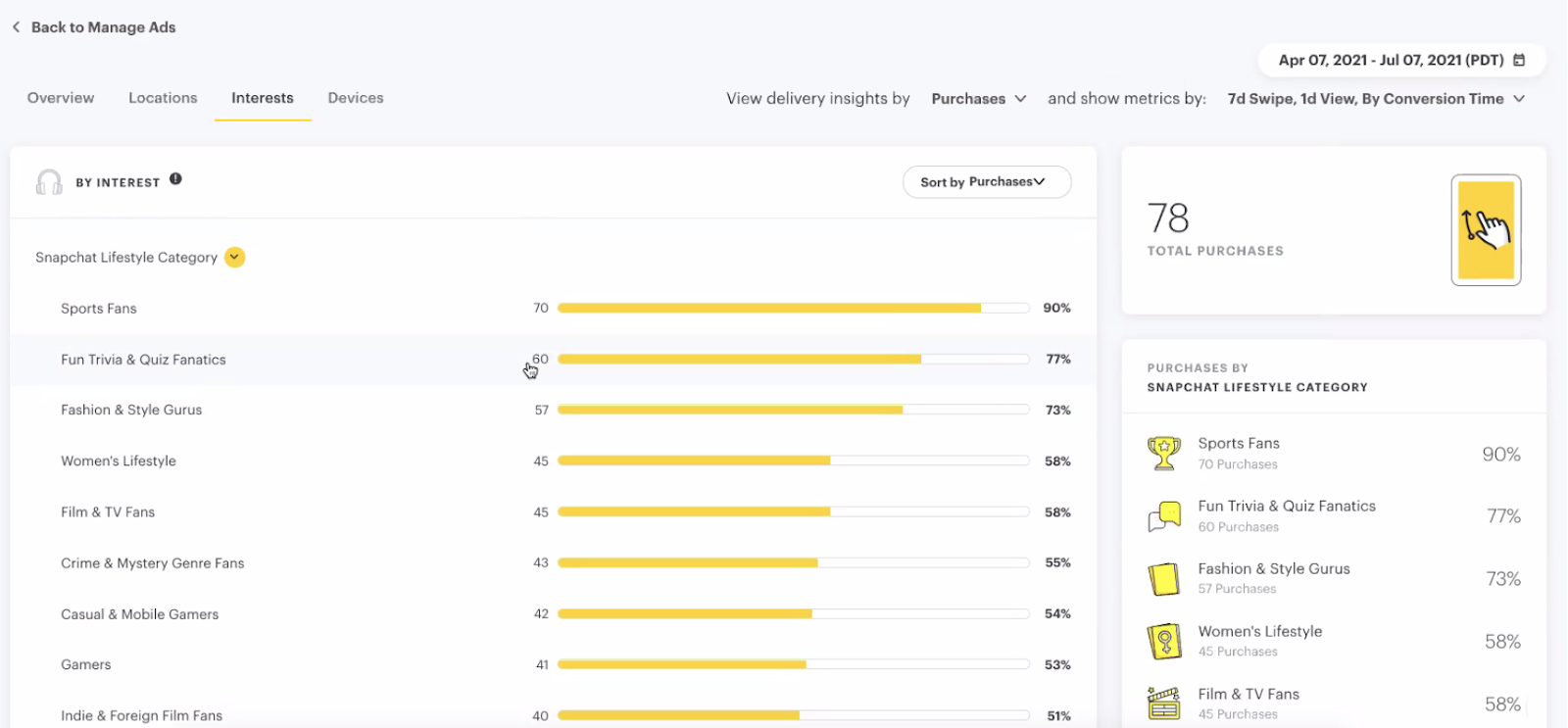

Snap UI: audience mapped to interests

To me, the above does not add up! We are clearly in the throes of a transition. Companies appear to be positioning themselves to maximize their own internal revenue. The juggernauts have yet to offer a viable probabilistic alternative that leverages 1st party data. So, until they do, here are our recommendations for what you can do when “nothing is making sense”!

POST-IDFA RECOMMENDATIONS

Deterministic tracking is eroding on iOS devices. Large social ad platforms continue to simplify and automate their media buying algorithms. So, the most efficient lever for sustained profitable user acquisition is creative optimization. Our recommendation is to develop persona-led creative that allows the algorithms to identify and cluster users based on their preferences, performance data, and response rates to creative styles. This insight then allows mobile app developers to tie events based on the probability of monetization. Which will guide consumers into an appropriate onboarding funnel in their app.

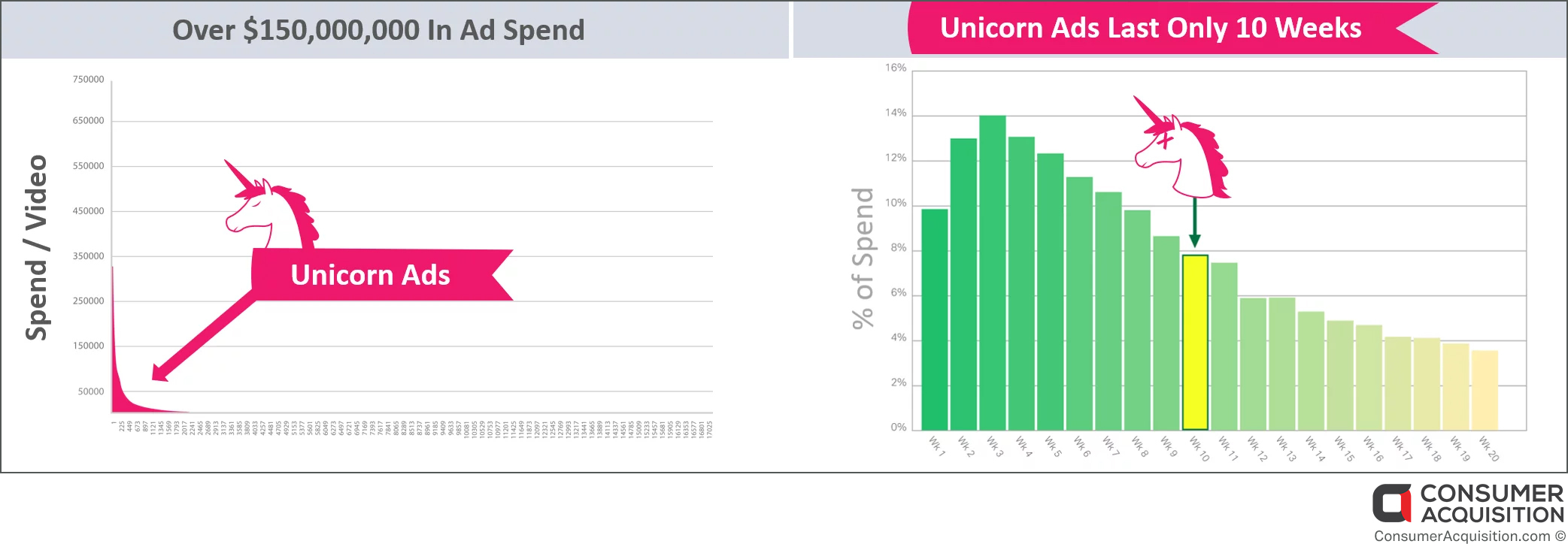

Creative Tips

- The most important lever in performance advertising is now creative, due to IDFA loss and media buying automation.

- 85-95% of new creative concepts will fail to outperform the best ad. So you will need 20-50 new original concepts to find your next winner.

- Winning ads last only 10 weeks, then fatigue and die creating a virtuous cycle of need for fresh creative concepts.

- With A/B testing creative no longer viable on iOS, creative teams need to shift from variation testing to developing new concepts.

UA Tips

- The first two weeks of July have been highly volatile across paid social channels. Profitable scale is difficult to achieve and sustain. Lookalike audiences appear to burn out in only two weeks. Until paid social advertising is thrown a lifeline, we recommend all advertisers diversify their acquisition portfolios across paid social channels. We also recommend SDK networks to uncover all pockets of efficiency.

- The strongest performance we are seeing is coming from top countries, localized ad copy with AEO or Broad targeting.

- An area of exploration is interest clusters coupled with persona-led creative.

- Facebook’s Big Catch Playbook outlines how ads they’re seeing are not speaking to the distinct motivations of different types of players; this is a critical oversight as the ability to track users declines. Pair creative with onboarding, tag to an event and allow Facebook to deliver qualified audiences.

- Similarly, Branch’s 2021 Mobile Growth Handbook recommends aligning creative with user intent to earn more high-quality top-of-funnel installs

- Persona-led creative developed through a creative journey helps advertisers design a solution to meet the target user’s expectations, needs, and desires.

- Restructuring your Facebook ad account for iOS 14.6+ is critical to adapt and thrive.

App Developer Tips

- For iOS, focus on tutorials to identify consumers that indicate a propensity to monetize in the first 48 hours post-install. Also, establish onboarding as events to educate the algorithms on what changes to make.

- Mobile app developers often succeed or fail based on how effectively they measure and improve retention, revenue, and LTV. Most companies focus on new updates, new features, and revenue.

- We are advising app developers to break down the silos between product and marketing teams. This will enable them to stay ahead of and measure creative fatigue. Resulting in a steady stream of fresh creative assets.

For More Background On Our Perspectives Around Post-IDFA Loss

- Hey Apple, You Suck!

- Adapt And Thrive In A Post IDFA World

- IDFA Loss Will Kill A/B Creative Testing

- The IDFA Armageddon Series: IDFA Armageddon Part I; IDFA Armageddon Part II; IDFA Armageddon Part III

- Joe Kim from The GameMaker’s states, some early takes on the impact of IDFA deprecation on iOS:

- “Facebook and Google appear to be more impacted than other ad networks in terms of ability to target the best users for games. Facebook is going so far as to change its targeting method to match what the SDK networks are doing more closely (they announced this).”

- “There’s very little VO-style inventory to be had.”

- “Advertisers are paying absurd amounts of money for impressions where IDFA is known.”

- “Organics are un-impacted for us, but we’re seeing some increase due to unattributed installs.”

- “The current environment is fucking bonkers!”

How We Can Help

- As research into this post, we have spoken with twenty large spenders. They agree that fully loaded costs of internal UA teams are 6-8% of media spend. Consider leveraging the expertise and optics that an external agency provides. This will help you gain a broader understanding of the highly evolving post-IDFA impact.

- Founded in 2013, ConsumerAcquisition.com is a technology-enabled marketing services company. We have managed over $3 billion in creative and social ad spend for the world’s largest mobile apps and web-based performance advertisers. In addition, we provide a creative studio and user acquisition services for Facebook, Google, TikTok, Snap, and Apple Search social advertisers.

- We can provide your internal user acquisition team a perspective on iOS14 impact across paid social providers. Our Hollywood-based team of storytellers can produce a steady stream of persona-driven creative ideas to stay ahead of creative fatigue.

- Contact Sales@ConsumerAcquisition.com to work with the team.

Why Electronic Arts, Star Wars: Galaxy of Heroes Ads Work – And Yours Don’t

Creative is an advertiser’s best opportunity for a competitive advantage in social advertising. The combination of Facebook’s and Google’s Media buying automation with Apple’s removal of IDFA will make ‘winning’ creative ﹘the five percent of Facebook videos that are successful﹘of paramount importance. Here we break down role playing games from Electronic Arts’ Star Wars Galaxy of Heroes with competitive trends & creative recommendations, so you can learn from their creative best practices.

Check Out Our RPG Gaming Reel!

