Challenges For Mobile App Advertisers:

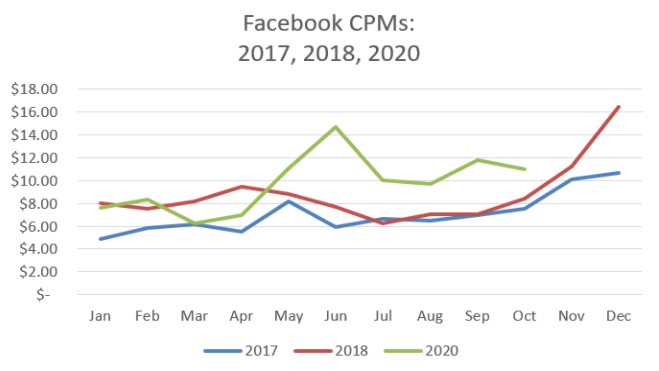

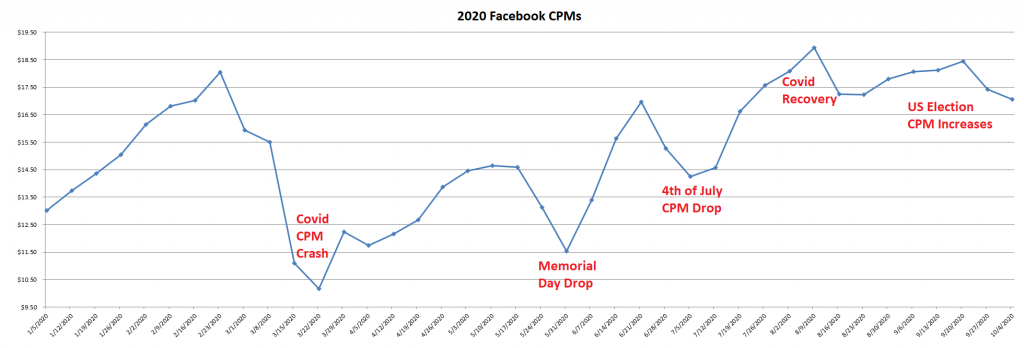

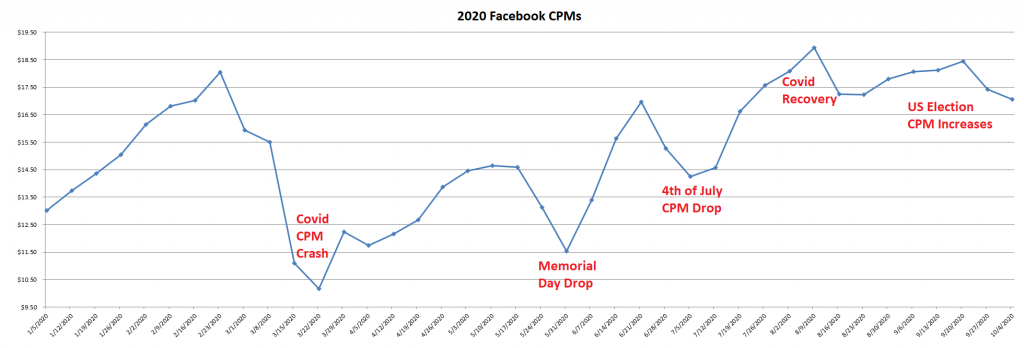

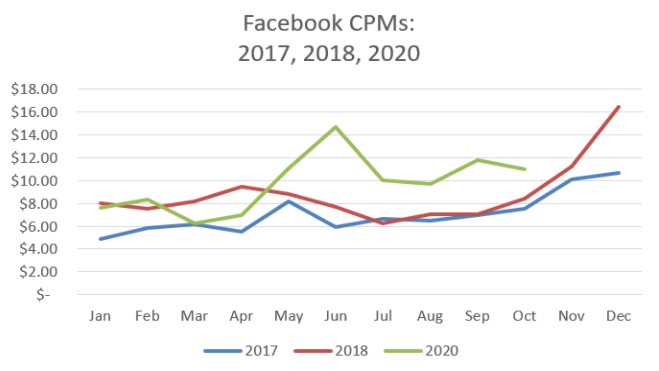

As we reflect back on the challenges and opportunities that 2020 presented and prepare for Q4 holiday spikes and the unknowns of 2021, we are sharing our biggest challenges for mobile app advertisers with suggestions to help navigate these upcoming changes. No 2020 mobile app advertising list would be complete without COVID-related CPM fluctuations. These fluctuations have been occurring in Q1 through Q3. As we exited Q3 and entered Q4, we’ve seen significant increases in CPMs. The increases are most likely due to US election spending. Therefore, just in time for the Q4 Holiday CPM spikes that occur between Black Friday and Christmas.

