In today’s post, we explain why the casino app genre continues to benefit from the pandemic activity boost and keeps growing in popularity.

- Casino is the #1 mobile game genre by consumer spend in the US, and #4 worldwide (via Data.ai)

- IAP revenue from casino games is expected to hit $6.9 billion this year

- 68% year-over-year growth in time spent in casino games

- $14.2 billion is the projected value of the casino games segment by 2026

Casino Genre Hits #1

For U.S. Mobile Game Spend

Casino App Market in 2022

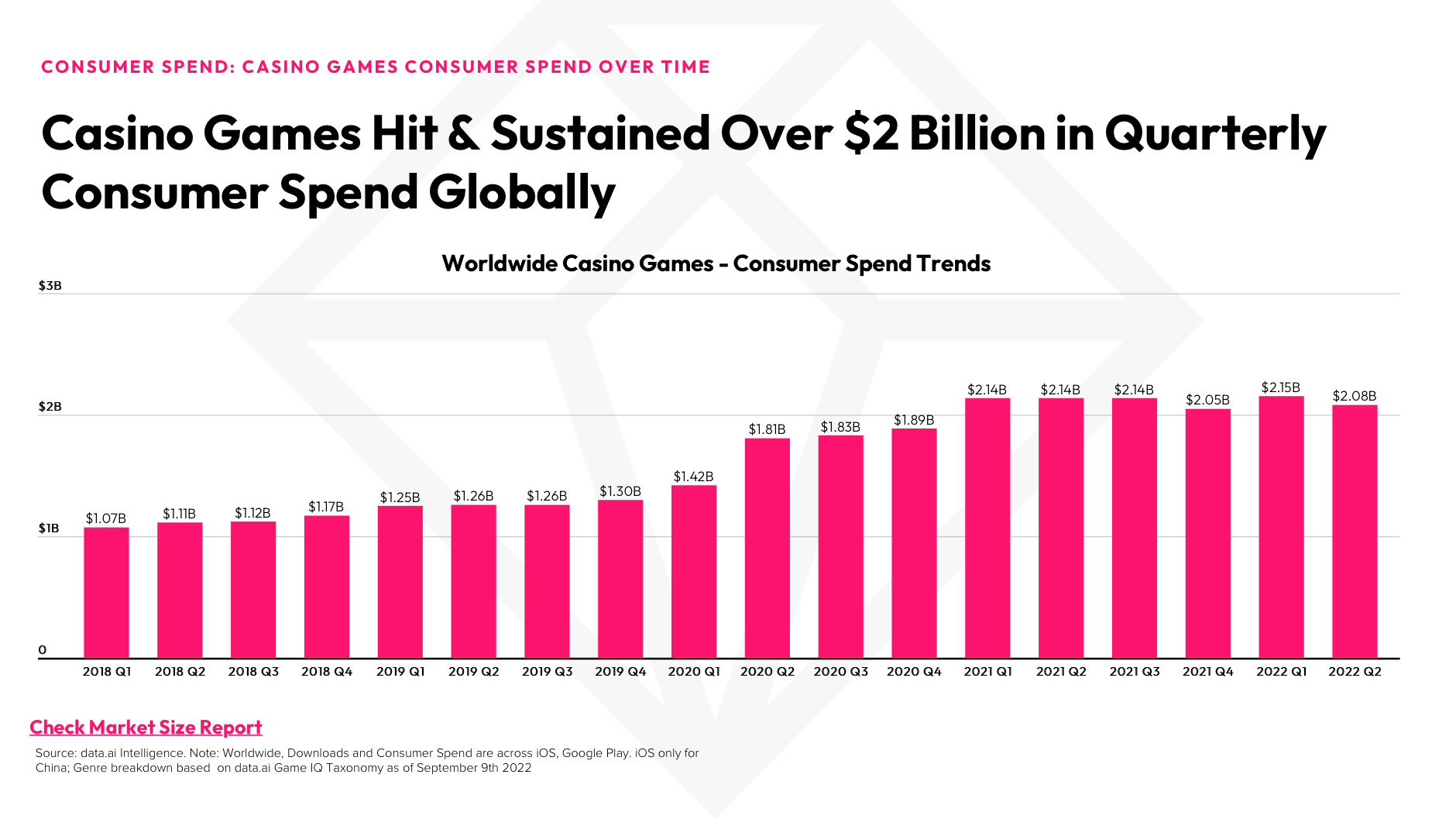

2022 is turning into an incredible year for mobile casino games, with global downloads passing the 300M threshold for the first time in Q1, according to a forthcoming report from data.ai. With total revenue expected to reach $8.7 billion by 2026, the genre is holding on to its pandemic performance boost even as download rates fluctuate.

While traditional top-performing markets have continued to deliver, emerging markets such as India, Indonesia, and Brazil have drawn a lot of attention this year. India saw a whopping 140% boost in downloads, compared to 2021. The US continues to earn about half of global revenue for gaming apps overall, with 60% for the casino genre.

Key casino games to watch include BINGO Blitz, Slotomania, Jackpot Party Casino, Cashman Casino, DoubleDown Casino, and Cash Frenzy. While slot games continue to be the most popular subgenre by installs, the #1 top performer in the US and UK was BINGO Blitz.

Slots Apps Dominate Casino Genre

According to data.ai, slots apps currently make up 25% of total downloads and two-thirds of consumer spend for the Casino genre. Compared to Q1 last year, they have seen a 14% increase in downloads globally. This very popular subgenre has a long history in the market and continues to innovate. Emerging slot games—often originating in foreign markets—are also introducing new monetization features including incorporating blockchain technology and cryptocurrency.

The Social Casino Boom

Social casino games saw an incredible boost in popularity with the pandemic. They games provided a simulation of a live casino experience unaffected by health restrictions. Users can gamble with virtual currency earned by playing the game itself or buy extra currency through in-app purchases. While IAPs are the main avenue of monetization, many developers implement hybrid monetization models that incorporate in-app advertising to attract the casual free-to-play gamer crowd.

