Apple announced the deprecation of the iOS Users’ Identifier for Advertisers (IDFA). This is the biggest change in the mobile app advertising ecosystem in the past 10 years. For some, Apple’s IDFA change will be company-crushing, while for others it will create a tremendous opportunity. This is part DEUX of our IDFA Armageddon round-up articles (Part I: In our first post, you will find quotes from 21 leaders in Mobile App Advertising.) If you are trying to understand what the change means to your business, read IDFA Armageddon Part Deux. We have done the hard work rounding and summarizing key articles and quotes for you.

Apple’s IDFA Armageddon Part Deux

- Facebook will not collect the identifier for advertisers (IDFA) on its own apps on iOS 14 devices but may revisit this decision as Apple offers more guidance.

- The company will remind its users that they have a choice about how their information is used on Facebook and about its Off-Facebook Activity feature, which allows users to see a summary of the off-Facebook app and website activity businesses send to Facebook and disconnect it from their accounts.

Partners

- For partners, Facebook will release an updated version of its Facebook SDK to support iOS 14, which will provide support for Apple’s SKAdNetwork API. To mitigate the impact of the efficacy of app install campaign measurement, Facebook is asking businesses to create a new ad account dedicated to running app install ad campaigns for iOS 14 users.

- The company believes that Apple’s changes will disproportionately affect its Audience Network given its heavy dependence on app advertising. The expectation is that advertisers’ ability to accurately target and measure their campaigns on Audience Network will be impacted, and publishers should expect their ability to effectively monetize on Audience Network to decrease. In fact, Apple’s updates may render Audience Network so ineffective on iOS 14 that it may not make sense to offer it on iOS 14. Facebook is however expecting less impact to its own advertising business.

Testing

- In testing, Facebook has seen more than a 50% drop in Audience Network publisher revenue when personalization was removed from mobile app ad install campaigns. In reality, Facebook says the impact to Audience Network on iOS 14 may be much more, so they are working on short-and long-term strategies to support publishers through these changes.

- Facebook is encouraged by conversations and efforts already taking place in the industry to get this right for small businesses – including within the World Wide Web Consortium (W3C) and the recently announced Partnership for Responsible Addressable Media (PRAM).

“It seems nearly impossible that advertisers won’t face deteriorating economics on Facebook in the short term as IDFA deprecation materially impairs Facebook’s ability to precisely target users. Over the long term, I believe that Facebook will find a path to its current level of ad serving efficiency without needing advertising identifiers. But the content of its own white paper underscores very clearly how important personalization is for ad targeting, and IDFA deprecation damages Facebook’s ability to deliver that kind of personalization.”

https://mobiledevmemo.com/idfa-deprecation-is-facebooks-sword-of-damocles/

“We’re still trying to understand what these [iOS 14 privacy update] changes will look like and how they will impact us and the rest of the industry, but at the very least, it’s going to make it harder for app developers and others to grow using ads on Facebook and elsewhere… Our view is that Facebook and targeted ads are a lifeline for small businesses, especially in the time of Covid, and we are concerned that aggressive platform policies will cut at that lifeline at a time when it is so essential to small business growth and recovery.”

https://appleinsider.com/articles/20/07/30/facebook-says-apples-ios-14-could-hinder-ad-revenue

“We don’t think fingerprinting is going to pass the Apple test. By the way, just to clarify, every time I’m saying something about a method that is unlikely, it doesn’t mean I don’t like that method. I wish it would work, but I just don’t think it would pass the Apple sniff test… Apple said, ‘If you do any form of tracking and fingerprinting is part of it, you have to use our pop up…”

“The challenge with that is it means that Apple needs to do us a favor and give us the IDFA. That means it’s unlikely because they just killed it very publicly. Why would they have an appetite to give anyone that access again?”

“SKAdNetwork, as Apple proposes, in its current form is very bare-bones. It’s okay, they gave us an API and said, ‘Go figure it out’… An ad network will report their spends, the number of installs, and their ROI – that’s insane. It’s like they can do anything, they can just report that it’s all whales.

https://mobiledevmemo.com/how-to-scale-and-optimize-marketing-spend-with-skadnetwork/

“The result [of the iOS 14 privacy update], most mobile experts think, will be a below-20% opt-in rate for IDFA tracking. (That’s probably high.) This is good for privacy. It’s also bad for legitimate advertisers and marketers. But potentially worse is Apple retaining advantages that other ecosystem players cannot, simply because Apple owns the iOS platform. Everyone else needs permission to allow “tracking,” but Apple retains its access to more data. And Apple potentially has a lot of on-device data. While the company is privacy-centric, and it does mix your data with groups of 5,000 other people to only target large segments, not individuals, Apple explicitly says it uses data about “your devices’ connectivity, time setting, type, language, and location” to personalize ads to you.”

“In iOS 14, Apple Advertising appears to have a separate settings panel with a default-on setting. Other advertisers and ad networks on iOS, however, need to ask permission every single time. ‘It’s preferential access to users’ data,’ mobile expert Eric Seufert says. ‘Now they’re best-positioned to gain market share in mobile app install ads.’ That’s close to an $80 billion industry that Google and Facebook currently dominate.

https://www.forbes.com/sites/johnkoetsier/2020/08/07/apple-ad-network-gets-special-privileges-that-facebook-google-wont-on-ios14/#56c68dd57515

“The notion of ‘deterministic’ performance attribution as we knew it for the past eight years has been a hoax. Most know this, but it was much easier to just accept the status quo. And you at Apple are really good at changing the status quo for the better. Just look at the iPod, iPhone, and iPad as examples. Uber was the perfect example of how attribution has been a hoax. It is a mobile-first company that used deterministic attribution based on user-level data, analytics, and so on, and it later found out that 80% of its ad spend – more than $100 million – was just cannibalizing its organic new users. Uber is just the tip of the iceberg for companies that believe they are making data-driven decisions based on wrong information.”