Role Playing Games

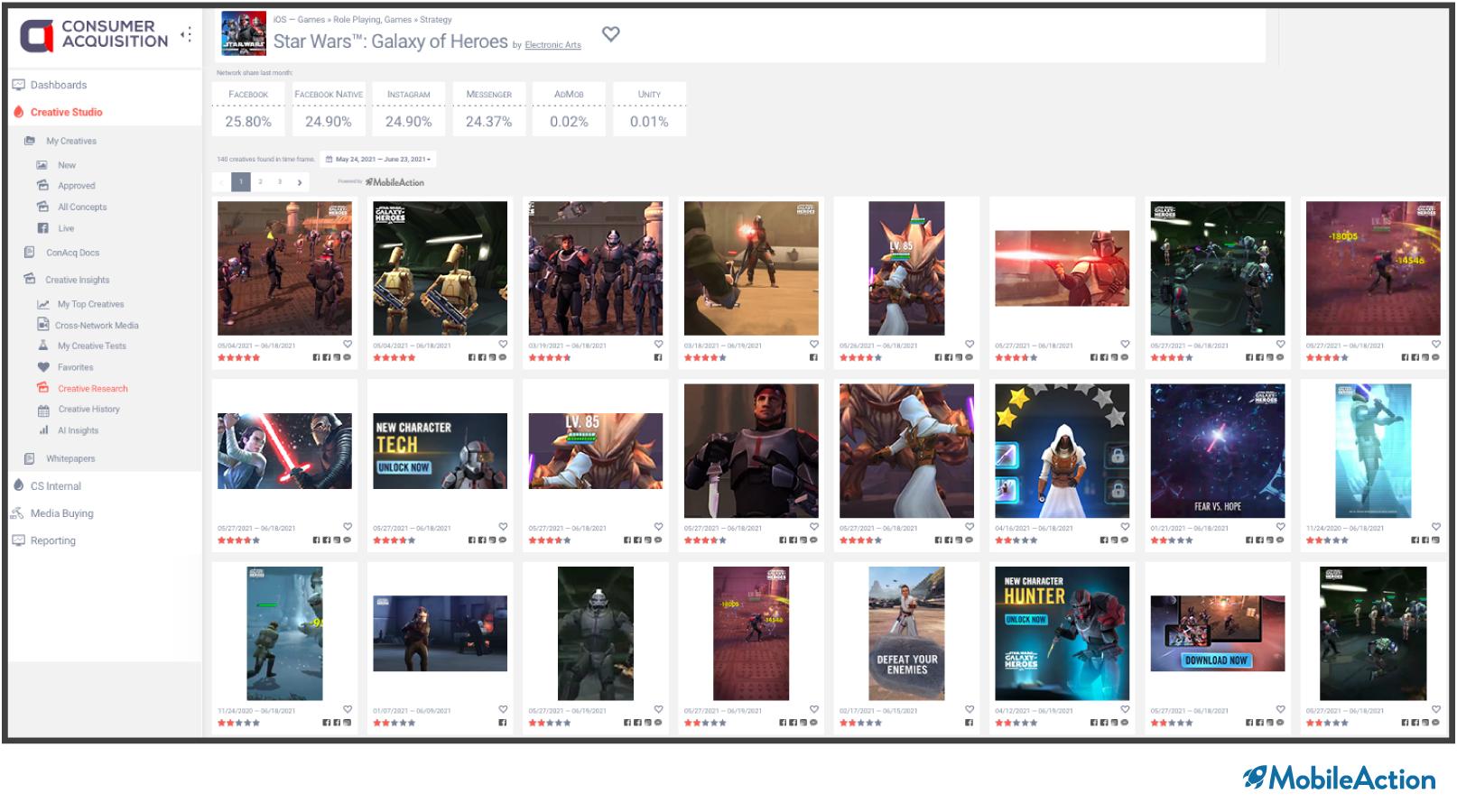

Top Trending Ads & Platform Distribution

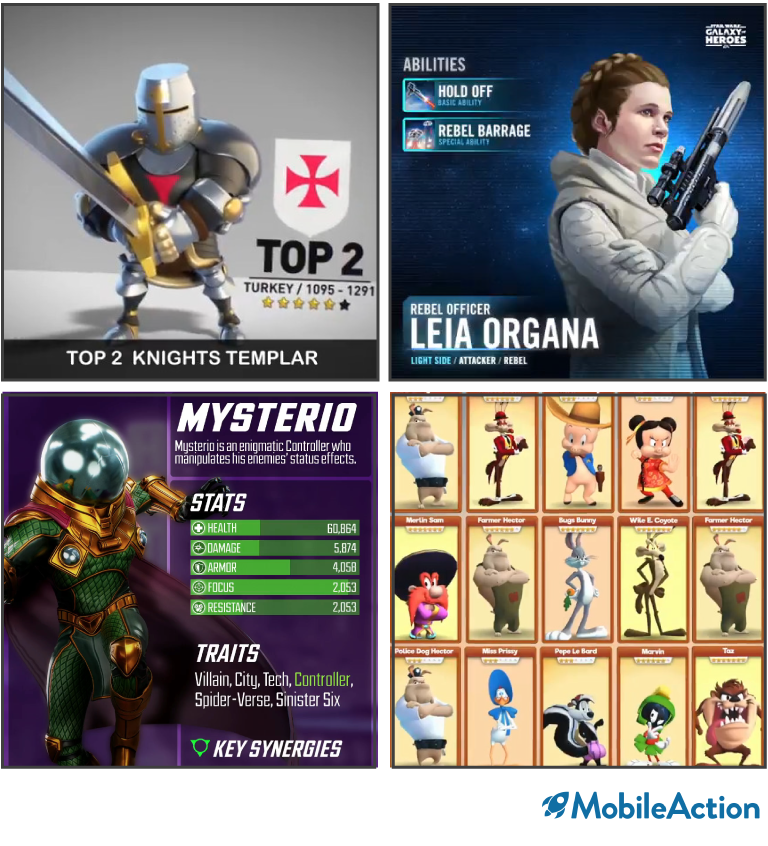

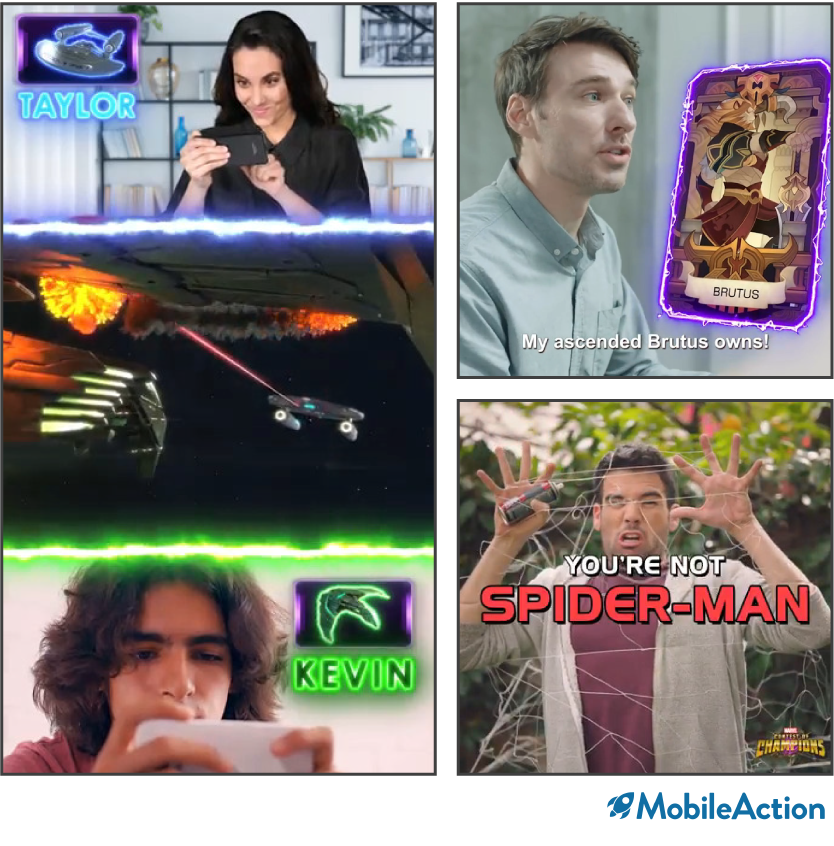

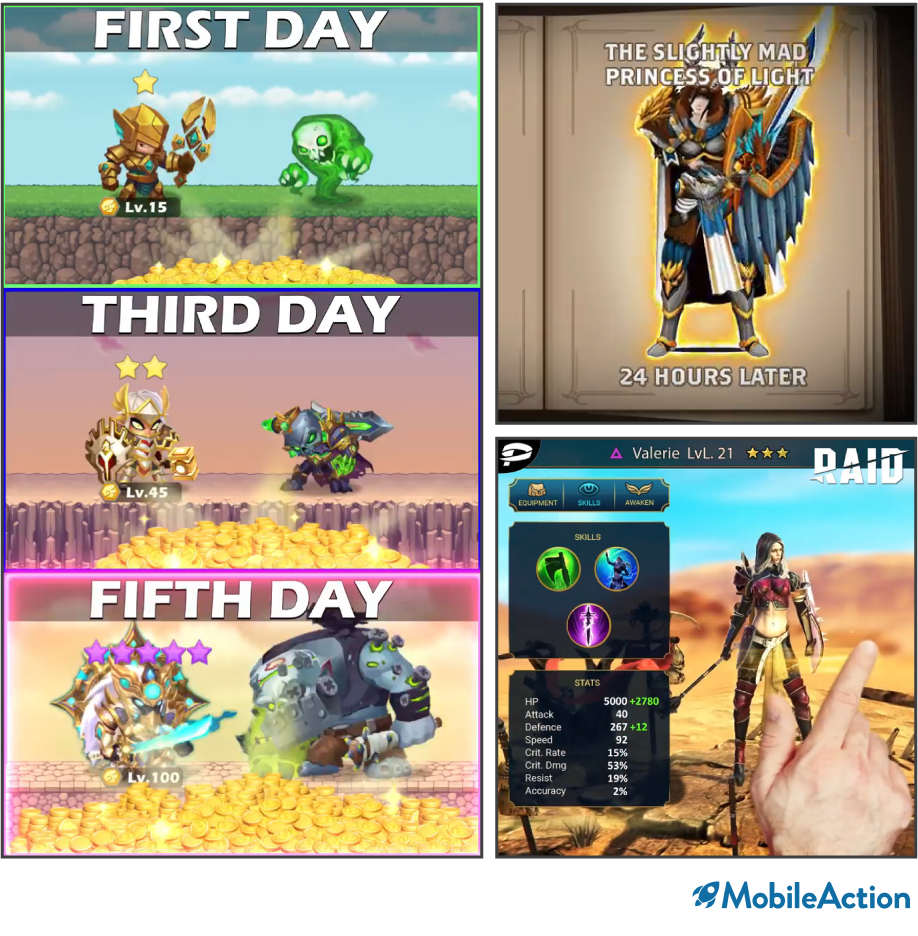

Role Playing Creative Trends

Star Wars Galaxy of Heroes Makeover: What’s Working

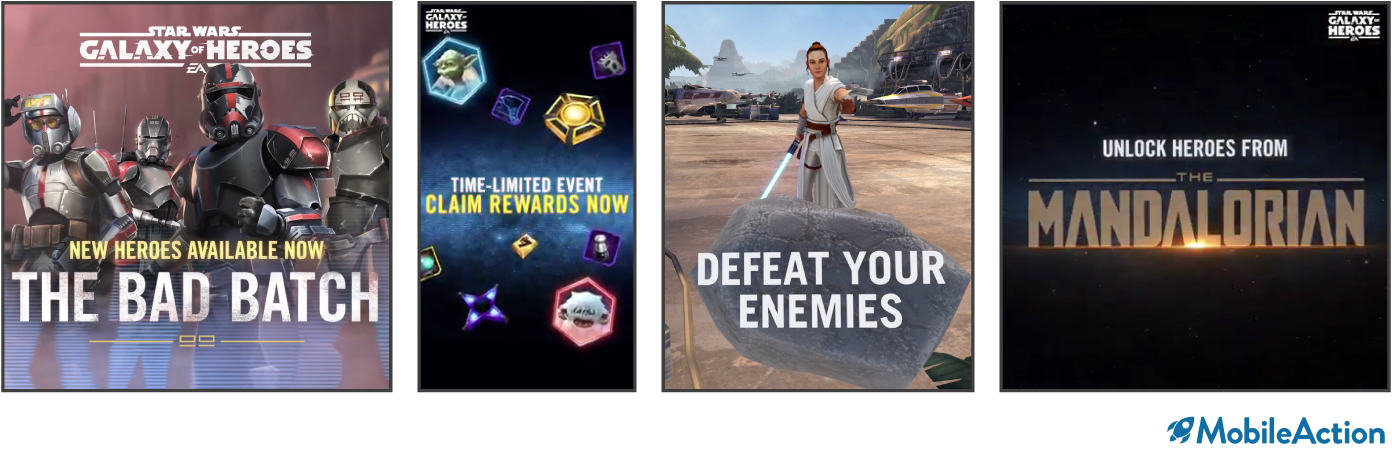

Game Trailer:

- Game Trailer concepts showcase game graphics, core objectives, and overall game experience

Achievement:

- Achievement concepts attract players interested in unlocking levels, characters, and power

- Showcases game graphics and gameplay

Gameplay:

- Gameplay concepts authentically showcase game graphics and characters

Promotional/Special Offers:

- Limited time reward offers, and promos attract new and returning players

Role Playing Iteration Ideas

Game Trailer:

- Try more overview/tutorial game trailer concepts to attract new players and casual Star Wars fans

Achievement:

- Continue achievement concepts with a focus on unlocking new characters/powers

- Try “Top Ten” character countdowns

Gameplay:

- Continue gameplay concepts, with PVP/inset players

- Try augmented gameplay, adding player comments or VO

Promotional/Special Offers:

- Continue promo/special offer concepts

- Try adding a seasonal (holiday/summer) layer to these concepts

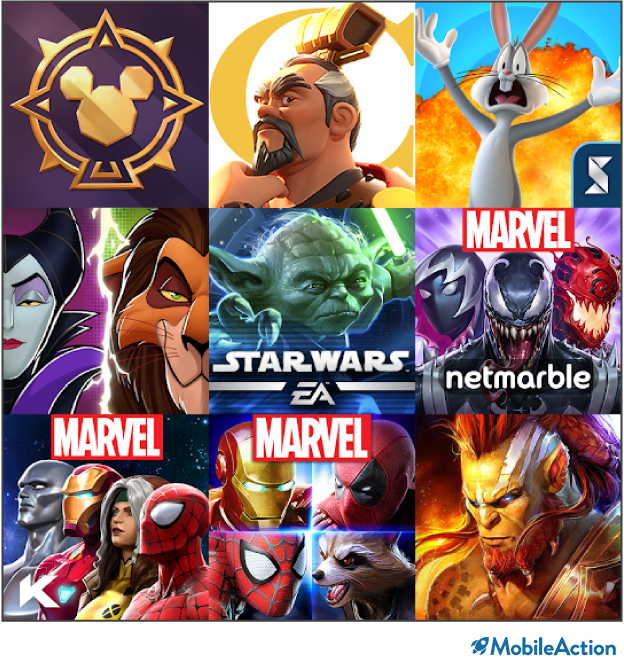

Electronic Arts: Star Wars Galaxy of Heroes Competitive Analysis

Competitors: Marvel Strikeforce, Marvel Contest of Champions, Disney Sorcerer’s Arena, Summoners War, Disney Heroes Battle Mode, AFK Arena, Raid Shadow Legends, Looney Tunes World of Mayhem, Marvel Future Fight, Questland: Hero Quest, Mighty Quest for Epic Loot, Legendary: Game of Heroes, Taptap Heroes, Cookie Run: Legend, Hustle Castle, Genshin Impact, Star Wars, Star Wars: KOTOR, Star Wars: Card Trader by Topps

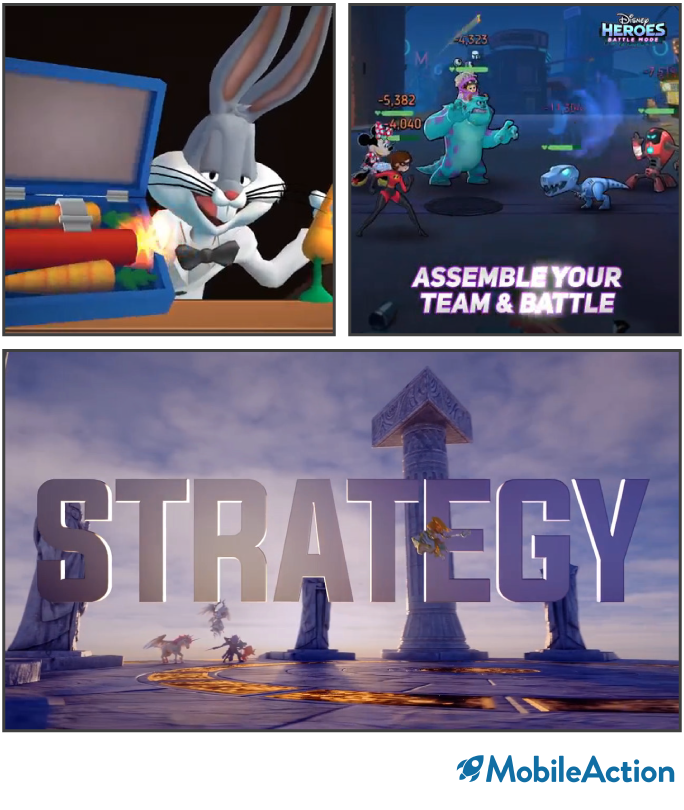

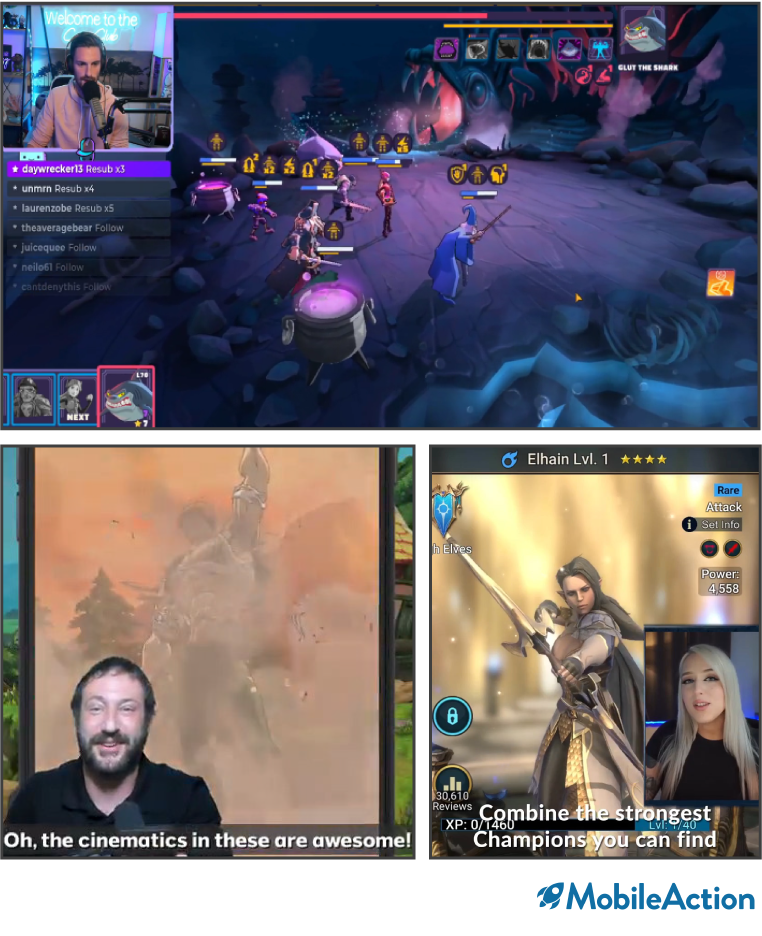

Role Playing Competitive Trends

- Game Trailer: Overview of the game showcasing characters, gameplay, and graphics.

(Marvel Future Fight, Summoners War, Disney Heroes: Battle Mode, many others) - Gameplay: Simple gameplay, sometimes simulated or augmented.

(Marvel Strike Force: Squad RPG, Disney Sorcerer’s Arena, many others) - Characters: Concepts built around game character personalities, powers, and origins.

(Raid: Shadow Legends, Looney Tunes World of Mayhem, Rise of Kingdoms, many others) - Player Focused: Player types, player interviews, and PVP gameplay.

(AFK Arena, Marvel Contest of Champions) - Influencers: Leveraging influencer interviews & reviews.

(Raid Shadow Legends, Rise of Kingdoms, The Seven Deadly Sins) - Pop Culture: Ads that have pop culture and lifestyle as a primary element.

(Looney Tunes World of Mayhem) - Competitive: Comparing the app against other apps or games.

(AFK Arena)

Role Playing Creative Trends

Concept: Gameplay

Create gameplay videos featuring more details of the game and player involvement:

- Heighten element of fantasy and role-playing, getting the chance to become your favorite character

- Highlight collection, powering up, and PVP in gameplay (player control)

- Augment gameplay with player voice-over (subtitled), providing commentary

Competitors utilizing trend:

- MARVEL Strike Force: Squad RPG, Marvel Contest of Champions, Disney Sorcerer’s Arena, Summoners War, Rise of Kingdoms

Player Motivations:

- Targets players interested in narrative, challenges, and completion

Concept: Game Trailer

Create videos explaining the game in more detail:

- Add more game features:

- Turn-based RPG and PVP

- Strategy and collection

- Social aspect/raids

- More emphasis on player control and the ability to be their favorite characters

- Try more themed trailers (e.g. Jedis from different chapters)

Competitors utilizing trend:

- AFK Arena, MARVEL Strike Force: Squad RPG, Summoners War, Raid Shadow Legends, many

others

Player Motivations:

- Targets RPG players who might otherwise not try the game, as well as clarifying for Star Wars fans

what the game is.

Concept: Characters

Leverage the incredible character roster of the game more clearly:

- Countdown of character attributes, powers, and strengths

- Continue videos centered on one individual character

- Videos featuring rival factions

- Thematic pairings (e.g., whose Jedi powers are greater?)

Competitors utilizing trend:

- Marvel Strike Force: Squad RPG, Disney Sorcerer’s Arena, Raid: Shadow Legends, many others

Player Motivations:

- Targets players interested in narrative, power, and completion

Concept: Player Focused

Create videos centered on the player experience of the game:

- Inset of players competing in PVP

- Player commentary on game and characters

- UGC of players as their favorite character

- Leverage the idea of DSA being the best way to experience being their favorite Disney character

Competitors utilizing trend:

- AFK Arena, Marvel Contest of Champions, Star Trek: Fleet Command

Player Motivations:

- Targets players interested in competition, as well as RPG and PVP aspects of the game

Concept: Influencers

Create short videos combining influencer gameplay and commentary:

- Attracts players while legitimizing the game

- Demonstrates how to win stages and rewards

- Demystifies the game for potential players who don’t understand Star Wars/RPG

Competitor/Share of Voice:

- Raid Shadow Legends, Rise of Kingdoms, The Seven Deadly Sins

Player Motivations:

- Targets players interested in social and competition aspects

Concept: Achievement

Create videos that demonstrate achievement, collecting stars, and powering up characters:

- Unlocked levels, characters, powers

- Leaderboards

- Results of powering up in battles

Share of Voice:

- Taptap Heroes, Questland

Player Motivations:

- Targets players interested in achievement & mastery

Non-Competitor’s Concept: Female Story

Capitalize on the wealth of great female characters in the Star Wars franchise with all-female videos:

- Engages players from other genres of games

- Targets female players

- Trailers featuring all-female lineups

- Gameplay featuring female teams

- Character countdowns of top female characters

Non-competitors utilizing trend:

- Matchington Mansion, Lily’s Garden

Player Motivations:

- Targets female players who haven’t discovered the game

Reveal more Role Playing Star Wars Galaxy of Heroes Secrets!

Download Star Wars Secrets Today!Check out more of our creative here!

Mobile App UA & Creative Roundup June 2021

Our UA and creative insights come from managing over $3 billion in creative and social ad spend for the world’s largest mobile apps and performance advertisers like Disney, Roblox, Glu, Jam City, NBA, MLB, and Supercell. This June 2021 inaugural newsletter highlights user acquisition and creative trends that directly impact Facebook, Google, and TikTok advertisers right now. And, our feature article shows creative trends in action for our new Rovio commercial, optimized for testing at scale.

User Acquisition Topics

UA Hot Tips

See what’s working in Facebook, Google & TikTok UA and get the additional scale from apps running multiple languages.

Get Insider Info on Creative Fatigue

We studied millions in ad spend to see when, why, and how the best ads lose their spark.

The Essential Guide to Apple and Google ASO

Everything you need to know, test, and track for app store optimization for the App Store and Google Play Store.

The Definitive Guide to Unity & Unreal Gameplay Capture

Gameplay footage is the best way to convey the excitement of your game in action. Here’s how to get it right.

How we created a commercial for Rovio optimized for testing

With some of the world’s most recognizable IP, Rovio wanted a fresh approach to promote Angry Birds 2, the new arcade mobile game in the billion-dollar franchise. In a departure from cartoon cardinals and canaries, Rovio wanted a live-action ad with real actors to highlight the universal appeal of the game across every demographic and device. Through our agile production process, we efficiently captured hundreds of video and photo assets in one shoot.

To understand user motivations and the competitive landscape, we incorporated intensive research from our creative learning agenda. Beyond an entertaining ad, our agile production approach provided Rovio with multiple variations to test, including different character reactions, different narrative progression, and different gameplay. The ad is optimized for multiple platforms and for iterative testing, allowing Rovio to sustain profitable ad spend. Watch the Angry Birds 2 commercial to see our agile creative capabilities in action.

Consumer Acquisition has partnered with Rovio since 2019 to generate original story-driven ads for Angry Birds Dream Blast, Small Town Murders, and Sugar Blast. Today, we’re providing thumb-stopping creative for their RPG, Darkfire Heroes.

Creative Topics

TikTok Creative Strategies That Work

We break down the trends in the best-performing mobile app ads on TikTok.

How to Develop Breakthrough Creative for Facebook App Ads

90% of ads fail to beat your best creative and creative fatigues after 10 weeks. Find out how player personas can help.

Better, Faster, Cheaper – Facebook Asset Production & Agile Shoots

Uncover original creative ideas that leverage the best attributes of your app, speak to your target audience’s motivations, and are visually unique.