Some of these apps put an emphasis on social features, designing progression systems that necessitate constant interaction with fellow users. Along with social connection, these features stoke a competitive fire, a major user motivator and performance driver across game genres. Proven ad creative trends that are driving performance include:

- Gameplay: “real-time” reactions of players hitting jackpots or earning “big money” in a few taps, may have stylized app UI

- Free rewards: A time-sensitive promotion with an additional install incentive such as free spins or currency

- User interaction: user experience featuring players outsmarting their opponents

- Partnerships and IP: Using known brands or IP to attract users

Total gross gaming revenue for social casino games amounts to $6.2 billion and is expected to reach $7.5 billion by 2026 according to Statista. This is hardly surprising given that the average in-app purchase rose to $11.92 in 2021, almost double the average of other popular genres. As it stands, the social casino genre has a lot of room to grow, leveraging current trends in popular social apps and multiplayer experiences. Augmented reality will be another logical path to growth as gamers want more realistic and immersive casino experiences.

How We Can Help

From cinematic trailers to influencer-style UGC, our Creative Studio provides clients with ad creative driven by Hollywood storytelling and quantitative analysis. Our creative expertise comes from managing $150m in monthly ad spend across Facebook, Google, TikTok, Snap, and Apple Search Ads with clients like Disney, Zynga, Rovio, Nickelodeon, Yelp, Sun Basket, NBA, MLB, Roblox, Glu Mobile, Jam City, and many others. Our creative team are masters of influencer-style UGC creative, live action, post-production, 3D animation, motion graphics, and illustration.

Creating and testing 100K videos and images each year for clients provides us unparalleled insights into the evolving mobile advertising ecosystem. From our strategic analyses of IDFA loss and media buying automation to tactical guidance for A/B testing, we ensure our clients can adapt and thrive. Contact us at sales@consumeracquisition.com to work with our elite creative team.