“SKAdNetwork 2.0 is a large improvement, and while far from perfect, it creates a well-guarded environment where advertisers can regain trust in their ad spend with no need for third-party attribution to guesstimate who should get credit… SKAdNetwork still gets something wrong: 100% of attribution credit goes to the last click. That means that a user watching a video ad on addressable TV, listening to an audio ad on Spotify, and seeing a full pre-roll ad on YouTube but ends up clicking a tiny button ad on a random app will get credit.”

https://www.adexchanger.com/data-driven-thinking/an-open-letter-to-apple-thank-you-for-throwing-the-industry-in-flux/

“As Eric Seufert mentions in his MobileDevMemo, a lot of parties in the advertising ecosystem will need to find new ways to provide value. Be it attribution, retargeting, programmatic advertising, ROAS based automation – this will all become incredibly vague and you can already see the attempts of some of these providers to find new sexy slogans and test the interest on the advertiser’s side for new incredibly risky ways of doing business as if nothing has happened.”

“Personally, I do expect that in the short term we will see a drop in top-line revenues for hyper-casual games, but I don’t see their death. They will be able to buy even cheaper and as their focus is to buy untargeted, they will adjust their bids against their expected revenues. As CPMs drop, this volume game might be able to work, though at smaller top-line revenues. If the revenues are then big enough is to be seen. For core, mid-core, and social casino games, we might see tough times: No more retargeting of whales, no more ROAS based media-buying. But let’s face it: the way we were buying media was always probabilistic. Unfortunately, now the risk will increase significantly and we will have much fewer signals to react quickly. Some will take that risk, others will be cautious. Sounds like a lottery?”

https://www.gamedev.net/blogs/entry/2269865-idfa-mobile-games-industry-up-for-a-bumpy-ride/

“What you need from your MMP is:

- Getting the right tech and data set-up

- Getting the right aggregation

- Serving as a postback solution for sharing that data with 3rd parties (FB, Google)

- Helping publishers optimize

- Helping publishers make algorithmic decisions on where to spend and not to spend”

“We’ll probably get only 10% of people to give consent, but if we get the right 10%, maybe we don’t need more. I mean, by day 7 you lost 80-90% of users anyway. What you need to learn is where that 10% are coming from … if you could get consent from all the people who pay, then you’d be able to map where they come from and optimize towards those placements.”

“Publishers might go after hyper-casual games or build hub apps. The strategy is to acquire highly converting apps (conversion to install), drive users there cheaply, and then send those users to the better monetizing products. What is possible is that you could use IDFV to target those users… It’s a pretty good strategy to retarget users. You could use an in-house DSP to do that, especially if you have multiple apps in the same category, like casino apps. In fact, it doesn’t have to be a gaming app: any app or a utility app could work as long as you have a valid IDFV.”

https://www.singular.net/blog/n3twork-prepare-ios-14/

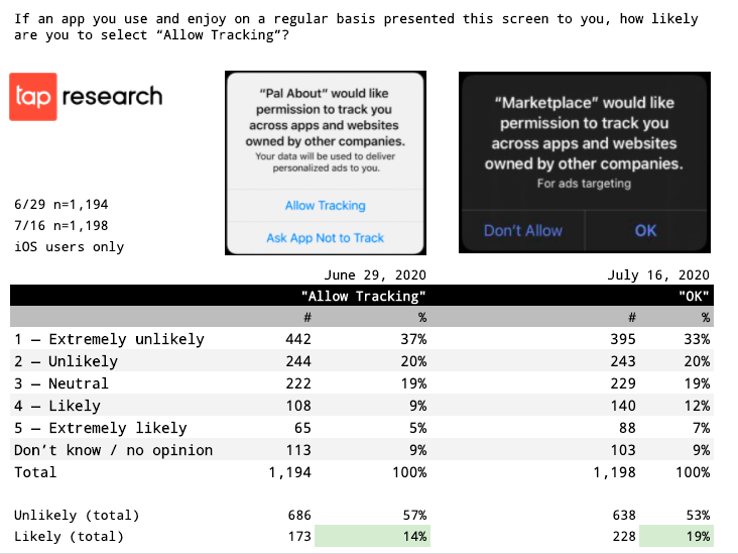

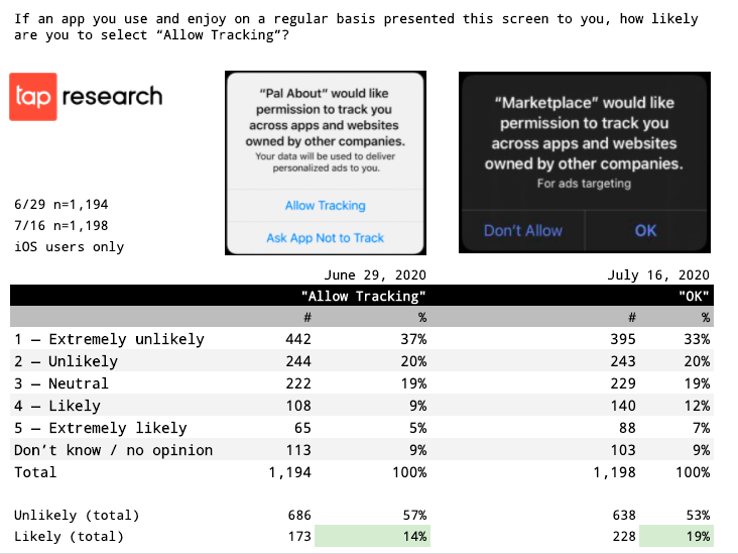

“If an app you use and enjoy on a regular basis presented this screen to you, how likely are you to select Allow Tracking?

1 – Extremely unlikely… 5 – Extremely likely. Of the 1,088 respondents who answered 1-5, the data suggests only 16% of iOS users would consider selecting the Allow Tracking option from an app they regularly use and enjoy. Full results of the poll are published here.”

https://blog.tapresearch.com/2020/06/30/new-poll-suggests-ios-users-unlikely-to-share-idfa-with-publishers/

“One approach to the measurement I’ve seen championed in the weeks since WWDC has been that of probabilistic attribution: using behavioral profiles to attempt to associate (“tag”) users with the channel or campaign most likely to have sourced them. I think this will be difficult to do competently…. without the ability to update model priors with successful prediction results, the models will simply privilege the channels that currently produce the most, highest-value traffic for advertisers.”