Life of Facebook Creative

From finding a unicorn ad to letting it nap, here’s the lifecycle of Facebook ad creative.

Measure your performance against competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and much more.

Check out our reels!

For more information, contact us at sales@consumeracquisition.com.

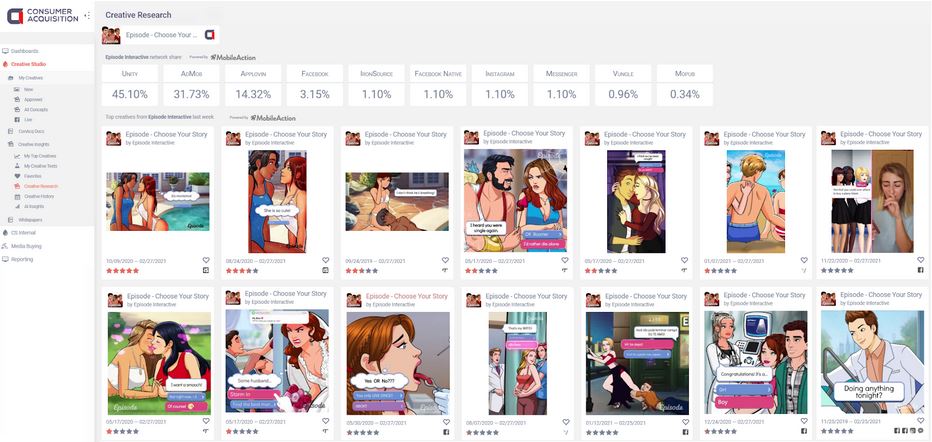

Romance App Ads Pocket Gems’ Episode: Creative Strategy

Creative is an advertiser’s best opportunity for a competitive advantage in social advertising, and it has been since 2019. Soon, the combination of Facebook’s and Google’s Media buying automation with Apple’s removal of IDFA will make ‘winning’ creative ﹘the five percent of Facebook videos that are successful﹘of paramount importance. Here we break down Romance App Ads Pocket Gems’ Episode with competitive trends & creative recommendations, so you can learn from creative best practices.

Check Out Our Romance App Ads Reel!

Episode’s Competitive Analysis

- Competitors: Choices: Stories You Play, Chapters: Interactive Stories, Lily’s Garden: Design & Relax, Moments: Choose Your Story, Linda Brown: Interactive Story, Journeys: Interactive Series, My Story: Choose Your Own Path, What’s Your Story?, Secrets: Game of Choices, Kim Kardashian: Hollywood, Tabou Stories: Love Episodes, Covet Fashion, Dreame, Galatea: Immersive Stories, iReader: Novel, Readict: Novels and More, Wattpad: Read & Write Stories, Kiss: Read & Write Romance, Hooked: Chat Stories, Lure: Interactive Chat Stories, Radish.

Episode’s Top Ads & Platforms

Romance Creative Trends

- Female Story: Women overcoming obstacles and misbehaving men (Hooked, Choices, Chapters, Readict, Dreame, Kim Kardashian)

- Female Story/Pregnancy: Pregnancy and the challenges of motherhood featured prominently. (Choices, Chapters, Dreame, Readict)

- Choices: Choosing an option that directs the narrative. (Chapters, Choices)

- Testimonial: Focused on a player’s review and/or experience of the game. (Hooked, Wattpad)

- R-Rated Humor: Risque, bawdy, sexually suggestive, and other adult humor. (Choices, Chapters, Dreame, Readict)

- Pop Culture: Concepts that leverage pop culture and trends. (Hooked)

- Relaxation: Concepts that tout relaxation as a primary benefit. (Dreame)

Romance App Creative

Episodes: What’s Working

- Quick vignettes are perfect for short attention spans and are culturally relevant

- Characters are quirky, aspirational, and realistic

- The graphic look is recognizable and polished

- Creative pushes boundaries but does not devolve into poor taste or misogynist fare

- Stories feature a diverse and inclusive cast of characters

Romance Iteration Ideas

- Continue short vignettes featuring multiple characters

- UGC testimonials are a good way to break up animation

- Character design concepts will engage users interested in decoration/design

- Social connection is another way to tell a story with less animation

- Try more concepts that engage the user as if they’re a character

- Try more concepts with humor around real-life situations (e.g., whether to shave your legs)

Romance Creative Trends

Concept: Female Story

Create videos with female-centered narratives:

- Overcoming badly behaving men

- Jealousy scenarios with men & women

- Female empowerment

- Narrative techniques can include:

- Choose the option to affect the narrative

- Pickers (picking clothes, hair, etc for a makeover)

- Social media (text chats between characters)

Competitors Utilizing Trend:

- Hooked, Choices, Chapters, Readict, Dreame, Kim Kardashian

Player Motivations:

- Immersion, romance, quality stories

Concept: Female Story/Pregnancy

Create videos that have pregnancy as the central topic:

- Renovation pickers to create the perfect environment for baby

- Who’s the father/jealousy scenarios

- Single mothers overcoming obstacles to raise their child

Competitors Utilizing Trend:

- Choices, Dreame, Chapters

Reader Motivations:

- Escapism, Immersion, Romance

Concept: Choose What’s Next

Create videos that simulate choose your own adventure stories:

- Usually female-centered stories

- Wide range of scenarios involving dating, cheating, jealousy, or choosing between action and apathy

- Dual choices keep it simple

Competitors Utilizing Trend:

- Choices, Chapters

Reader Motivations:

- Immersion, Fantasy, Being someone else

Concept: Testimonials

Create testimonial videos and images featuring user reviews:

- Reviews from Google Play & App Store

- Supered or voice over quotes

- Filmed UGC

- Try different categories/genres to target users

Competitors Utilizing Trend:

- Hooked, Readict

Reader Motivations:

- Quality stories

Concept: R-Rated Humor

Utilize double entendres and other suggestive languages to attract users interested in more adult stories:

- Dating and relationship issues

- Jealousy scenarios with men & women

- Control/power scenarios

- Narrative techniques can include:

- Choose the option to affect the narrative

- Social media (text chats between characters)

Competitors Utilizing Trend:

- Hooked, Chapters, Choices, Dreame

Reader Motivations:

- Quality stories

Concept: Pop Culture – Memes

Create videos/images that leverage current events and/or pop culture:

- Meme format

- Pair with app imagery

- Pair with stock photos

- Humorous takes on romance genre and relationships

Competitors Utilizing Trend:

- Hooked, Chapters

Reader Motivations:

- Fun, romance

Concept: Diverse Stories

Explore stories that are inclusive of all types of relationships:

- Same-sex couples

- Interracial couples

- Unique situations utilizing a broader definition of family

Competitors Utilizing Trend:

- Hooked, Dreame, Chapters, Choices, Readict

Reader Motivations:

- Immersion, fantasy, relatable narrative

Concept: User/Character Interaction

Create concepts that simulate a user interacting with a character in the story:

- Character texting user

- User reacting to various characters

- Character talking to a user

Competitors Utilizing Trend:

- Hooked, Dreame, Readict

Player Motivations:

- Fantasy, immersion, romance

Reveal more Romance App Ads Pocket Gems’ Episode Secrets!

Download Episode Secrets Today!Check out more of our creative here!

Check out more of our creative here!

Please reach out to sales@consumeracquisition.com if you have any questions about our Romance App Creative Best Practices and Recommendations. We power some of the world’s largest mobile game advertisers on Facebook, Google, TikTok, Snap, and Apple Search Ads.

Adapt and Thrive in a Post IDFA World! Diversify Your UA Portfolio & Scale Winning Creatives Across Platforms

It is certain now that Apple’s Identifier for Advertisers (IDFA) tracking is going away by early spring this year. But there is much uncertainty left among the mobile ecosystem of what comes in a post IDFA world. February 16, 2021, Facebook started imposing ad limits per page based on the highest amount of money advertisers spent in any month in 2020. This means your page may run as few as 250 ads or as many as 20,000 ads, depending on your spend last year.

No one knows exactly the level of impact to expect from the loss of IDFA. But, the fact remains that app publishers will need to diversify their campaign traffic across the mobile advertising network. This will mitigate the risk from any one network that may have weaker audience targeting.

This will mean that advertisers will diversify risk by spreading their resources across many more platforms than ever before. Including budget and creatives to campaign management and tracking resources. Advertisers will need to be more efficient to survive and thrive in a post-IDFA world.

It is an opportunity for app publishers to hone creative concepting, testing, and development skills. Then, efficiently take their winning creative across the network to outperform competitors.

Here is how to embrace the change in a post IDFA world, and prepare your creative strategy for the challenges ahead:

Mobile Ad Strategy in the Post IDFA World

Double-digit growth from any one channel is over. Whether or not it is Facebook, TikTok, Snap, Google, or the SDK ad networks. So, app publishers will have to diversify their campaign strategy across a multitude of platforms and marketplaces, period.

This expansion of ad channels may also put pressure on app development as well. Firebase is a backend service that provides developers with a variety of tools and services. It helps them develop quality apps, grow their user base through advertising, and earn a profit. It is also built on Google’s infrastructure but works for both iOS and Android apps. When Firebase is linked to advertising channels, it can help support tracking the target return on advertising spend (tROAS). This will be critical in the new post IDFA world of advertising.

The need to diversify is also being felt in more traditional media channels as well. As a result, over-the-top media services (OTT) are the belle of the ball right now. They bypass cable, broadcast, and satellite television gatekeeper platforms to instead stream media via the Internet directly to viewers. As advertisers need more effective ways to bring their campaigns to consumers across networks, technology like OTT is helping make this happen.

The Power of One Winning Creative

What does it mean to have a ‘winning’ creative? What is the value, and what can you do with it?

A ‘winning’ creative is an ad that outperforms all others when tested in the market. It’s truly a rare find, and the most impactful on your ad spend ROI.

We test a lot of creative. In fact, we produce and test more than 100,000 videos and images yearly for our clients. In addition, we have performed over 10,000 A|B and multivariate tests on Facebook and Google. After managing more than $3 billion in paid ad spend for our clients, we discovered that between 85-95% of all ads tested fail. So, only about one in 20 ad creatives is good enough to beat the current winning creative. And, that one winning creative is what is going to be used to convert and acquire customers cost-effectively.

When you need to keep feeding an increasing number of networks with effective, winning creative, it may seem like an overwhelming task. But we’ve developed our own approach to testing and producing winning concepts.

Here is how you can leverage our approach:

Creative Testing: Our Unique Way

When we test, our goal is to compare new concepts versus the winning video (control) to see if the challenger can outperform the champion. Why? If you cannot outperform the best ad in a portfolio, you will lose money running the second- or third-place ads.

Our testing process is designed to save both time and money by killing losing creatives quickly and to significantly reduce non-converting spend. Our process will generate both false negatives and false positives. We typically allow our tests to run between 2-7 days to provide enough time to gather data without requiring the capital and time required to reach statistical significance. And we always run our tests using our software, AdRules.

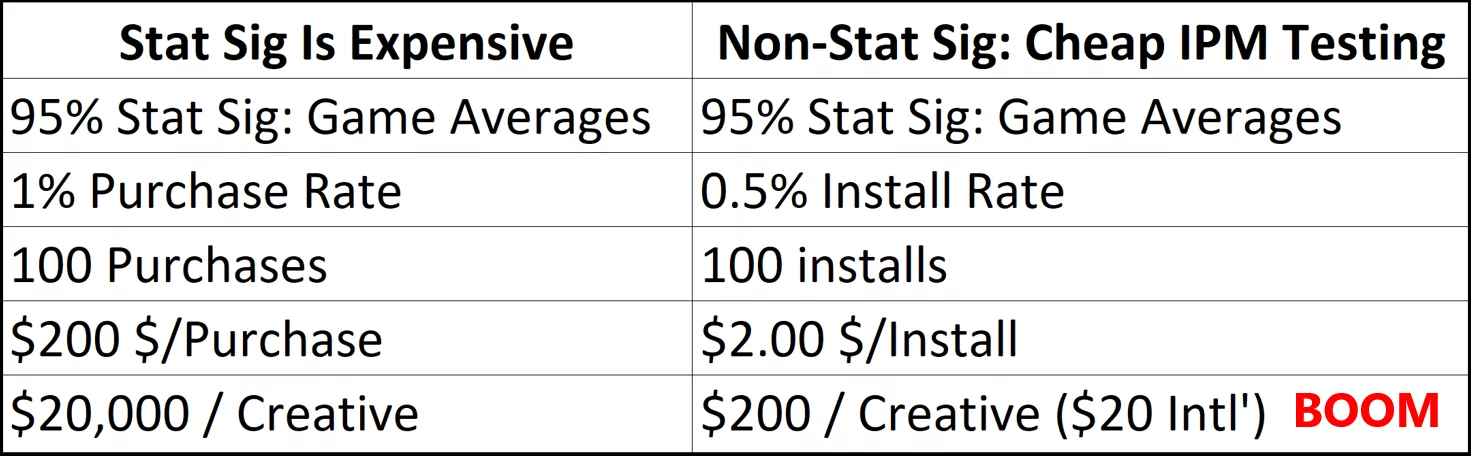

Statistical Significance vs Cost-Effectiveness

Let us take a closer look at the cost aspect of creative testing. In classic testing, you need a 95% confidence rate to declare a winner, exit the learning phase, and reach statistical significance. That is nice to have but getting a 95% confidence rate for in-app purchases may end up costing you $20,000 per creative variation.