If that wasn’t enough, we expect the biggest change in the mobile app advertising ecosystem in the past 10-15 years. This includes Apple’s removal of IDFA. Plus even more change with full automation offered by Facebook (AAA – Automated App Ads) and Google (AC – App Campaigns).

So… let’s jump in!

COVID CPM Fluctuations – Q4 2020

End of March 2020, we were one of the first sources to highlight the dramatic decrease in CPMs related to COVID and advised our clients to front-load spend and in June we issued a warning that CPMs had almost fully recovered and advised clients to be careful as we’re close to the top.

In April/May 2020 gaming advertisers front-loaded as much of their annual spend as they could to capture COVID-induced CPM decreases. However, post this CPM boon, most advertisers have been slow to increase spend August until September due to US election-driven CMP increases that quickly followed COVID.

Advertiser Productivity

Additionally, all advertisers have had to become remote organizations overnight and that had an impact on their productivity and roadmaps. Most notably, it has lengthened development cycles which slowed down updates and new titles coming to market (for which media spend is significantly greater during the launch period). The slowing of new titles means more legacy titles in the market with a higher probability of fatigue. This impacts performance and therefore media spend and short-term revenue.

Ever wonder how your mobile game or app KPIs perform vs industry benchmarks? Check out our “Mobile App Industry Benchmarks” dashboard and it is 100% FREE. Uncover your performance vs competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and much more. To get full access to all industry benchmarks, please register for a free AdRules account.

U.S. Election Spending – Q4 2020

Facebook Political Spending has grown significantly over August and September. The pundits expect this spend to continue through the November 3rd election. Political spending has been at an all-time high and CPM’s have remain inflated. Media performance inevitably has suffered and is likely to drive reduced spending from performance advertisers sensitive to ROAS (return on ad spend).

Q4 CPM Spikes – Q4 2020

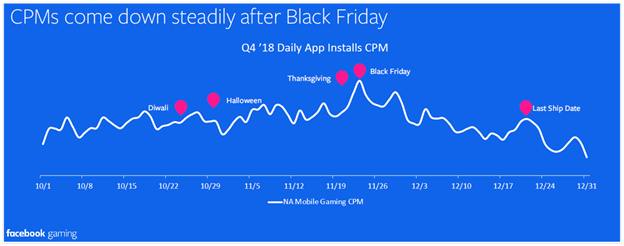

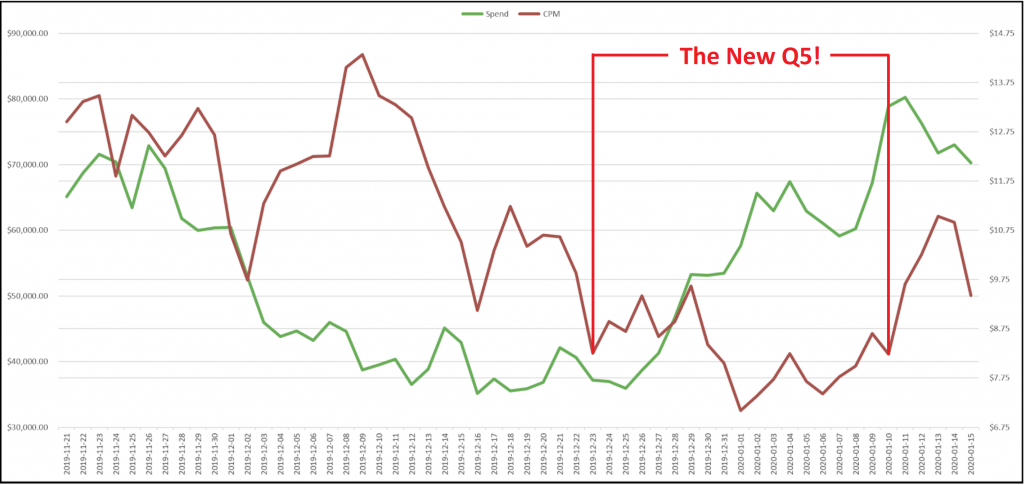

We see yearly CPM increases of 30-40% between Black Friday and Christmas. CPMs then plummet 12/26 and typically stay low through the end of January. Aside from COVID, CPMs in this period are traditionally the lowest of the year. We expect a spike in spend following the US holiday season as concerns around IDFA loss will increase.