“My sense is that the best strategic path forward for mobile performance advertisers is to lean into the SKAdNetwork framework and to fundamentally shift their advertising approach away from the user- and device-centric targeting to campaign-level optimization. Doing this well means establishing an acute product focus on delivering conversion values to ad networks that are predictive of user LTV…. leaning into the SKAdNetwork framework is a relatively low-risk bet: Apple appears to be championing SKAdNetwork as the central measurement tool for iOS, and advertisers should understand how to build infrastructure and strategy around it.”

https://mobiledevmemo.com/how-to-scale-and-optimize-marketing-spend-with-skadnetwork/

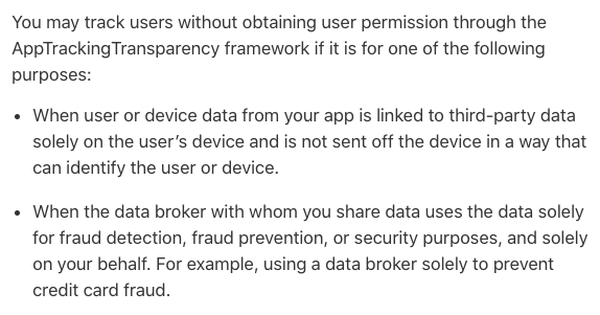

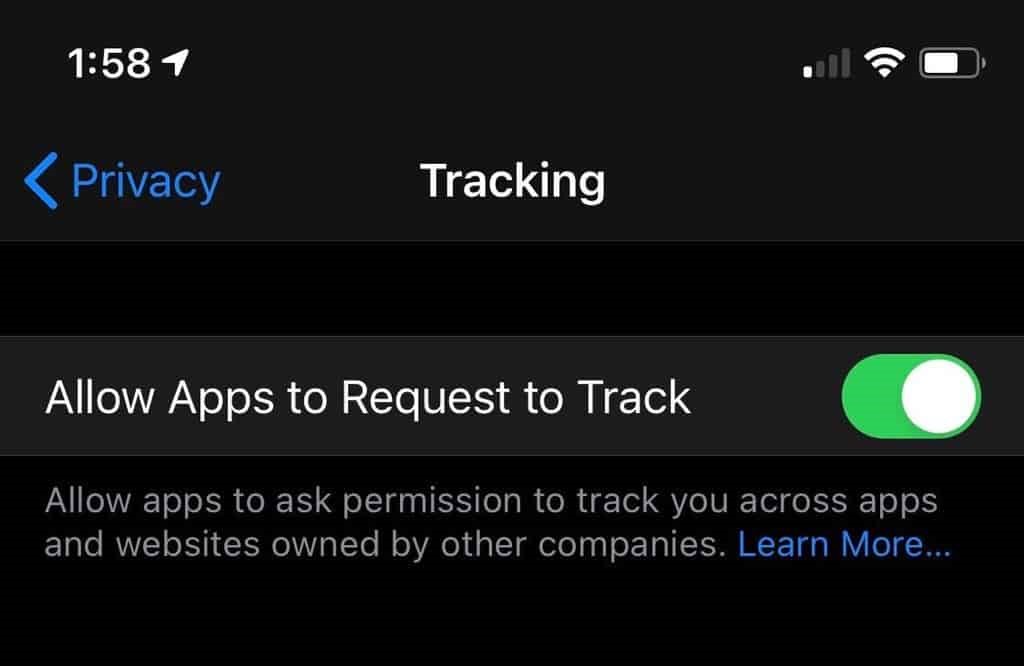

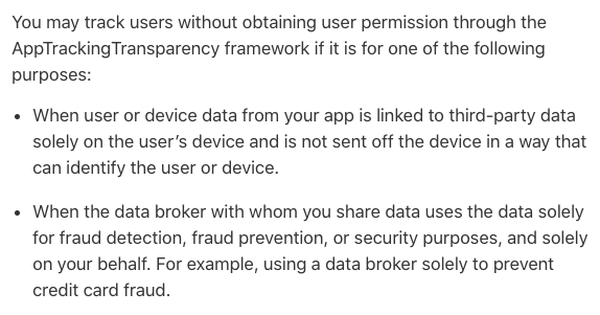

“Apple introduced the AppTrackingTransparency (ATT) framework that manages access to the IDFA with required user consent. Apple also outlined exemptions for this framework that might provide the ability for attribution as it exists today. We believe that focusing on this framework and creating tools within these rules is the best way forward – but before diving into this further, let’s have a look at the other potential solution. Often mentioned in the same breath, SKAdNetwork (SKA) is an entirely different approach to attribution that removes user-level data entirely. Not only that, but it also puts the burden of attribution on the platform itself.”

“Adjust and other MMPs are currently working on cryptographic solutions using practices such as zero-knowledge theorems that might allow us to attribute without having to transfer the IDFA off the device. While this may be challenging if we have to use on-device for source and target app, it is easier to imagine a solution if we are allowed to receive the IDFA from the source app and only have to perform the matching on-device in the target app… We believe that obtaining consent in the source app and on-device attribution in the target app might be the most viable path for user-level attribution on iOS14.”

https://www.adjust.com/blog/the-future-of-the-ad-ecosystem-on-ios-14/

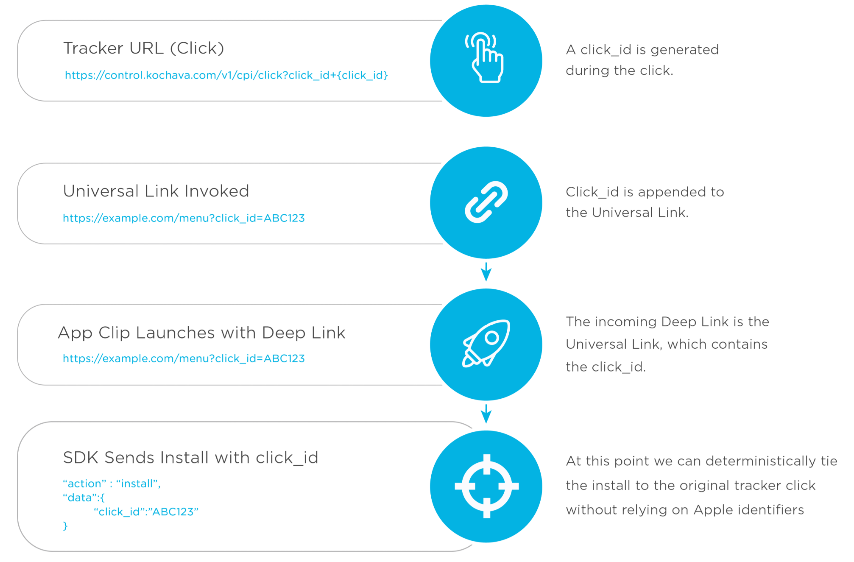

“Kochava’s layered approach to tackling mobile measurement post-iOS 14 Privacy Update

-

Deterministic

- Users that opt-in to IDFA-based tracking.