Here is an example scenario: To reach a 95% confidence level, you will need about 100 purchases. With a 1% purchase rate (which is typical for gaming apps) and a $200 cost per purchase, you will end up spending $20,000 for each variation to accrue enough data for that 95% confidence rate. There are not a lot of advertisers who can afford to spend $20,000 per variation. Especially, if 95% of new creative fails to beat the control. In this example, with a cost of $20,000 per variation and a 95% failure rate, it would cost $400,000 just to find a new control. That is because we would have to test 20 variations to find the winner, and – as mentioned earlier – testing each variation costs about $20,000.

So, what should you do?

To avoid such high testing costs, we move the conversion event we are targeting up, or towards the beginning of the sales funnel. For mobile apps, instead of optimizing for purchases, we optimize for impressions per install (IPM). For websites, we would optimize for an impression to top-funnel conversion rate. This is our own methodology, designed to allow advertisers to find new, top-performing creative in the most cost-efficient and reliable way.

IPM Testing is Cost-Effective

A concern with our process is that ads with high CTRs and high conversion rates for top-funnel events may not be true winners for down-funnel conversions and ROI / ROAS. But while there is a risk of identifying false positives and negatives with this method, we would rather take that risk than spend the time and expense of optimizing for statistically significant bottom-funnel metrics.

To us, it is more efficient to optimize for IPMs vs. purchases. Most importantly, it means you can run tests for less money per variation because you are optimizing towards installs vs purchases. For many advertisers, that alone can make more testing financially viable. $200 testing cost per variation versus $20,000 testing cost per variation can mean the difference between being able to do a couple of tests versus having an ongoing, robust testing program.

So, the key takeaway for you here is to approach your creative testing process thoughtfully. Leverage as much of our recommended approach as you like and let us know if you have questions. Check out our latest creative testing whitepaper for more information.

Our 3-Step Creative Testing Process for IAP (In-App-Purchases)

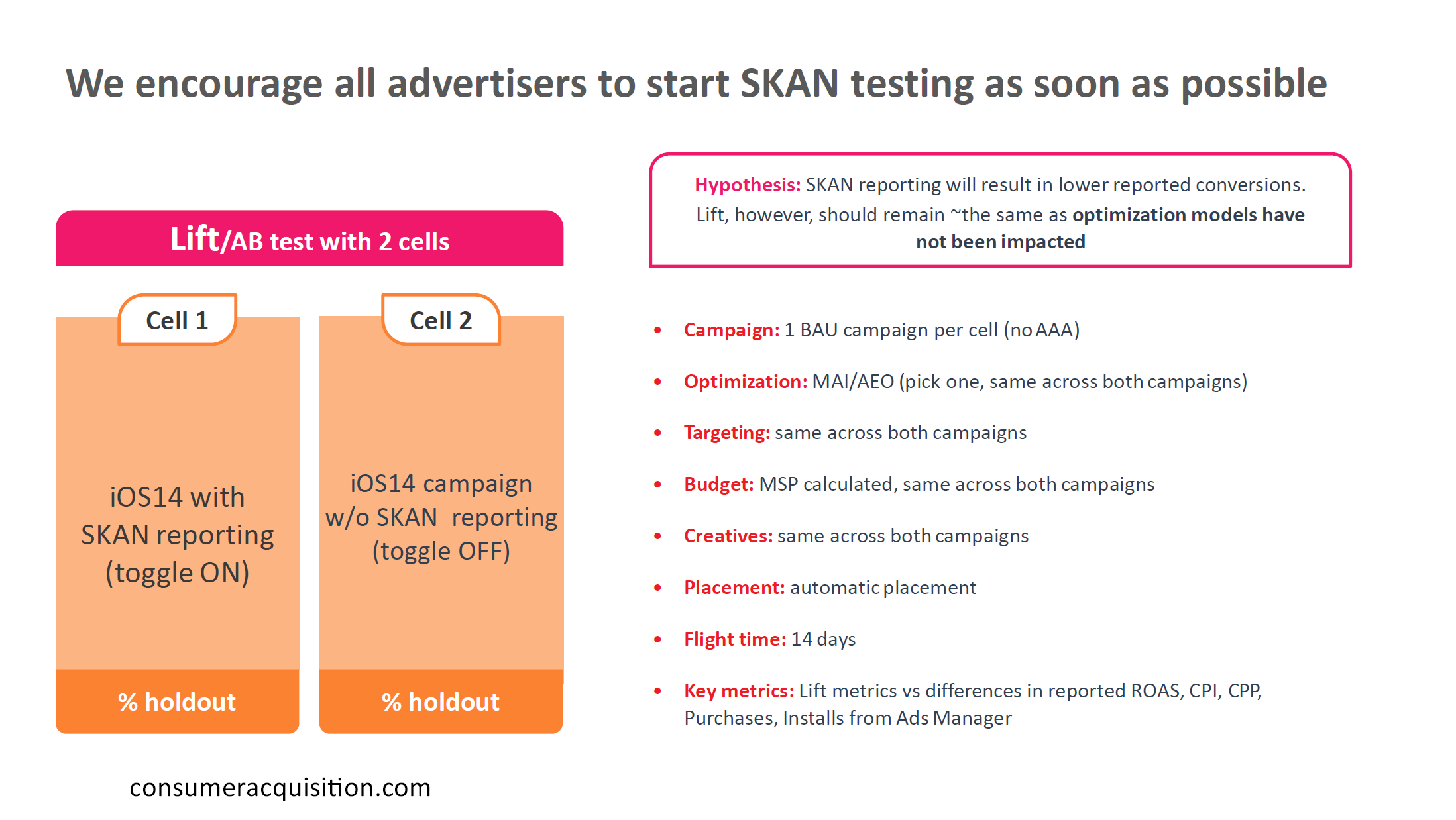

Our 3-Step Creative Testing Process for IAA (In-App-Advertising)

Facebook Ad Account Restrictions Have Begun Rolling Out

In the past, you personalize ads by creating a high volume of creative and hoping the ‘winning’ one would be seen by your target audience. But with the ability to now creative dynamic formats and ad creative, personalization is done through machine learning-driven products and with optimal results.

The volume of active ads from your page correlates with the time needed for ad performance optimization. As a result, larger accounts may cause content to be stuck in the ‘learning phase’ for too long. Facebook claims that four in 10 ads fail to exit the learning phase in high-volume accounts. So, with a reduction in ad volume, you can expedite optimal ad performance.

The ad volume limit is based on the highest amount you spent in any month in 2020. Starting February 16, 2021, you will fall into one of the four groups listed below. Please see Facebook’s native tools for the date when your account(s) will transition to ad limits.

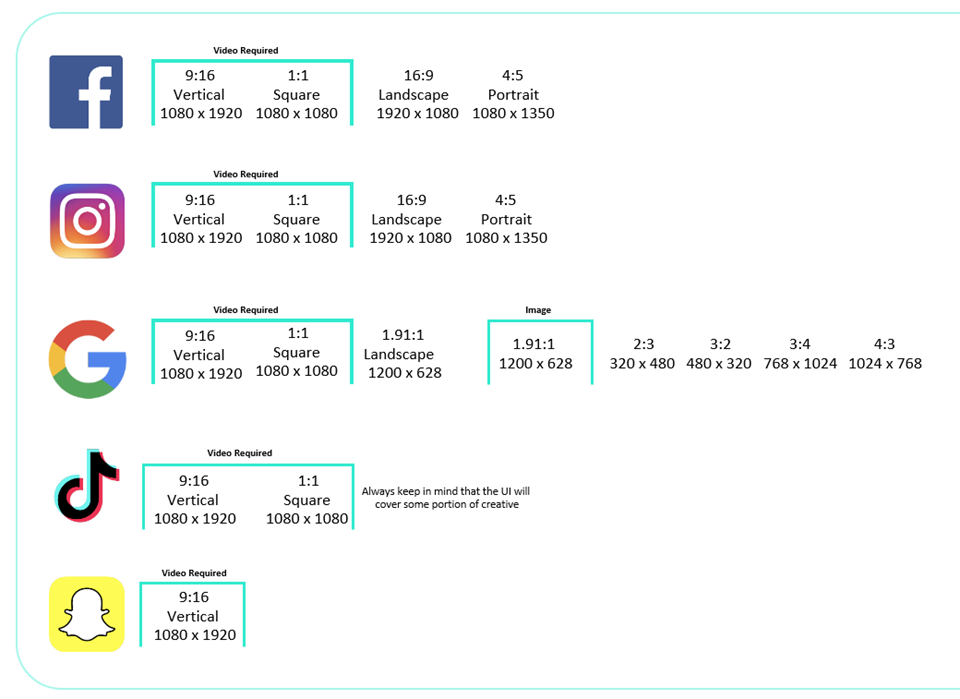

Best Practices to Maximize Creative Distribution and Minimize Production Work

- To maximize distribution across platforms while minimizing creative production, we recommend producing the following sizes of videos and images (in green).

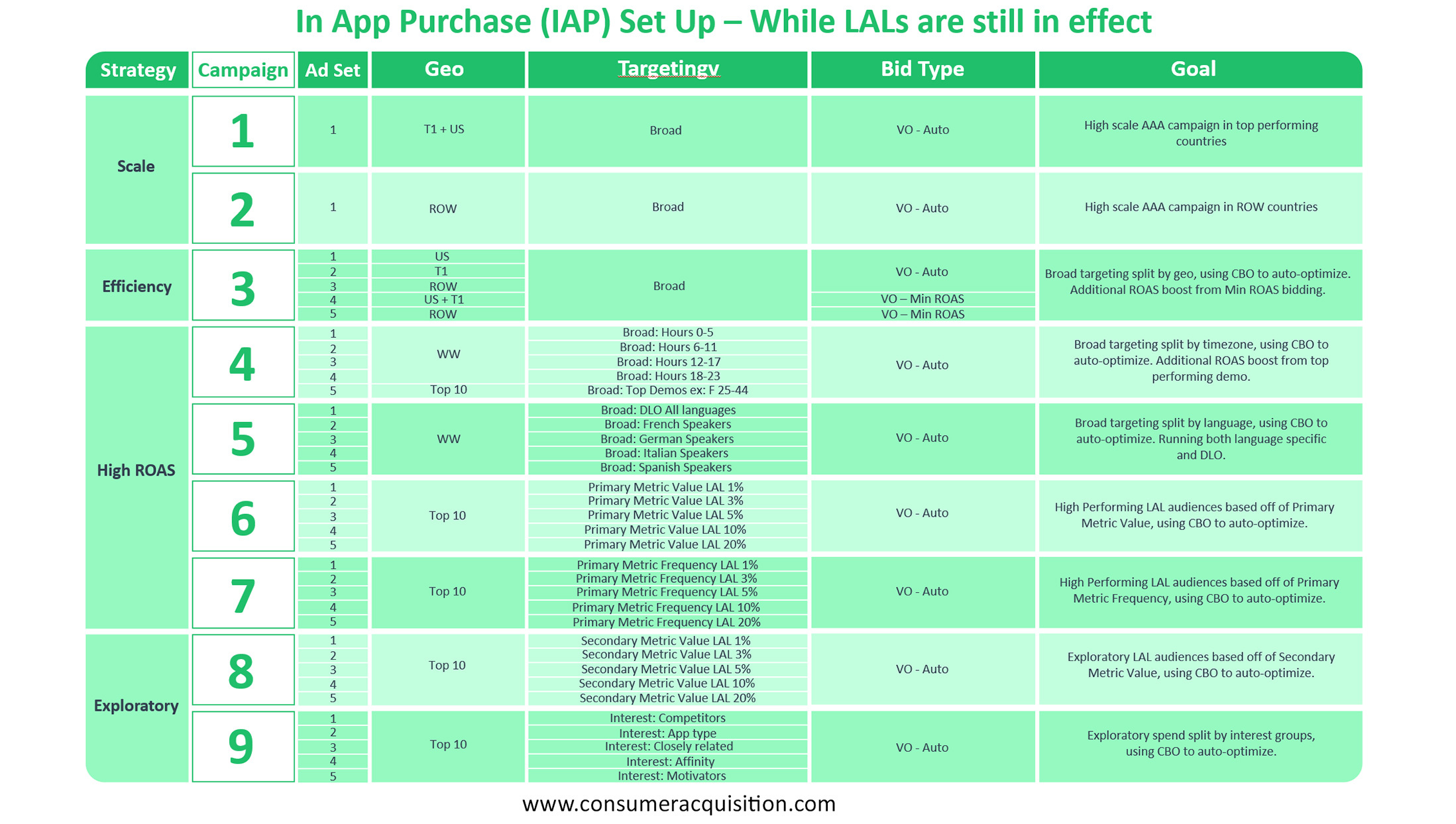

Post IDFA Facebook Campaign/Account Structure Recommendations

- Suggestions for how to set up your iOS14 Account for In-App Purchase (IAP) apps and ideas for how it will evolve when lookalike audience performance erodes.

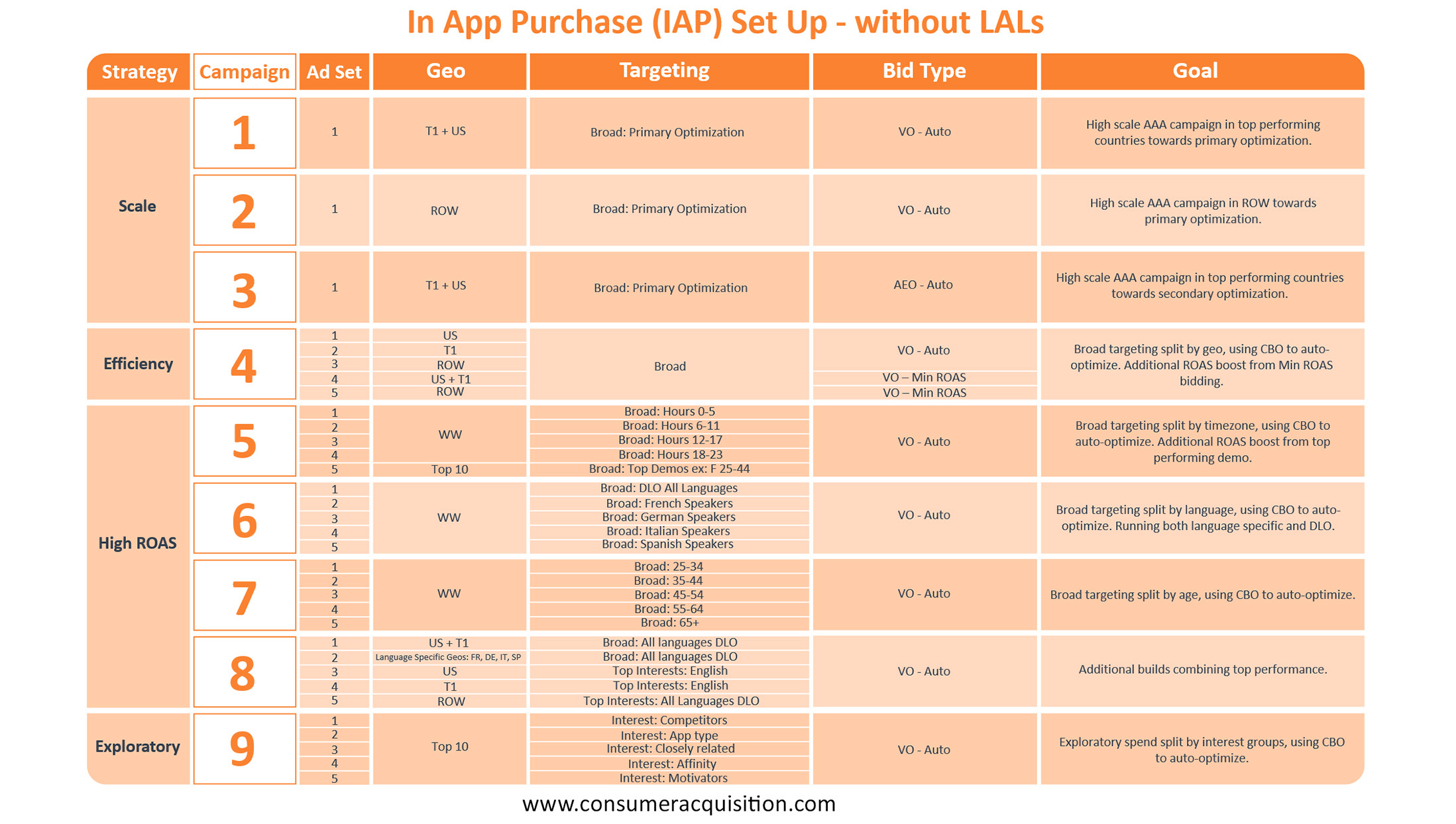

- Recommendations for how to set up your iOS14 Account for In-App Purchase (IAP) apps when lookalike audience performance erodes.

- Suggestions for how to set up iOS14 accounts for In-App Purchase (IAP) apps once your lookalikes have eroded and you have tried the above. Please note, these recommendations are not in order of priority and should be evaluated based on your app/audience and optimization techniques.

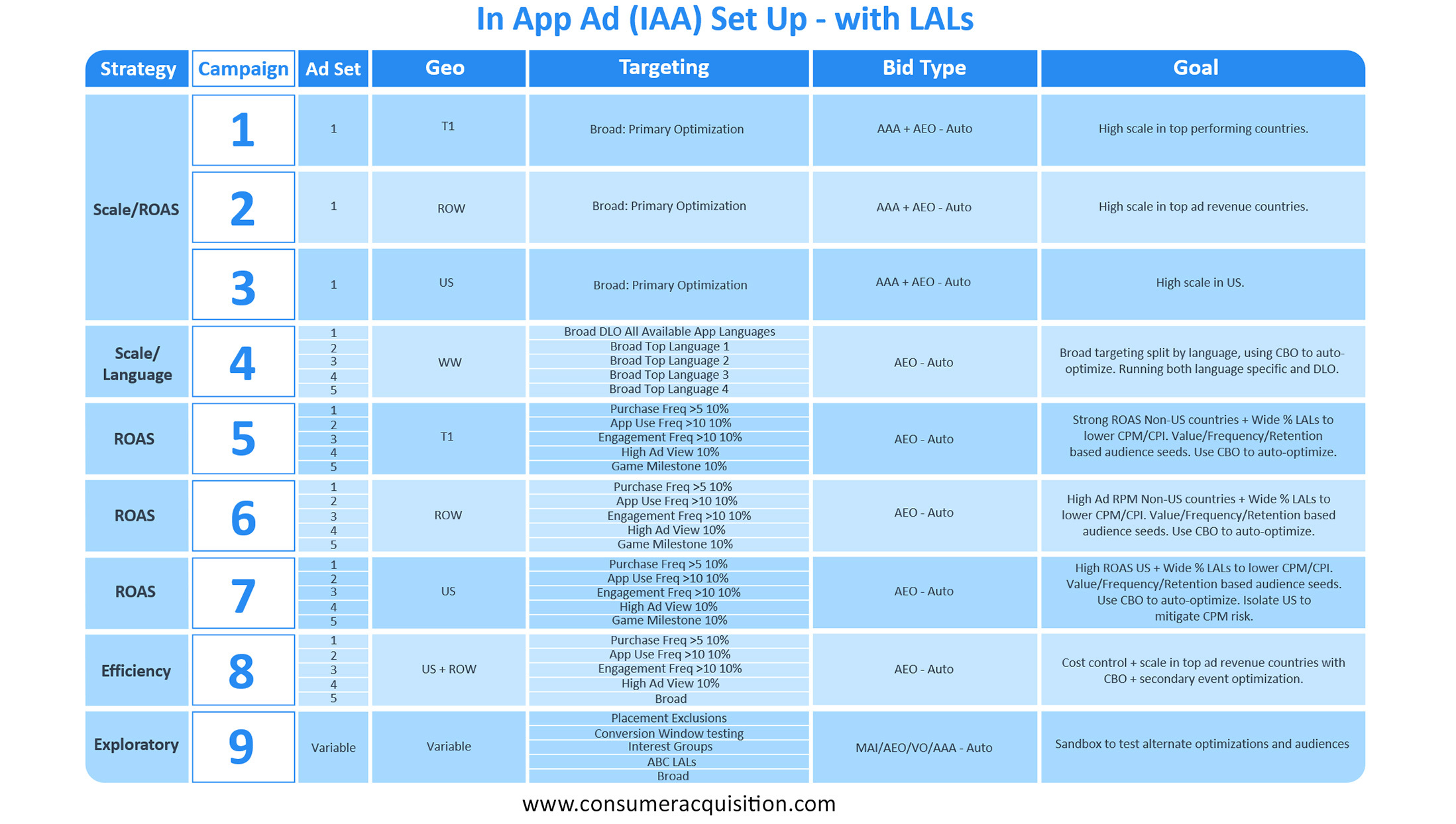

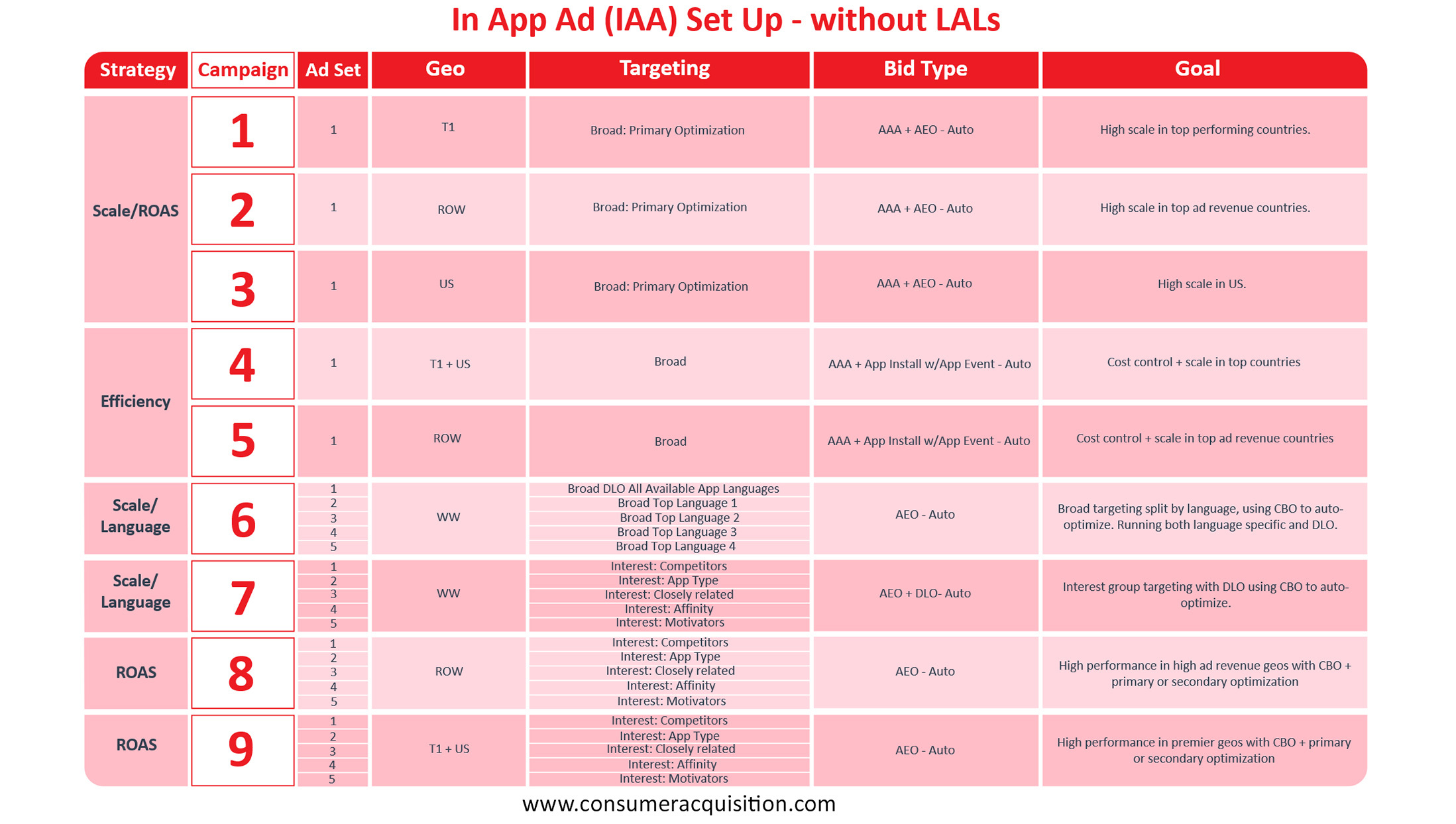

- Recommendations for how to set up your iOS14 Account for In-App Ads (IAA) apps, and ideas for how it will evolve when lookalike audience performance erodes.

- Suggestions for how to set up your iOS14 Account for In-App Ads (IAA) apps when lookalike audience performance erodes.

How We Can Help You Win Creatively in the Post IDFA World

Now is the time to focus on your creative strategy and prepare for the IDFA changes. We have also developed a library of guides to help you along the way. Each content piece details the best practices to drive creative concepting and development, auditing, and testing at scale. Check out our papers here:

- IDFA Armageddon Part 3

- The Definitive Guide to TikTok Ads 2021

- Facebook Creative Testing: Why Is The Control Video So Hard To Beat

- The Definitive Guide To Creative Trends For Mobile Game Advertisers in Summer 2020

Please reach out to sales@consumeracquisition.com if we can help with fresh creative or media buying on Facebook, Google, TikTok, Snap, and Apple Search Ads.

IDFA Armageddon Part III: We are in The End Game Now!

The wait is over — Tim Cook, CEO of Apple, stated the ATT prompt will be mandatory with the next release of iOS14 and thus remove the IDFA in March or “early spring”. This morning 2/2, we heard from multiple sources that Apple’s new Beta candidate is out, and ATT is off by default… so, it is really happening! The goal of this article is to share highlights from my conversations with industry leaders and make some suggestions to help you prepare to navigate the POST IDFA world and future-proof your mobile app ad accounts. While this is a massive industry change, full of uncertainty, the good news is that we are all in the boat together.

Impact of Losing IDFA

Over the last seven months, I have spoken to many CEOs, user acquisition, and growth leaders across the mobile app ecosystem. I gathered their perspectives on the impact of losing IDFA on their business and the mobile app/mobile web industries. Their opinions were highly varied. And what is clear, is that no one knows for sure what will happen to their business with the IDFA removed. What is universally accepted is that the financial impact will not be isolated to a titan battle between Facebook and Apple. But it will cause uncertainty and financial stress across the mobile app and mobile web industries during a pandemic and at a time of record unemployment.

Account Restrictions of Apple’s SKAN

The account restrictions of Apple’s SKAN will cause a significant reduction in mobile app and mobile web company’s ability to profitably advertise – with certainty. However, it appears not all market segments or companies will be impacted the same. For example, companies running an eCommerce mobile app using a single agency of record will be less impacted than a game and mobile app advertiser that runs an internal UA team with one or more agencies. SKAN’s negative impact will be driven by both a loss of deterministic measurement and the need to limit the ad account structure to 1 account per app with 9 campaigns and 5 ad sets per campaign. The requirement of a single account restriction will force companies to decide to either keep the iOS 14 account internal or to allow a partner/agency to drive that one account. Obviously, no changes to Android are currently forecast.

Last week, Facebook and Google rolled out recommendations on how to prepare for ATT/IDFA loss. I have summarized my thoughts and recommendations for how to survive and thrive through these highly uncertain times. Also, how to best leverage the expertise of agencies, which will have a broad view into the rapidly evolving impact of IDFA’s rollout to mitigate risk. Please start your review by reading Apple’s SKAdNetwork article.

Implementation of iOS14 and ATT

The implementation of iOS14 and ATT will cause fluctuations in CMPs, reporting efficiency, audience, deterministic LTV models, and traffic quality. But we are uncertain how quickly things will change. Facebook’s testing has revealed more than a 50% drop in Audience Network revenue which may impact apps that make money via ads. Will CPMs drop as impacted companies and segments pull out of the market? We believe spending should slow for those more impacted. Such as, remarketing, hyper-casual / IAA monetized apps, and whale hunters (mid-core/hard-core/social casino). But will other companies step in to keep CPMs high (branding, CPG, etc.)?

It is highly unlikely that the bottom will drop out of any platform, Facebook, TikTok, Snap, or SDK Networks (Unity, Applovin, Vungle, IronSource). However, it is more likely that erosion will occur over 2-4 months as the efficiency of lookalike audiences drop and deterministic LTV models get replaced with less efficient probabilistic solutions.

Recommendations on How to Prepare:

Please review this Facebook post on Actions to Ads for Ads Ecosystem Changes.

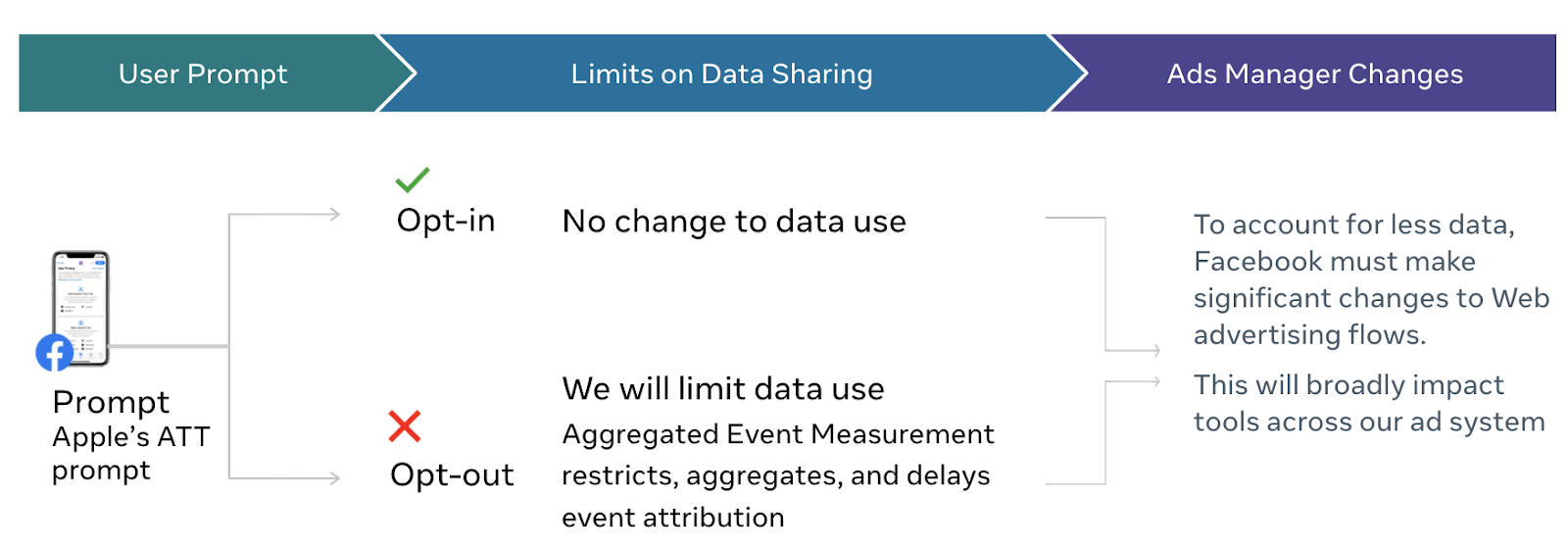

For advertisers that optimize, target, and/or measure using web events here is how Apple’s user prompt impacts information sharing:

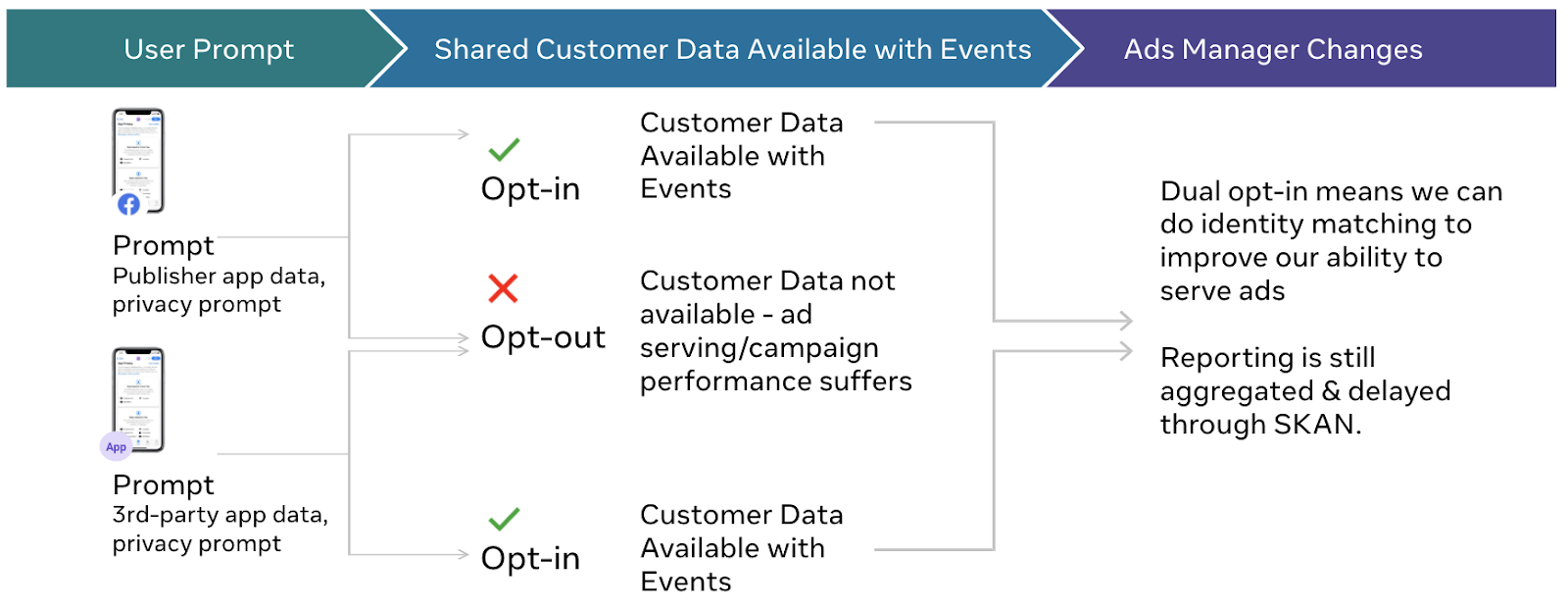

For advertisers that optimize, target, and/or measure using app events here is how Apple’s user prompt impacts information sharing:

Key actions Mobile App Advertisers need to take before Apple’s IDFA removal in “early spring”.

- Do It Now: Review Facebook’s developer blog post as a great starting point.

- Do It Now: Upgrade to Facebook’s SDK version 8.1 or later, assuming you are using their SDK for advertising.

- Get Ready: Configure App Events Optimization, Mobile App Install, and Events with AAA and Value campaigns.

- Be Ready: Advertisers using Facebook SDK & App Events API, get prepared to use “Advertiser Tracking Enabled” to tell Facebook to restrict data use on a per-event basis.

- Get Ready: If you are using App Events API, plan to integrate SKAN API using Event manager. See instructions in Facebook’s native tools.

- Be Ready: Create several ad accounts (1) Android, (2) iOS < 14, and (3) iOS14 and later. The iOS14 account must strictly adhere to the following account requirements. Including, 1 account, 9 campaigns per app, and 5 ad sets per campaign of the same optimization type. See below for some of our recommendations.

Suggestions for how to set up your iOS14 Account for In-App Purchase (IAP) apps and ideas for how it will evolve when lookalike audience performance erodes.

Recommendations for how to set up your iOS14 Account for In-App Purchase (IAP) apps when lookalike audience performance erodes.

Suggestions for how to set up iOS14 accounts for In-App Purchase (IAP) apps once your lookalikes have eroded and you have tried the above. Please note, these recommendations are not in order of priority. They should be evaluated based on your app/audience and optimization techniques.

Suggestions for how to set up your iOS14 Account for In-App Ads (IAA) apps and ideas for how it will evolve when lookalike audience performance erodes.

Recommendations for how to set up your iOS14 Account for In-App Ads (IAA) apps when lookalike audience performance erodes.

Key actions Web Advertisers need to take before Apple’s IDFA removal “early spring”. (Cont.)

- Do It Now: Verify your domain in Facebook Business Manager, see their developer blog post for more information.

- Get Ready: Prepare to operate and define the priority of each of 8 total events per domain. Note this may be a significant change for some companies and require experimentation.

- Be Ready: Evaluate and experiment with attribution windows. Note the potential loss of view-through attribution and required short windows of 24-48 hours.

- Get Ready: Experiment with campaign optimization strategies, bidding, audiences, etc.

Facebook’s AAA API

If you develop proprietary AdTech using the Facebook API, we also recommend that you implement Facebook’s AAA API that was just released on February 1, 2021. Facebook has expanded the access of Automated App Ads to the Marketing Ads API.

Automated App Ads API is a new way to run an app install ad on Facebook. This helps app marketers of all sizes achieve better performance, greater scale, and more efficiency.

Automated App Ads leverages powerful machine learning to automatically optimize your campaigns across creative, audience, and optimization. They also deliver more high-value conversions with less effort.

The product is designed to improve your experience with app marketing in three areas:

- Better performance with AI-powered targeting and improved delivery models.

- Sustain performance when increasing budgets with machine learning that automatically tests creative combinations to deliver the highest performing ads.

- Faster and more efficient campaign management with a streamlined campaign creation flow that reduces the need for manual adjustments.

Please see their developer documentation for more details on the API.

Check out our other articles related to IDFA removal:

External Articles we recommend:

- Preparing our Partners for iOS 14: Impacts to App Advertisers and Developers

- App Tracking Transparency Codex: the ultimate guide to ATT, IDFA deprecation, and SKAdNetwork

- Tim Cook to speak at EU data conference at Apple-hosted advertising session

- Facebook Login Updates: A New Limited Data Mode

- Apple privileges its own ad network with ATT. What is its privacy endgame?

Facebook’s latest updates to prepare partners for iOS 14:

- Preparing our partners for iOS 14: Mobile Web Advertising [December 16, 2020]

- Facebook’s Previous Updates to Prepare Partners for iOS 14:

- Preparing for Apple’s App Store Data Disclosure Requirements [October 22, 2020]

- Preparing our Partners for iOS 14 [Updated September 10, 2020]

- Download the new IDFA Armageddon Part 3 White Paper today!

Please reach out to sales@ConsumerAcquisition.com if we can help with IDFA strategy, creative or media buying on Facebook, Google, TikTok, Snap, and Apple Search Ads.

Sports Games Creative Strategy

Creative is an advertiser’s best opportunity for a competitive advantage in social advertising. Soon, the combination of Facebook’s and Google’s Media buying automation with Apple’s removal of IDFA will make ‘winning’ creative ﹘the five percent of Facebook videos that are successful﹘of paramount importance. Here we break down Sports Games Creative Strategy with competitive trends & creative recommendations, so you can learn from their creative best practices.

Sports Games Competitive Analysis

- Competitors: MLB Tap Sports Baseball 2020, 8 Ball Pool™, Real Boxing 2, My NBA 2K20, Tennis Clash: Online League, NBA 2K Mobile Basketball, Asphalt 9: Legends, Basketball Stars™, Homer City, MADDEN NFL MOBILE FOOTBALL, Golf Battle, WWE SuperCard, Oh My Goal! – Soccer, Baseball Boy! MLB 9 Innings 20, NBA LIVE Mobile Basketball, Dream League Soccer 2020, MLB Champions, FIFA soccer, EA SPORTS™ UFC®, PBA® Bowling Challenge, Football Strike, Score! Hero, PGA TOUR Golf Shootout, NBA 2K20, R.B.I. Baseball 20, NBA JAM by EA SPORTS™, Football Manager 2020 Mobile

- View competitive videos by hitting the competitor tab here.

Sports Games Creative Trends

- Gameplay/Game Overview: Shots of gameplay that showcase graphics and players. (Home Run Clash, NBA 2K, Boxing Star, many more)

- Distance Challenges: Simple gameplay that challenges viewers to hit an object as far as they can. (Baseball Boy, Slap Master)

- Competition: Videos dramatizing head-to-head competition between players. (Darts of Fury, Home Run Clash)

- Noob vs. Pro: Videos displaying bad versus good gameplay. (Darts of Fury, Mini Golf King)

- Real Player Footage: Real footage replacing game characters and gameplay. (Tennis Clash, Sniper Arena, Draft Kings)

- Cinematic Techniques: Slo-mo, camera pans, and other cinematic techniques utilizing game characters. (Johnny Trigger, Mr. Bullet, Sniper Arena, Tennis Clash)

- Augmented Gameplay: Illustrations, emojis, talk bubbles, and voice-over added to gameplay or characters (Mr. Bullet, Draft Kings, Flip & Dive 3D)

- Game Controller Overlay: The game controller overlays on gameplay to give it a game console effect. (Tennis Clash, City Fighter Vs. Street Gang)

Concept: Statcast

Create videos that incorporate statistics into the gameplay

- Overlay graphics to show the distance of tape measure shots and challenge viewers to play and hit home runs

- Overlay graphics on pitching stats and ground covered by outfielders, challenging viewers to beat their opponent

Competitor/Share of Voice

- Baseball Boy: 90% SOV

- Slap Masters: 100% SOV

Concept: Character Countdown

Create a countdown of featured players in the game

- Showcases animation style, range of players, and stats

- Use baseball card like graphics

- Generates engagement (curiosity over the list of characters)

Competitor/Share of Voice

- Rise of Kingdoms: 28% SOV

Concept: Trash Talk Voice Over

Juxtapose gameplay with player trash talk

- Showcases gameplay and graphics

- Mimics player dialogue and chat portion of the game

- Uses subtitles

Competitor/Share of Voice

- Icing on the Cake: 54% SOV

- Flip & Dive 3D: 90% SOV

Concept: Emoji Gameplay

Feature gameplay with emoji overlays and talk bubbles to communicate player emotions

- Humorous

- Humanizes players

- Showcases game graphics

Competitor/Share of Voice

- Bullet: 3% SOV

- Flip & Dive 3D: 90% SOV

- DraftKings: 12% SOV

Concept: Real Game Footage

Intercut gameplay with real footage, so that it’s hard to tell what’s real and what’s the game

- Showcases game graphics

- Promotes simulation aspect of the game: “The closest thing to being on the field”

Competitor/Share of Voice

- Tennis Clash: 50% SOV

- Sniper Arena: 3% SOV

Concept: Announcer Calls

Re-create the feel of a famous announcer calling a legendary game with gameplay and voice over

- Creates emotional “what if” scenarios (see MLB The Show 2012 “Cubs Win” ad here)

- Engages the viewer’s curiosity

- Highlights the passion of sports fans

Competitor/Share of Voice

- N/A

Concept: Cinematic Stories

Create videos using cinematic techniques and voiceover to up the emotional ante of the game

- Showcases game graphics

- Utilizes nostalgic sports documentary feel

- Appealing to sports fans

Competitor/Share of Voice

- Tennis Clash: 2% SOV

- Johnny Trigger: 97% SOV

- Bullet: 3% SOV

Concept: Noob vs. Pro

Create side-by-side videos of good and bad gameplay, with “Noob vs. Pro” header

- Shows the difficulty of the game

- Triggers player competitive urge

- Incorporates head-to-head aspect

- Highlights both “wins” and “fails” – both powerful hooks for players

Competitor/Share of Voice

- Darts of Fury: 13% SOV

- Mini Golf King: 12% SOV

Sports Games Creative Trends Concept: Sports Chants

Create a sing-along music video of gameplay with a famous sports chant

- g. bouncing ball version of “Take Me Out to the Ballgame”

- Most chants are in the public domain

- Showcases graphics and gameplay

- Will appeal to sports fans (specific team chants could accompany more targeted campaigns)

Competitor/Share of Voice

- N/A

Reveal more Sports Games Creative Strategy Secrets!

Download Sport Games Today!Check out more of our creative here!

Entertainment Games Creative Strategy

Creative is an advertiser’s best opportunity for a competitive advantage in social advertising. Soon, the combination of Facebook’s and Google’s Media buying automation with Apple’s removal of IDFA will make ‘winning’ creative ﹘the five percent of Facebook videos that are successful﹘of paramount importance. Here we break down Entertainment Games Creative Strategy with competitive trends & creative recommendations, so you can learn from their creative best practices.

Entertainment Games Competitive Analysis

- Top Competitors: Netflix, Hulu, Disney+, Tubi, Philo, Pluto TV, Starz, Sling, Crackle, Paramount Network, SyFy, BET Now, Shudder, Vudu

- View competitive videos here.

Entertainment Games User Motivations:

What are you looking for in an Entertainment app?

- Something to put me in a positive mood

- Background noise until I finally fall asleep

- Something short before work

- “Anything to help me wind down from work”

Why do you open an Entertainment up?

- Unwind/settle in

- Relax and escape

- A quick laugh

What need are you fulfilling when using an entertainment app?

- Eliminate boredom

- I need my time to not worry about anything and just relax, catch my breath, be lazy and pamper myself

- Elevate mood + aid sleep

- Laugh and have good thoughts before going to bed

- Access to content

- Fulfills some nostalgia of shows I used to watch with family or siblings growing up

- Catch up on new/old movies I have not seen before

- I can select from a huge pool of movies and shows, and I am not limited to what I can and cannot watch

- Find movies I might have a hard time finding another service

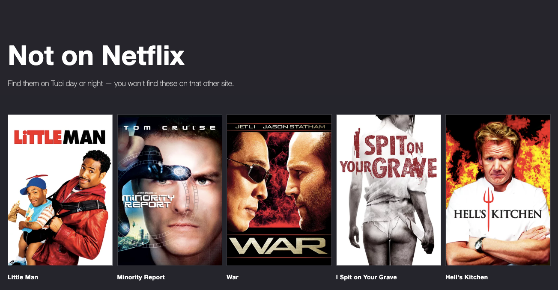

Concept: “Only on…” / “Not on…”

Focus on exclusive content. User profiles suggest hard-to-find content is a big reason for using multiple entertainment apps

- “Only on…”, “Only free on”, “Not on <competitor>…” are all appropriate messages.

- Images

- Leverage specific exclusive titles, especially if those that are free to watch.

- Feature hard-to-find titles that have remakes/sequels that competitors are hyping, e.g. Tubi promoting the original “Dolemite” when Netflix went all out on “Dolemite is My Name”.

- Video trailers

- 00:15-00:30 second trailers that feature a combination of scenes and dialogue from multiple movies and alongside “Only on…” or “Not on…” messaging.

Insight

- Given the popularity of Netflix and Disney+, it may be advisable to target them as competitors

Entertainment Games Competitive Trends

- Movie Trailers: Videos with movie trailer-style content, featuring multiple titles. (Vudu, Pluto, Shudder, Netflix, Sundance Now)

- Promoting Exclusive Content: Videos or images promoting exclusive or original content. (Hulu, Vudu, Netflix, Starz, BET, Crackle)

- Special Offers: Videos or images with special offers. (Netflix, Hulu, Philo, Starz)

- Competitive: Videos or images comparing prices to competitors or cable. (Sling, Hulu, Pluto)

- Movie Poster: Images leveraging a singular movie or TV series to promote the service. (Vudu, Hulu)

- Genre content: Video or images promoting a specific genre (sports, horror, etc.). (Sling, Shudder, Hulu)

- Shared Passion: Videos or images that engage passion communities (e.g., Star Wars fans) with quizzes, trivia, and profiles. (SyFy)

Concept: Genre-Focused Creative

Evolve current movie poster creative to focus on genres and seasonal titles, from Black cinema and Nostalgia TV to Academy Award-winners and seasonal/holidays

- Users see specific genres not necessarily available on category leaders such as Netflix & Hulu.

- Image ads include

- Awards season focuses on Oscar-winning titles, e.g. Chinatown. Movie poster or multiple titles.

- Seasonal focus: summer blockbusters, holiday movies, etc.

- Call out unique genre titles available.

- Videos

- 00:15-00:30 second trailers hype specific genres and seasonal offerings with scenes/dialogue from multiple titles.

Concept: Creativo Centrado en el Género

Evolve current movie poster creative to focus on genres and seasonal titles in video and image creative, specifically targeting Spanish-speaking audiences

- Memes with captions in Spanish.

- Genres focused on Spanish-speakers, e.g.:

- Para niños y familias

- Peliculas en Español

- Telenovelas y series

- Escape the commute

- Relax and enjoy some “Me Time”

- Looking for a good action/family movie

- Reality-TV

Concept: Shared Passion

User profiles suggest a love of nostalgia, old movies, and TV series. Let us reward that passion by using memes, quizzes and trivia to engage film buffs, movie fans, and TV addicts

- Expand memes to use scenes from nostalgic TV and film.

- Simple quizzes about old and new films and TV shows:

- What actor starred in Greatest American Hero?

- Random trivia about new and old genres:

- John Travolta turned down the role of Forrest Gump. (Photoshop his face into iconic Tom Hanks pic?)

- Combine with competitive “Only on…” or “Not on…” messaging.

Insight

- SyFy and Shudder are currently running similar campaigns.

Concept: YouTube Pre-Roll with Google Vogon

TV and movie fans regularly look up scenes on YouTube. Create pre-roll ads that target the specific genre they are looking at, with Google Vogon ads

- Example of how Campbell’s Soup utilized technology here

- 00:10 second pre-roll ads target a range of categories, with emphasis on competitive messaging:

- Horror: “Scared of costly subscriptions? Stream your favorite horror movies for free with <app>.”

- Sports: “Don’t pay to play with <competitor>. Stream great sports movies for free with <app>.”

- Kids Show: “Put the money you’d spend on <competitor> in the kids’ college fund. Stream for free with <app>.”