To avoid a 30-40% increase in CPMs during the holidays, most non-eCommerce advertisers typically pull back spend between Black Friday until Christmas. Then, they accelerate spend 12/26/20 until 1/31/21. While that is not a universal rule as many brands will see increased demand and conversion throughput, it will have an impact on revenue visibility across the board.

For the past couple of years, we shared our thoughts on how to stay efficient during the holiday cost spikes. 2019 Black Friday & Q4 Facebook Ad Playbook: How to Stay Efficient When Costs Rise

Apple’s IDFA Loss – Q1 & Q2 2021

We have written extensively about the impact that Apple’s IDFA removal will have on the mobile ecosystem (IDFA Armageddon Roundup! & IDFA Armageddon Part Deux!). Without a doubt, the changes Apple will roll out will be the biggest change in the mobile app advertising ecosystem in the past 10-15 years. In this post, I laid out what could happen if Apple did not delay the rollout of their half baked SKAdNetwork, Game Over – Apple’s iOS 14 & IDFA Loss Will Drive Layoffs! As Apple did delay until some unknown date in 20201, please skip scenario 1 and focus on “Scenario 2: Layoffs, Consolidation, & Business Darwinism”. As the industry has a reprieve from Apple’s change, how will we use the 4-6 months we’ve been given? Check out this solid article from Dean for some perspective, The DeanBeat: What’s at stake in Apple’s potentially apocalyptic IDFA changes.

As stated in the above reference articles, the true impact of Apple removing IDFA from the iOS ecosystem is unknown. At least until they are willing to clarify SKAdNetwork capabilities and restrictions with a formal SDK update. In a public statement about the IDFA delay, Apple said, “We believe technology should protect users’ fundamental right to privacy, and that means giving users tools to understand which apps and websites may be sharing their data with other companies for advertising or advertising measurement purposes. This also includes the tools to revoke permission for this tracking. When enabled, a system prompt will give users the ability to allow or reject that tracking on an app-by-app basis. We want to give developers the time they need to make the necessary changes. As a result, the requirement to use this tracking permission will go into effect early next year.”

IDFA

What is known, is that IDFA will impact all iOS advertisers equally including all mobile app advertisers, Facebook, Google, TikTok, Pinterest, Snap, Brands, and Mobile Ad Networks. Said differently, we are all in the same opaque boat waiting on Apple’s clarifications, which are expected sometime in Q1 2021. Regardless of Apple’s update, there is both governmental (GDPR 2018 and CCPA [California Consumer Privacy Act 2020] and the related Proposition 24 privacy law upgrade on California’s ballot in November and end-user desire for more privacy and that will result in the reduction of deterministic modeling and a movement towards a probabilistic, mixed media model.

Based on my conversations with CEOs / CTOs / Mobile Measurement Partners and countless mobile app advertisers, the consensus is that all mobile app advertisers that rely on IDFAs have begun to conservatively model cash management options until they have a clear line of sight on the impact of IDFA loss to their P&L and LTV models. Without the certainty of deterministic tracking or viable fingerprinting alternatives or time to process SKAdNetwork enhancements, the industry expects reductions in costs and ad spend associated with mobile app advertising.

While mobile app spending appears ready to decrease, there is a growing demand for high-performing creative and creative optimization, which has become the last lever for driving net profit.

To date, we are seeing an increase in performance targets from our clients and the market in order to increase short term profitability and cash from UA activities. While that doesn’t mean revenue compression or sustained long term reduction in spend, it creates an impact on short-term Q4 / Q1 forward-looking revenue and we expect softness due to lack of measurement certainty but expect clarity in Q2 2021.

See Apple’s User Privacy & Data Use Here:

2021 Crystal Ball for Mobile App Advertisers:

I see three main drivers for mobile app advertising challenges & opportunities in 2021: (1) Apple’s IDFA Loss, (2) Automated Media Buying, and (3) Creative Optimization.

1. Apple’s IDFA Loss / SKAdNetwork Adoption

As detailed above, it has the potential to drive spend reduction in Q1, layoffs, or consolidation of UA/Growth/Data Science Teams for the first half of 2020. But the good news is that we are all in this together. The impacts will be felt throughout the industry and the solutions will be shared broadly.

2. Automated Media Buying

The full rollout of Facebook’s Automated App Ads (AAA) product actually represents an opportunity for buyers savvy enough to develop a successful strategy early in its life. Unlike Google’s AC, for now, Facebook’s standard auction buying still exists. It can also thrive alongside AAA campaigns and we expect that to continue for the first half of 2021. Formulating a tandem strategy for AAA and standard “business as usual” campaigns is key for Q4 2020 and 2021, with several important layers to consider. Check out our full blog post on this topic for more details.