- App Clip deep links (new to iOS 14) – apparently App Clips (functional snippets of apps) will be triggered by a deep link that can pass on a click ID.

- SKAdNetwork for cohort data

-

Probabilistic

- Harvesting IP and User Agent data

- Contextual, i.e. device parameters that can be queried by the MMP’s SDK, e.g. screen brightness, audio volume, locale, language, timezone.

- Hyper-granular lookback windows – to increase the accuracy of the probabilistic model, hyper-granular lookback windows, down to just 1-minute post-click. Kochava suggests that sub-10 minute lookback windows offer 98% probabilistic accuracy vs. <90% accuracy for 0.25-3 hour windows.

Aggregation, combination, and correlation of these mobile measurement layers should augment measurement accuracy to an extent that would trump any purely probabilistic model.”

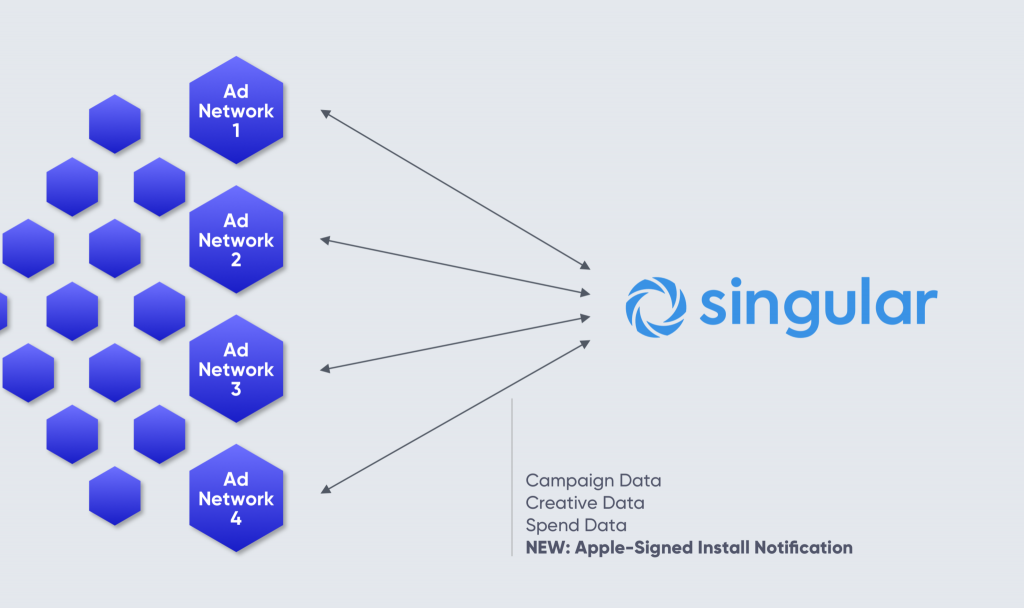

“Singular announces SKAN: an open-source, SKAdNetwork-based framework to support the entire mobile marketing ecosystem in running user acquisition post-iOS 14 with an eye to ROAS.”

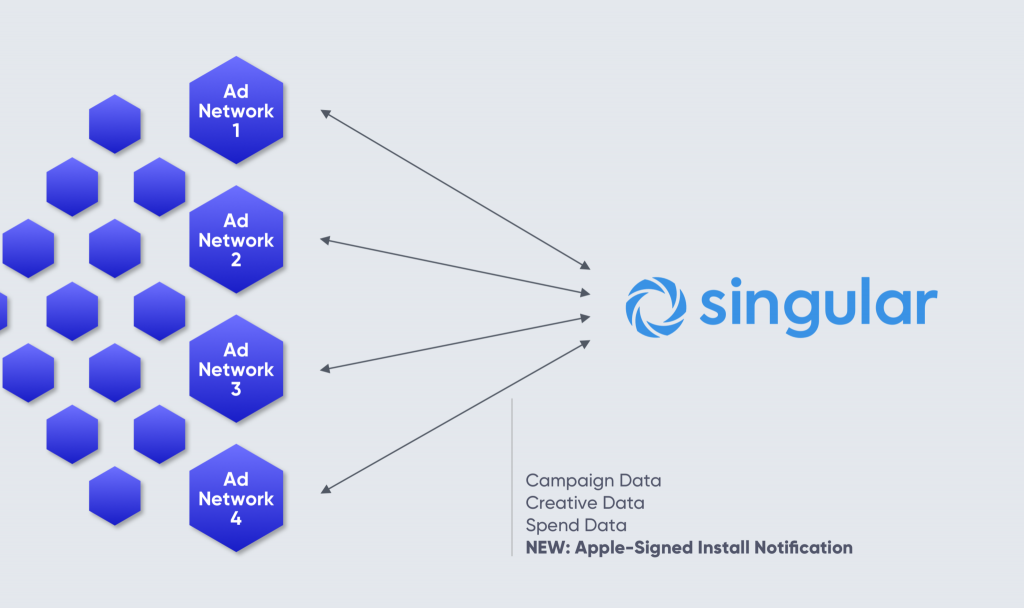

“By default, the entity that receives the SKAdNetwork notification (postback) is the ad network, which needs to register with Apple. Ad networks can then forward install postbacks to advertisers and MMPs to validate them, which is rather straightforward as Apple cryptographically signs them.

Singular’s Secure-SKAN solution

There is however one critical flaw that has to be addressed: Apple does not sign conversion values in SKAdNetwork. That effectively means that conversion values are self-reported by ad networks. That’s where Singular’s Secure-SKAN solution comes into play. Secure-SKAN is a solution where Singular as the MMP will register jointly with every partner that will be publishing your ads. SKAdNetwork supports this by design, and we’ve been working closely with partners and advertisers (including Apple) to validate the solution is technically equivalent and solves the trust piece. On the ad network side, adopting Secure-SKAN is straightforward as you essentially receive the same exact postback — however, Singular is simply forwarding it.

When done right, the six bits of conversion values provided by SKAdNetwork can do quite a lot — including cohorts, which can be used for ROAS analysis. To keep ourselves honest here, six bits won’t give us the ability to report on 180-day cohorts. We wish it did. But at the same time, establishing 3-day and even 7-day cohorts provides a great foundation for optimization that takes you a whole lot closer to true LTV.

Conversion management in SKAdNetwork is a fascinating topic, and we can’t wait to provide more details about it soon.

By design, SKAdNetwork data is highly fragmented. We have solved a very similar problem for ad spend and ad network data, so these challenges are quite familiar. Then there are also conversions. You will need to translate values to meaningful event information. Then, tie it all back to the right campaigns.

As you may recall, the fields available in the SKAdNetwork response are the following:

- Source, which would normally be the attributed ad network or any other registered publisher that called loadProduct() to display the ad

- Campaign ID, which is generated by the ad network

- Source App ID, which is the actual publisher app that showed the ad

Leveraging Singular’s Data Connectors, we can connect this data to campaign names, app names (for the publishing app), bids, and other metadata at the campaign and publisher level and of course — ad spend. Tying this together with 3-day, 5-day, or even 7-day cohorts can produce a powerful report that continues to enable user acquisition teams to make informed decisions about their ad spend.”

https://www.singular.net/blog/skadnetwork-solution-ios14/

“The extreme ends of the mobile gaming spectrum — “core” games driven by regular in-app events and extreme in-app purchase monetization, and hypercasual games that monetize exclusively through advertising and allow the aforementioned core games to go “whale hunting” via IDFA-targeting — thrive in the current, profile-centric advertising environment, and both of these categories face significant headwinds when the IDFA is deprecated.”

https://mobiledevmemo.com/consumer-behavior-changes-in-ios-14/

Here’s My Take on IDFA Armageddon Part Deux!

ConsumerAcquisition shares Apple’s values when it comes to protecting user privacy. As an industry, we must embrace the new rules of iOS14. We need to create a sustainable future for both app developers and advertisers. Please check out part I of our IDFA Armageddon roundup.

If I had to guess about the future:

IDFA Armageddon Part Deux: Short Term

- We encourage all publishers to talk to Apple and seek clarification on process and end-user consent along with the use of IDFVs & SKAdNetwork product road map, etc.

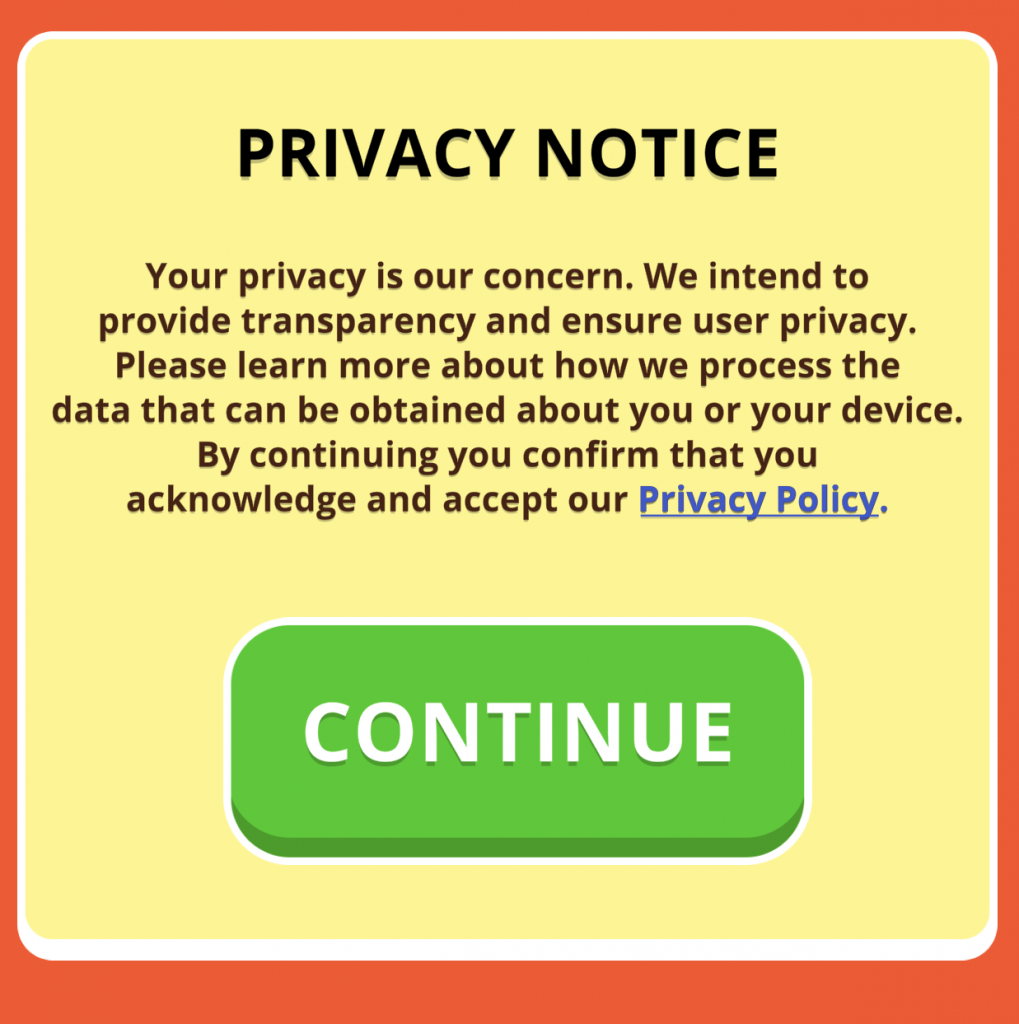

- We believe publishers will aggressively optimize sign-up funnels, consent flow, and onboarding processes. This is to maximize consent and privacy opt-ins or live with the campaign-only level metrics and lose end-user targeting.

- The growth and data science teams we’ve spoken with have already starting experimentation.