3. Creative Optimization

Brought on by the loss of deterministic media buying certainty and automation — creative is the only major lever remaining to influence performance for mobile app advertisers.

How We Can Help Mobile App Advertisers?

We are aggressively expanding our creative capabilities to deliver “Cheaper, Better, Faster” (Sir Martin Sorrell). In addition, we believe this will be the new marketer checklist during the economic recovery.

- Produce Hollywood-level creative at a fraction of the cost of holding company creative shops. We do this at a high velocity of production with proprietary testing methodology tied to business outcomes.

- Check out our new Gaming Reel & Non-Gaming Reel.

- Have sharpened our teeth in immersive digital storytelling (gaming) and bring that storytelling to new brands, verticals, and markets.

- Our creative and platform are geared towards performance and business outcomes instead of awards.

- Our capabilities lend themselves to emerging digital media. The digital media includes OTT, DTC, Mobile Web, and DOOH as established brands are forced to adapt to post-COVID digital transformation.

- In the first half of 2021, we will enhance our Creative Studio with 3D animation, Live Action, Logo Design, and other services.

Creative Optimization for Mobile App Advertisers

- Facebook’s automated media buying solution Automated App Ads (or triple A-AAA) appears to work best with these groupings: Country, OS, Language, Optimization Type.

- This change in account configuration will require a fundamental restructuring for how companies work with Facebook Marketing Partners and Agencies. For the first half of 2021, we expect lots of pockets of efficiencies in manually optimizing outside the AAA algorithm. Towards the second half of 2021, we expect those gaps to being too close and full automation to kick in.

- We imagine that Facebook will lift the 50 creative per campaign limit. Most likely unrestricted, but bound by Country, OS, Language, Optimization Type.

- You could image easily envision the following account structure geared to maximize the AAA algorithm and creative optimization.

- United States & maybe Tier 1

- 50 Creatives: US + iOS + English

- 50 Creatives: US + Android + English

- Tier 2 English Speakers

- 50 Creatives: Tier 2 + iOS + English

- 50 Creatives: Tier 2 + Android + English

- Tier 2 Spanish Speakers

- 50 Creatives: Tier 2 + iOS + Spanish

- 50 Creatives: Tier 2 + Android + Spanish

- Tier 2 other languages (Germany, etc., etc.)

- Tier 3 English vs other languages, etc.

Consulting Services Overview for Mobile App Advertisers

Support our client’s transition to internal UA (AAA & iOS 14 changes). Our services are designed to:

- Mitigate our client’s risk in the transition process.

- Provide coaching, training, support, and best practices. Do this to ensure internal teams can leverage our broad view across Facebook, Google, and TikTok.

- Provide internal UA teams with wider visibility and context into the Facebook post-iOS14 & AAA best practices and tradecraft.

- Services Include:

- Creative Trends, Competitor & Creative Insight Report: highlighting which creative trends are working, key benchmarks for the genre/sub-genre.

- Auto Reporting: Reduce the internal team’s time spent on low-value data gathering. Do this by leveraging the AdRules platform with our automatic audits, weekly reports, and dashboard.

- Bi-Weekly Coaching & Auditing of your accounts to provide performance & creative suggestions of new ideas to test and scale.

- Creative Testing: Phase 1 and Phase 2 testing to identify creative winners that have the ability to appropriately scale.

- Audience Building: Support audience development with our proven ability to build audiences at scale. We can build > 10% audiences.

- AAA out-of-the-box builds: Support new AAA builds leveraging best practices and tradecraft pooled from our global client accounts.

- Copywriting Services: Human and machine learning wrote ad copy suggestions based on what is working across our portfolio of clients.

- General Insight/Best Practices: Watch out for an increase in costs around the holidays. Also, during political campaigns or at the ends of quarters.

- ML Creative Feedback: Advice on how they may improve creative. Analysis and pattern finding what is working for them.

Preparation by Mobile App Advertisers for the loss of IDFA

Plan now and prepare for the loss of IDFA, automated media buying, and creative optimization. With lean testing and a stable of winning creatives (videos, images ad copy), mobile app advertisers will be better prepared for the curveballs that are sure to chuck at the mobile app industry over 2021. As always, the two rules of app marketing remain unchanged. Know your product and Know your users’ motivations. The time for thoughtful AAA/human campaign integration and creative optimization is now.

Please reach out to sales@ConsumerAcquisition.com if we can help with fresh creative for video ads or media buying on Facebook and Google.