- If a mobile app company would like to continue to optimize towards ROAS, we encourage them to think of privacy consent as a step in the UA conversion funnel necessary to show targeted ads to consumers.

- Companies will aggressively experiment with flow optimization and user messaging.

- They will get creative testing web-based user flows for registration to preserve IDFA. Then, cross-selling into the AppStore for pay off.

- Here’s one solution from a game company

We believe phase 1 of the iOS 14 rollout could look like this:

In the first month of the iOS rollout, the supply chain for performance advertising will experience a short-term hit. Especially for DSP remarketing.

1st Step

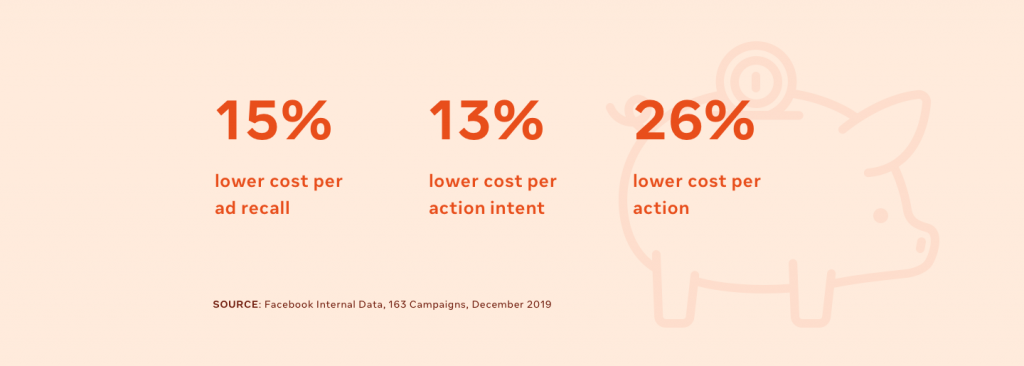

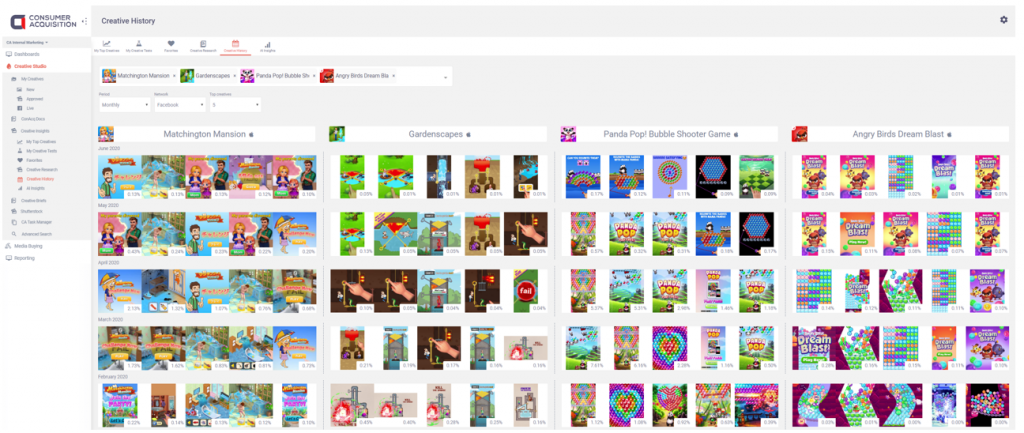

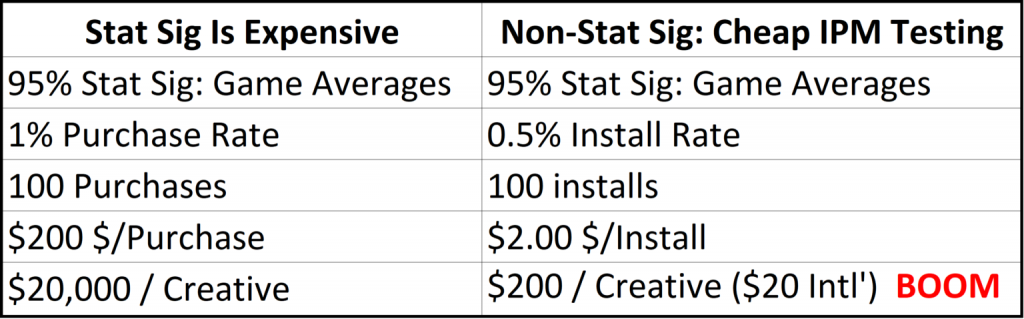

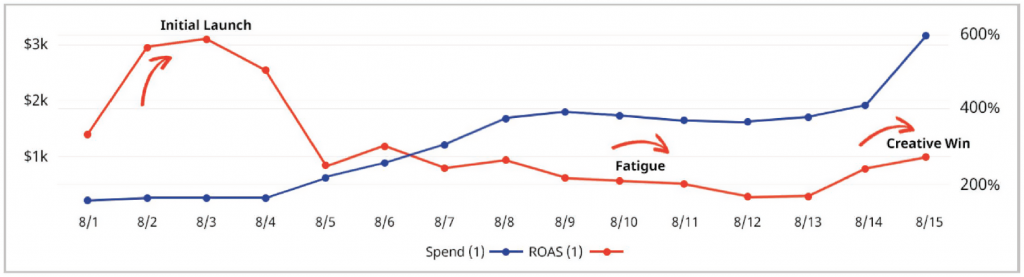

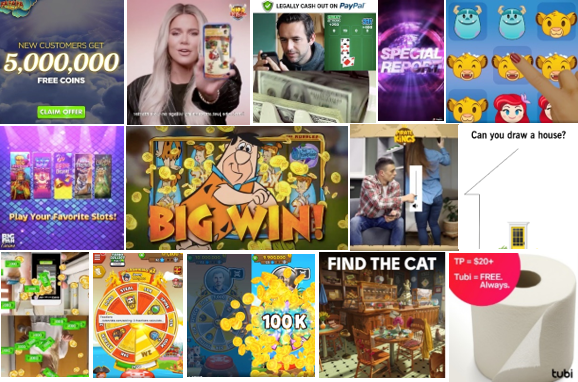

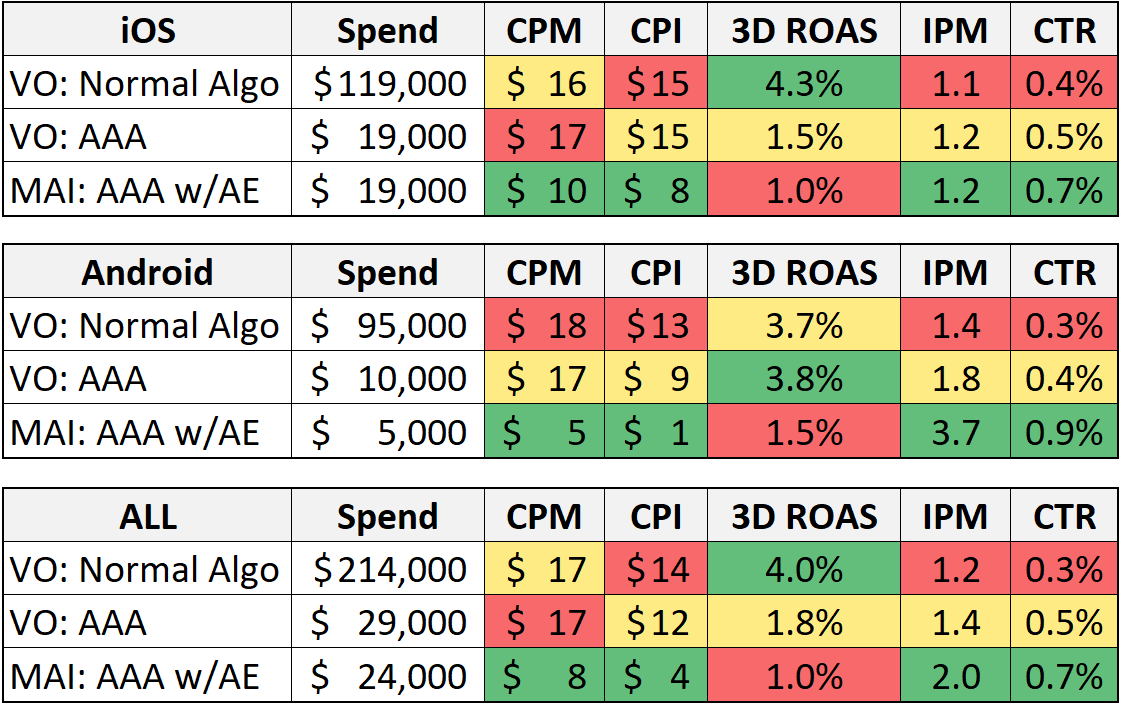

- Mobile App advertisers heavily invest in creative optimization of their ads as their primary lever to drive performance.

2nd Step

- Publishers will start to optimize user consent flows

3rd Step

- UA Teams & Agencies will be forced to rebuild campaign structures.

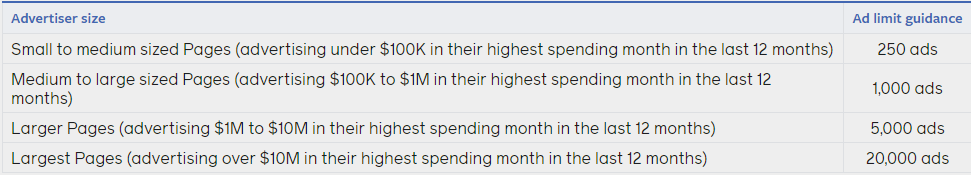

- The 100-campaign limit imposed by Apple will force mobile app advertisers to rethink the number of accounts they run. Also, how many external partners they use. This will force temporary inefficiency as new structures will need to be re-optimized.

- Google will receive a traffic bump from mobile app advertisers pushing more ad dollars where it can be measured. Those advertisers will be surprised when they evaluate how much Google traffic comes from Apple. We’re advising clients to check out their Apple contribution to their YouTube traffic to get a handle on traffic allocation. We’re seeing 10-25% Apple traffic coming out of Google for larger advertisers.

4th Step

- User “opt-in” sharing increases but is estimated to only hit a max of 20%.

- Developers implement Google’s Firebase to gain monetization efficiencies.

- Advertisers shift time from optimizing smaller ad networks to customizing in-game experiences. They produce predictive behavioral dynamics that result in higher-value users (whales).

5th Step

- Fingerprinting users rapidly expands in an attempt to maintain the status quo.

- A publisher’s internal fingerprinting, IDFV, (which may not leverage fingerprinting) may not create a privacy problem if it is not used for re-marketing/re-targeting. If abused, Apple is sure to shut it down quickly.

- While fingerprinting may be outside of Apple’s control, it appears highly likely to fragment the ecosystem. It will create more barriers for entry to building competitive measurement solutions.

- If a publisher or MMP sends their fingerprinting to a 3rd party network, this may be a violation of Apple’s policy. This may result in getting an app rejected by Apple’s App Store.

- Open questions remain on how audiences comprised of apps + down funnel user actions (purchases, etc) without user consent will be created/used.

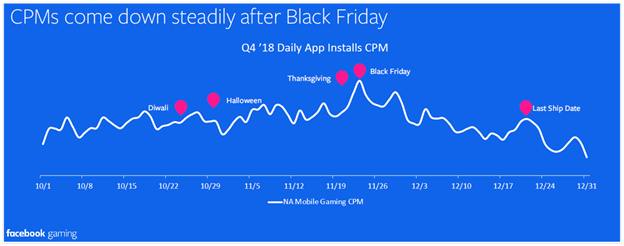

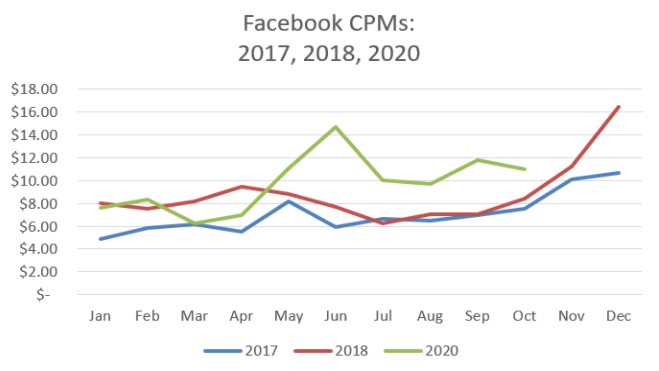

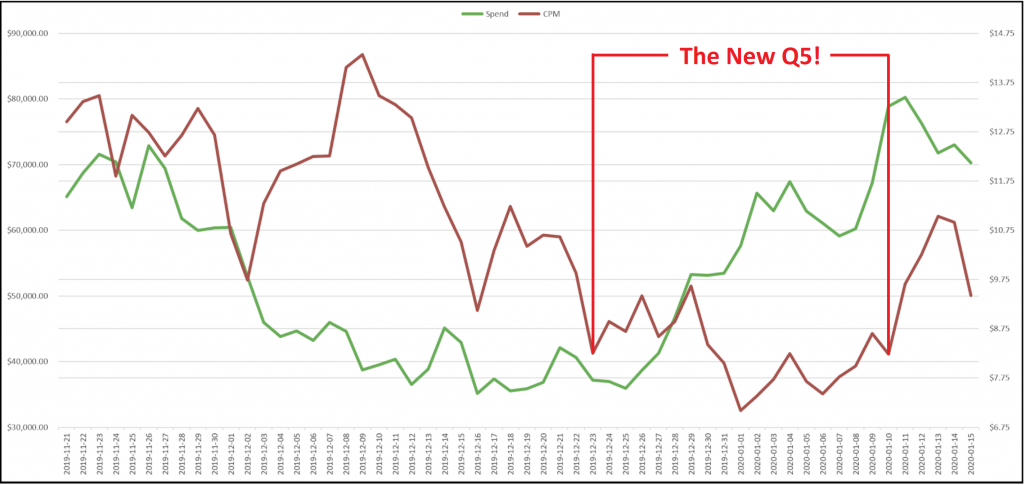

- Note: Hyper casual advertisers leveraging broad targeting may be able to initially benefit as the “high-end whale hunters” are pull back causing a temporary CPM deflation. We expect the high cost per subscriber and niche or hard-core games to be most impacted. We recommend these company front load incremental creative testing now to bank wins.

IDFA Armageddon Part Deux: Mid Term

- Fingerprinting will be an 18-24 month solution and entered into everyone’s internal algorithm/optimization black box. As SKAdNetwork matures, Apple is likely to shut down fingerprinting or reject apps that violate its App Store policy.

- There will be sustained challenges for programmatic/exchanges / DSP solutions.

- Growth teams find a new religion with “mixed media modeling.” They take lessons from brand marketers. At the same time, they seek to broaden last-click attribution to open new sources of traffic. Success will be based on deep experimentation and alignment of data science and growth teams. Those companies that get their first will have a significant strategic advantage to achieve and sustain scale

- SKAdNetwork must be enhanced with Campaign/AdSet/Ad level information to keep the mobile ad network functioning.

- Mobile apps that monetize with mostly ads will pull back. There is likely to be decreased revenue with lower targeting but should normalize over the next 3-6 months.

IDFA Armageddon Part Deux: Long Term

- User consent optimization becomes a core competency.

- Google deprecates GAID (google ad id) – Summer of 2021.

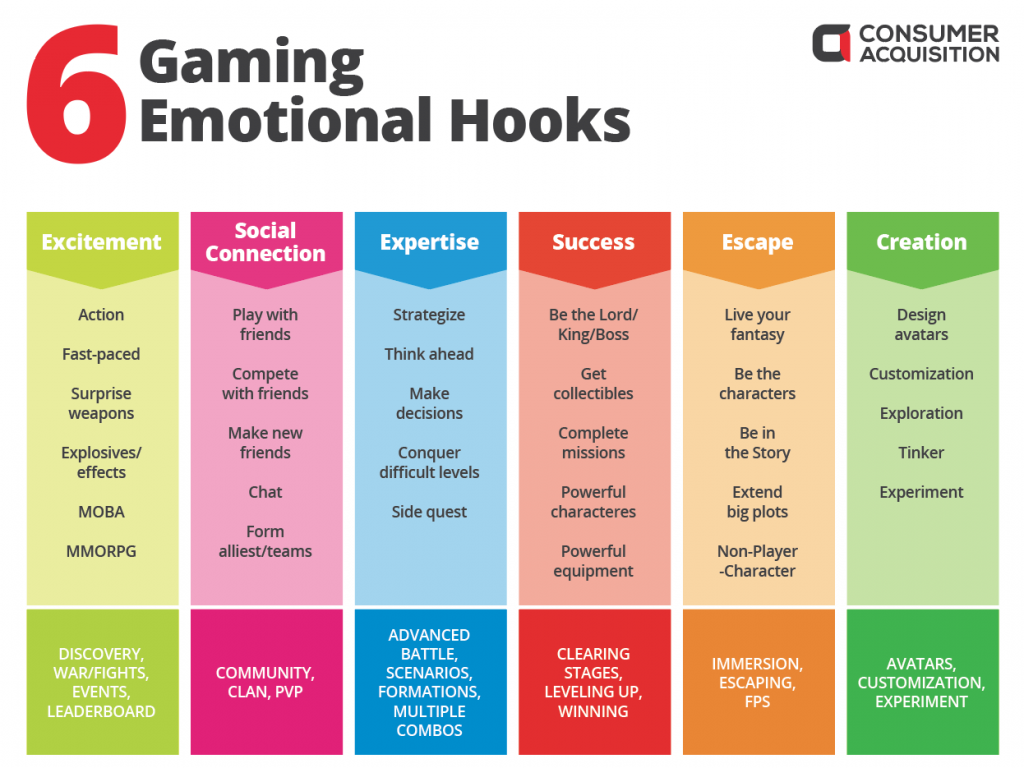

- Human-driven, creative ideation, and optimization are the primary lever for user acquisition profitability across networks.

- Incrementality and optimal channel mix become critical.

We are looking forward to working with our clients, Apple, Facebook, Google, and MMPs to participate in shaping the future of our mobile app industry advertising.

Look out for more updates from us regarding IDFA changes.

Oh yeah, and now a word from our lawyers: Nothing stated in IDFA Armageddon Part Deux is legal advice. Please work closely with legal and other professional advisors. Determine how IDFA changes, GDPR, CCPA, or other laws may or may not apply to you and your business.

Sources for IDFA Armageddon Part Deux: